5.3.4.1.7 Spread from Interest Rate Code

Under this method, the Transfer Rate is determined as a fixed spread from any point on an Interest Rate Code.

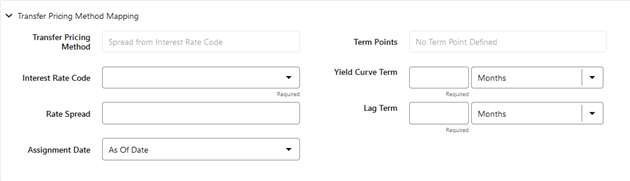

Figure 5-46 Spread from Interest Rate Code

The following options become available on the application with this method:

- Interest Rate Code: Select the Interest Rate Code for transfer pricing the account.

- Yield Curve Term: The Yield Curve Term defines the point on the Interest Rate Code that will be used to transfer price. If the Interest Rate Code is a single rate, the Yield Curve Term is irrelevant. Select Days, Months, or Years from the drop-down list, and enter the number.

- Lag Term: While using a Yield Curve from an earlier date than the Assignment Date, you need to assign the Lag Term to specify a length of time before the Assignment Date.

- Rate Spread: The transfer rate is a fixed spread from the rate on the Transfer Rate Yield Curve. The Rate Spread field allows you to specify this spread.

- Assignment Date: The Assignment Date allows you to choose the date for which the Yield Curve values are to be picked up. Choices available are the As-of-Date, Last Repricing Date, Origination Date, Adjustment Effective Date, or TP Effective Date.

- Mid-Period Repricing Option: Select the check box beside this option to invoke the Mid-Period Repricing option.

Note:

The Spread From Interest Rate Code Method applies to either data source: Ledger Table or Account Tables.