5.3.7.1.2.1 Defining the Structure of the Prepayment Model Using Dimensions section

This page consists of the Prepayment Dimensions and the Bucket Values for these Dimensions which you select on this page. To define the Prepayment Model Structure, you can select a maximum of three Prepayment Dimensions. After the dimensions and the number of buckets (tiers) are defined, you need to assign values to the buckets.

Note:

You can use the analogy of a three-dimensional table to understand how to deal with the Prepayment Dimensions. The first dimension you select would resemble the row (X-axis).

The second dimension would act as the column (Y-axis). The final third dimension will be the page (Z-axis).

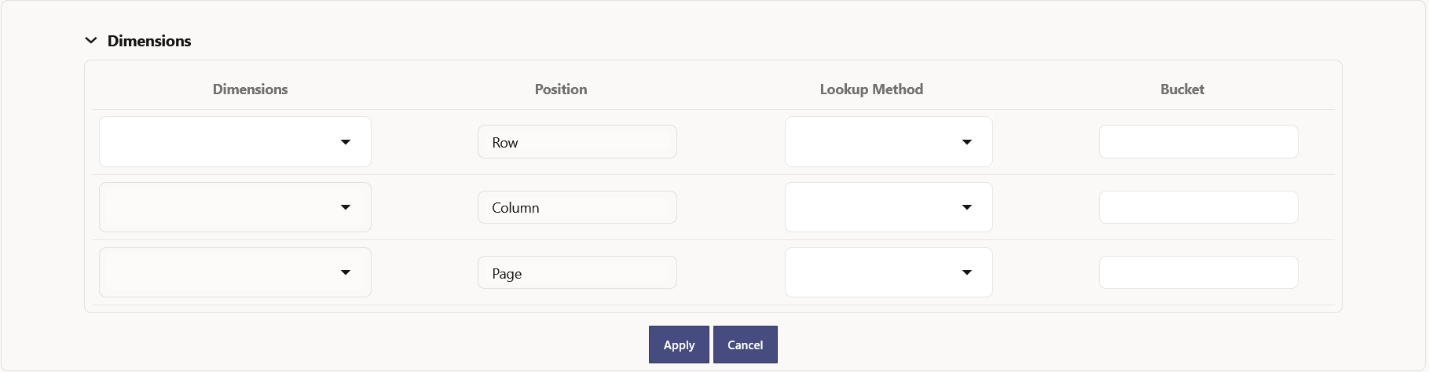

Figure 5-93 Dimensions section

- Enter the following details in Dimension section:

- Dimensions: Select the Dimension, such as Repricing Term, Rate Ratio, and

others.

The Dimension Section Influences the Prepayment Behavior of an instrument. You can build a Prepayment Model using up to three Prepayment Dimensions. Each dimension maps to an attribute of the underlying transaction (For example, age/term or rate and so on) so the Cash Flow Engine can apply a different Prepayment Rate based on the specific characteristics of the instrument.

- Position: Shows the position of dimension as Row, Column or Page.

- Lookup Method: Select the Lookup Method for selected Dimension. It is used to calculate Prepayment Rates for the Prepayment Dimension Values that do not fall exactly on the defined Prepayment Dimension Nodes. Oracle Asset Liability Management offers the following Lookup Methods:

- Interpolation: Under this method, the Prepayment Rates are determined by calculating an exact value on an axis. This method assumes that Prepayment Speeds change on a straight-line basis between the two nodes and calculates accordingly.

- Range: Under this method, the prepayment rates are determined by calculating

a range of values on an axis. This method assumes that the Prepayment Speed

will remain the same for the entire range.

The following example explains the differences between these two Lookup Methods. The following lists show the age and corresponding Prepayment Rates of instruments.

Age

12

24

36

60

Prepayment Rates

5

10

15

20

Under the Interpolation method, the Prepayment Speeds increase gradually. In this example, the Interpolated Prepayment Rate of an instrument aged 30 months is 12.5%.

This is exactly halfway between the 10% and 15% rate. However, the Range Method, the Prepayment Speeds increase in steps. Using the Range method, the Prepayment Rate is 10%, as this rate percentage would apply to the range from 24 months to 35.9999 months.

- Bucket: Enter the number of Buckets for the Dimension. This number may vary from dimension to dimension. Exact points for each dimension where attribute information has been defined.

- Dimensions: Select the Dimension, such as Repricing Term, Rate Ratio, and

others.

- If required, repeat the previous three steps for up to two additional Dimensions.

Note:

There are certain restrictions while defining Dimensions:

- You must select the Dimension type for a row and define the values for that dimension.

- You cannot define the second (row) dimension until you have defined the first (row) dimension. Similarly, the third dimension cannot be defined until you have defined the first two dimensions.

The Define Dimensions Page is refreshed. You can now assign the Bucket Values for each dimension. At this point, you can also modify the structure of the table, if required.