5.3.5.2 Defining Add-on Rate Methods

The definition of Add-on Rate Methods is part of the Create or Edit Add-on Rate Rule.

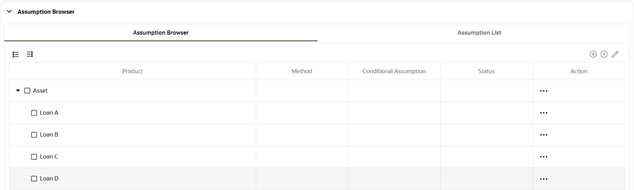

Oracle Funds Transfer Pricing Cloud Service provides you with the option to copy, in total or selectively, the Product Assumptions contained within the Add-on Rates Rule, Transfer Pricing, and Prepayment Rules from one currency to another currency or a set of currencies or from one product to another product or set of products.

Table 5-21 Fields and Descriptions for Add-on Rate Method Specification Screen

| Term | Definition |

|---|---|

| Reference Term |

The associated term is used for the Add-on Rate assignment. You can select one of the following types of reference terms:

|

| Interest Rate Code | Used for the Rate Lookup for the Formula Based Rate, and in the Breakage Charge - Economic Loss Method when discounting Cash Flows. |

| Assignment Date |

Allows you to choose the date for which the Yield Curve values are to be sourced. Choices available are:

|

| Lookup Method |

The method used to derive an Add-on Rate for different reference Term Values.

Deals that are outside of range or ranges will not be populated with any values. |

| Term | In conjunction with the Multiplier, this field allows you to specify the value for the Reference Term for a given Lookup Tier. |

| Multiplier |

The unit of time applied to the Term. The choices are:

|

| Rate | The Add-on Rate to be applied to instruments where the Reference Term is the product of the Term and Multiplier defined for the row. The rate should be in percentage form, for example, 1.25 percent should be input as 1.25. |

| Amount | The Add-on Amount to be applied to instruments where Reference Term is the product of Term and Multiplier defined for the row. |

| Formula | The mathematical formula used in the Formula Based Rate Method to determine the Add-on Rate: (Term Point Rate * Coefficient) + Rate Spread. |

| Rate Floor and Rate Cap | The minimum and maximum rate. If the calculated value is less than the Floor or more than the Cap, then these rates will be applied. These boundaries are applicable only to Formula Based Method and Use the TP Method from TP Rule add-on rate Method types. These are optional inputs. Ensure that the Rate Floor value is always less than or equal to the Rate Cap Value. |

| Term Point | In conjunction with the Multiplier (Day, Month, or Year), it is used in the Formula Based Rate Method when looking up the rate for the designated Interest Rate Code. |

| Coefficient | Coefficient by which the Term Point Rate should be multiplied. |

| Rate Spread | The spread added to the Interest Rate read from the selected Interest Rate Code. Rate Spread is used in the Formula Based Rate and Breakage Charge - Economic Loss Add-on Rate Methods. For the Formula Based Rate Method, the spread is added to the result of the Term Point Rate * Coefficient. Enter the Rate Spread in percentage form, for example, 1.25 percent should be input as 1.25. |

| Minimum Charge | Used in the Fixed Percentage and Economic Loss Add-on Rate Methods for Breakage Charges. If the calculated Break Funding Amount is less than the Minimum Charge, then the Minimum Charge overrides the calculated amount and is written to the Break Funding Amount column. |

| Original Term | Select to apply Original Term to both Fixed and Adjustable Rate Instruments. |

| Standard Term | Standard Term is the traditional approach used in Funds Transfer Pricing, which is the Original Term for Fixed-Rate Instruments and Repricing Terms for Adjustable-Rate Instruments. |

| Repricing Frequency | Repricing Frequency is the frequency of rate change of a product. |

| Remaining Term | Remaining Term is the number of months remaining until the instrument matures. |