5.3.9.3.7 Migration

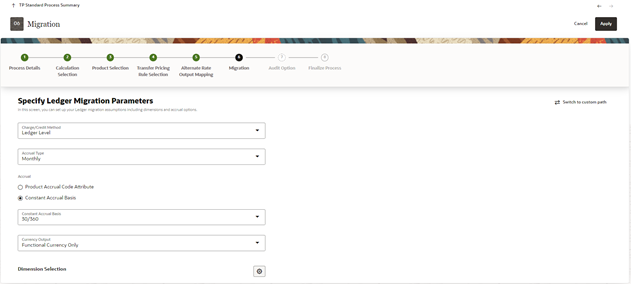

The Migration screen displays the Migration Details that you want to migrate.

The purpose of the Ledger Migration process is to generate Dollar Charges or Credits for funds provided or used for a combination of Dimensions. The information necessary to generate these Charges or Credits (through Transfer Rates, Add-On, and Rate Lock Option Cost processing) originates from the instrument tables and the results are inserted into the Management Ledger table, and are available for use in the calculation of Profitability and Risk Measures.

Note:

The seeded Management Ledger table is FSI_D_MANAGEMENT_LEDGER, also placeholder Management Ledger can be enabled and used for Charge/Credit migration.Figure 5-111 Migration

- Within the Transfer Pricing Process definition screen, on the

"Migration" block, you can select from the following options for the Charge/Credit

Method:

- Account Level

- Ledger Level

The Account Level method will sum the charge / credit amounts computed at the individual instrument level (based on the instrument's current or average book balances) and will group the results by the set of selected dimensions and migrate the amounts, together with the weighted average transfer rates to the Management Ledger table.

The Ledger Level method will compute the weighted average transfer rates from the instrument data and will migrate these values to the Management Ledger table. The migration process will then multiply the weighted average transfer rates by the Ending or Average balances on the Management Ledger table to arrive at the TP charge or credit amounts.

With both methods, the following rows are created for each product (and combination of selected dimensions). An offset entry to the funding center (offset org unit) is also created.

When Transfer Rate is selected (based on Standard or Remaining Term option):

- Financial Element 170, Average Transfer Rate

- Financial Element 450, Charge/Credit

- Financial Element 172, Average Remaining Term Transfer Rate

- Financial Element 452, Charge/Credit Remaining Term

When Adjustments are selected (based on population of noted adjustment type):

- Financial Element 174, Average Liquidity Rate

- Financial Element 414, Liquidity Charge/Credit

- Financial Element 175, Average Basis Risk Cost Rate

- Financial Element 415, Basis Risk Cost Charge/Credit

- Financial Element 176, Average Pricing Incentive Rate

- Financial Element 416, Pricing Incentive Charge/Credit

- Financial Element 177, Average Other Add-On Rate

- Financial Element 417, Other Add-On Charge/Credit

Note:

For a given combination of Organizational Unit and Product dimensions (or any other combination of dimensions), only one row should exist for the associated rate (170, 172) and charge/credit amount (450, 452). An offset posting to the "Offset Org Unit" or Funding Center, is also made for each posting.Oracle Funds Transfer Pricing Cloud Service provides great flexibility in the ledger migration process and the generation of corresponding Charges and Credits. Users can specify ledger migration for a combination of an extended List of Dimensions, including Common COA, Organizational Unit, Product, GL Account or any other Dimension that is part of the Key Dimension set.

Note:

Only the Key Dimensions are available for inclusion during the migration process. This is because Oracle Funds Transfer Pricing displays only the Processing Key Dimensions in the UI.You can choose to migrate the transfer rate, Add-On amounts or the Rate Lock option costs, within the respective Standard Transfer Pricing process.

- TP Application Preferences. Choices include Average Balance, Ending Balance or Other Balance.

- Oracle Funds Transfer Pricing Cloud Service offers the following accrual basis

options:

- 30/360: This is the default Charge/Credit Accrual Basis option. It applies the accrual basis calculation of 30 days divided by 360 days.

- Actual/360: Applies the accrual basis calculation of number of days in the month divided by 360 days.

- Actual/Actual: Applies the accrual basis calculation of number of days in the month divided by number of days in the year.

- 30/365: Applies the accrual basis calculation of 30 days divided by the 365 days.

- 30/Actual: Applies the accrual basis calculation of 30 days divided by the number of days in the year.

- Actual/365: Applies the accrual basis calculation of number of days in the month divided by 365 days.

- Business/252: Applies the accrual basis calculation of number of business days in the month divided by 252 days. A Holiday calendar selection is required if business/252 accrual basis is selected. If the holiday calendar is not selected, the engine considers Accrual type ACT/ACT as a default for calculation.

- A migration block parameter, it allows you to select the output currency. Oracle

Funds Transfer Pricing offers you the following currency output options:

- Entered and Functional Currency

- Functional Currency Only

For example, a bank's loan may have Yen as entered currency. However, the bank might use US Dollar to display its consolidated annual results. In this case, US Dollar is the functional currency. In other words, the currency in which an organization keeps its books is its functional currency.

- Click Apply to navigate to the next screen.