5.3.4.5.1 Defining Assumptions with the Default Currency

For cases where you have the same assumption (Method and IRC) which is applicable to all currencies or multiple currencies, you can define rules for the combination of Product and Default Currency. To define assumptions for the Default Currency, select a Product from the Hierarchy and Default Currency from the currency list and proceed with the assumption definition. When processing data, the TP engine will first look for an assumption that exactly matches the product or currency of the instrument record. If not found, the engine will then look for the combination of the product and the Default Currency. This is a useful option to utilize during setup when the same product exists across multiple currencies and shares the same TP Assumption and Interest Rate Code.

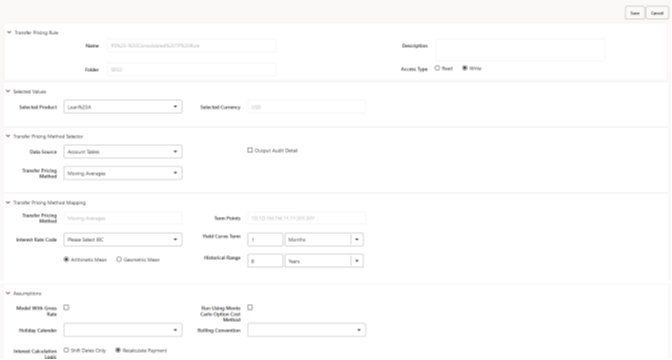

Figure 5-58 Transfer Pricing Rule Definition (Edit Mode)

Default Currency setup example: If you have two instrument records of the same product, each with a different currency, for example, 1 is 'USD' and the other is 'AUD', you have two configuration choices. You can either:

- Define the assumptions individually for each product-currency combination using direct input or copy across.

- You can create one assumption for the combination of Product and Default Currency. When you use Default Currency, the TP Engine will apply this assumption to ALL currencies (unless a direct assumption is available for the product + currency processed). In the case where users have many individual currencies that utilize the same TP Method and reference IRC rates, this is a useful option because you only have to define the assumption 1 time and it applies to many different Product + Currency combinations.

For defining assumptions with Default Currency, you must perform the basic steps for creating or updating Transfer Pricing Rules.

Procedure:

The following table describes the key terms used for this procedure.

Table 5-18 Fields in the Transfer Pricing Rule Definition Screen

| Term | Description |

|---|---|

| Yield Curve Term | Defines the point on the yield curve that the system references to calculate Transfer Rates. |

| Historical Term | Specifies the period over which the average is to be taken for the Moving Averages Method. |

| Lag Term | Specifies a yield curve from a date earlier than the Assignment Date for the Spread from Interest Rate Code Method. |

| Rate Spread | The fixed positive or negative spread from an Interest Rate Code or Note Rate is used to generate transfer rates in the Spread from Interest Rate and Spread from Note Rate Methods. |

| Model with Gross Rates | This option becomes available when you select Account tables as the data source and allows you to specify whether modeling should be done using the net or gross interest rate on the instrument. This option is only applicable when the Net Margin Code is also set to one, for example, Fixed. Gross rates are selected while modeling the effect of serviced portfolios where the underlying assets are sold but the organization continues to earn servicing revenue based on the original portfolio. |

| Mid Period | This option applies to Adjustable-Rate instruments only. It dictates whether the transfer rate is based on the Last Repricing Date, Current Repricing Period, Prior Repricing Date, or some combination thereof. |

| Audit Trail | Select to generate Audit Trail Output for specific product/ currency combination. |

| Assignment Date | This is the effective date of the yield curve. |

| Percentage/Term Points | The term points that the system uses to compute the Redemption Curve Method results. A percentage determines the weight assigned to each term point when generating results. |

| Add Dimension Values | Allows you to select the products that you want to use as source values when you transfer price using the Unpriced Account Method. |

| Across All Organization Units | When this option is enabled, the Transfer Price is calculated as a weighted average across all organization units for the matching product value and currency, and any optional migration dimensions selected in the Transfer Pricing Process Rule. Otherwise, the Transfer Price is calculated from accounts only within a particular Organizational Unit. |

| Holiday Calendar | Holiday Calendars are defined in the Holiday Calendars UI. In the Holiday Calendar, you can specify weekend days and Holiday Dates as applicable. |

| Rolling Convention | Rolling Conventions allow you to specify how dates falling on specified weekends or holidays should be handled. |

| Interest Calculation Logic | The Interest Calculation Logic Assumption allows you to specify whether to simply the date of the computed Cash Flow or to shift the date and recalculate the interest payment amount. |

To define the assumptions with the default currency:

- Navigate to the Assumption Browser page.

- Select a Product Hierarchy.

- Select a Currency.

- The list of currencies available for selection is managed with Currency module and reflects the list of Active currencies.

- Expand the hierarchy and select one or more members (leaf values and/or node values) from the product hierarchy.

- Click the Add icon to begin mapping Transfer Pricing Methods to the list of selected product dimension members. The system displays a list of all the products (for which you can define assumptions) or currencies (that are active in the system).

- From the Transfer Pricing Method Selector Page, select the appropriate data source: Account Tables or Ledger Table.

- Select the Transfer Pricing Method for the selected product member.

Tip:

The Transfer Pricing Methodologies are available depend on the selected data source. See: Transfer Pricing Combinations.Depending on the Transfer Pricing Method selected, certain required and optional parameter fields are displayed. You can update these fields as required. See Required Parameters for a Transfer Pricing Methodology. See also: - Select Output Audit Trail to output the audit data at the time of processing.

- Select the Holiday Calendar. The screen displays the Holiday Calendar inputs only

for Cash Flow TP Methods – Duration, Average Life, Weighted Term, and Zero Discount

Factors. The default assumption is None, meaning the Holiday Calendar adjustments

are turned off. If a Holiday Calendar is selected, Holiday Calendar adjustments will

be enabled and the following two additional inputs will be required:

- Rolling Convention

- Following Business Day: The Payment Date is rolled to the next business day.

- Modified following Business Day: The Payment Date is rolled to the next business day unless doing so would cause the payment to be in the next calendar month, in which case the payment date is rolled to the previous business day.

- Previous Business Day: The Payment Date is rolled to the previous business day.

- Modified previous Business Day: The Payment Date is rolled to the previous business day unless doing so would cause the payment to be in the previous calendar month, in which case the payment date is rolled to the next business day.

- Interest Calculation Logic

- Shift Dates Only: If a future Payment Date (as computed by the Cash Flow Engine (CFE)) falls on a designated holiday (including weekends), the CFE will shift the Payment Date from the holiday as per the rolling convention. No changes will be made to the payment amount or accrual amount; this is simply shifting the date on which the Cash Flow will post. The subsequent Payment Dates resume according to the original schedule.

- Recalculate Payment: This option includes the same Holiday Calendar

definition as in the Shift Dates Only option, but it also takes one

additional step to recalculate the interest payment amount (and

interest accruals) based on the actual number of days in the

(adjusted) payment period. The instrument records use the payment

frequency (term and multiplier) and the Re-Price frequency (term and

multiplier) in association with the Next/Last Payment Date and

Next/Last Re-Pricing Date to determine when the cash flow will post.

The CFE logic is enhanced to acknowledge Holiday Dates and

re-compute the payment/interest amount given the change in days. In

addition, the engine gets back on the scheduled track of payment

events after a holiday event occurs in one (or many sequential)

events.

Note:

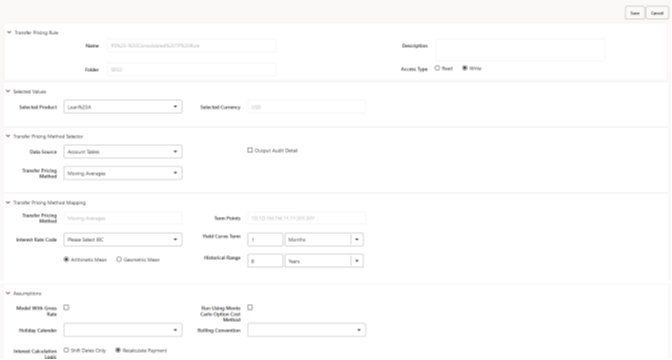

Holiday Calendar adjustments can also be applied to the Tractor TP Method. For this method, the Holiday Calendar assumptions are defined within the Behavior Pattern > Replicating Portfolio UI.Figure 5-59 Transfer Pricing Rule Definition (Edit Mode)

- Rolling Convention

- Click Apply.

At this point, you can:

- Continue defining additional methodologies for other product-currency combinations contained in your selection set, by repeating the above procedure.

- Complete the process by clicking Cancel or by answering NO to the confirmation alert after applying the assumptions for each Product or Currency combination in your selected set.

- From the Assumption Browser page, click Save.

The new assumptions are saved and the Transfer Pricing Rule Selector page is displayed.

Note:

Oracle Funds Transfer Pricing Cloud Service provides you with the option to copy, in total or selectively, the product assumptions contained within the Transfer Pricing, Prepayment, and Adjustment Rules from one currency to another currency or a set of currencies. For more information, see Copying Assumptions across Currencies.