5.3.11 Rate Lock Option Volatility Curve

A Rate Lock is a lender's promise to hold a certain interest rate for the borrower, usually for a specified period of time and fee, while the loan application is being processed. Rate locks are commonly granted to borrowers when they apply for a mortgage loan and carry a term of 30, 60, or 90 days.

In Oracle Funds Transfer Pricing Cloud Service, these loan commitments (which are not yet on the balance sheet) are stored in the FSI_D_LOAN_COMMITMENTS table, separate from loans that are already funded. These loan commitments can be Transfer Priced using implied forward rates, which correspond to the assumed loan start date (end of commitment period). This capability allows the treasury to “lock-in” a loan-funding rate at a point in time before the actual loan funding.

Rate Lock Options

Many times, lenders also offer a one-time option for borrowers to take a lower rate if market rates drop during the commitment period. If on the Settlement Date, the advertised rate for the chosen fixed-rate period falls below the 'Locked Rate', the borrower will benefit from the lower of the current advertised Fixed Rate and the 'Locked Rate'. The benefit granted to the user to receive the lower rate at the time of settlement can be thought of as an option, specifically, the bank sells the customer a European 'at the money spot' Interest Rate swap option. The cost of this option can be calculated and should be charged by the treasury back to the line of business as an internal cost. Oracle FTPCS provides the capability to calculate the 'rate lock' option cost. The general approach assumes that loan commitment information will be available in sufficient detail from the source systems to support cash flow transfer pricing using forward FTP curves and all required information describing the terms of the Rate Lock.

Calculate Rate Lock Option Costs and Percentage

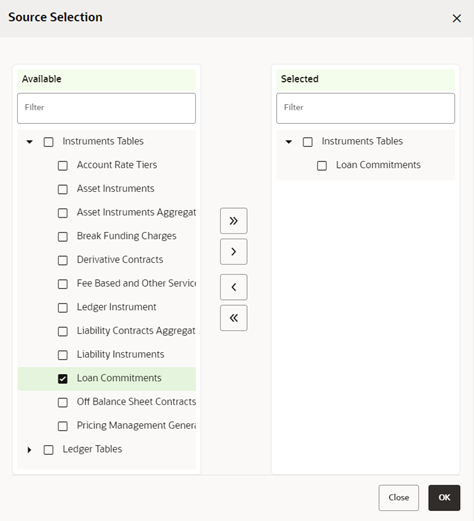

The Standard FTP Process provides setup options that allow you to Transfer Price Data in the Loan Commitments table using Forward Rates and calculate the Related Rate Lock option costs. To do this, select the Loan Commitment table under Source Selection.

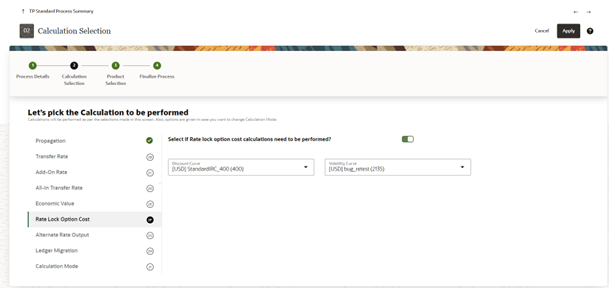

The following options are available on the Calculation Selection page.

Figure 5-128 Source Selection

Note:

These calculation options assume the user has also selected the Loan Commitments table on the Product Selection page under Source Selection.Figure 5-129 TP Standard Process Rule

Discount Curve: User can select any IRC as per the selected currency in user preferences, this curve will be used as risk free rate.

Volatility Curve: User needs to define volatility curve in Rate lock option volatility curve module, as per the selected currency in user preference, all the corresponding volatility curves will be listed for selection.