5.3.9.3.2 Calculation Selection

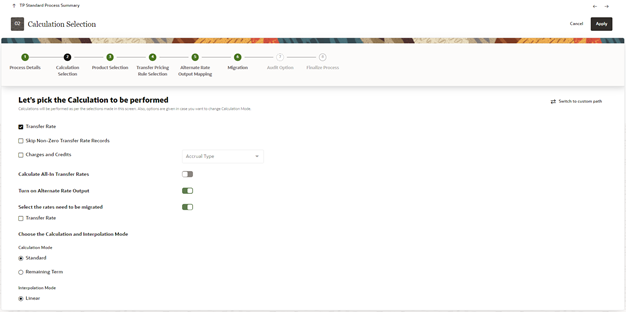

The Calculation Selection screen displays various calculation options that you can select. Depending on the choices you make, the progress train on the screen include few optional steps like Audit, Migration, and Prepayment Rule selection. In the below sample screen, the options Turn On Alternate Rate Output and Select the rates need to be migrated are selected; accordingly progress train on the top, starts displaying the Alternate Rate Output Mapping and Migration options as well.

You can switch the UI to a Custom Calculation Selection at any time. Clicking Switch to custom path will help you if you realize given calculation options in selected scenario, does not have all the required calculation and you like to customize the selection. When you enable the custom flow, a confirmation message is displayed to confirm the re-routing to custom flow.

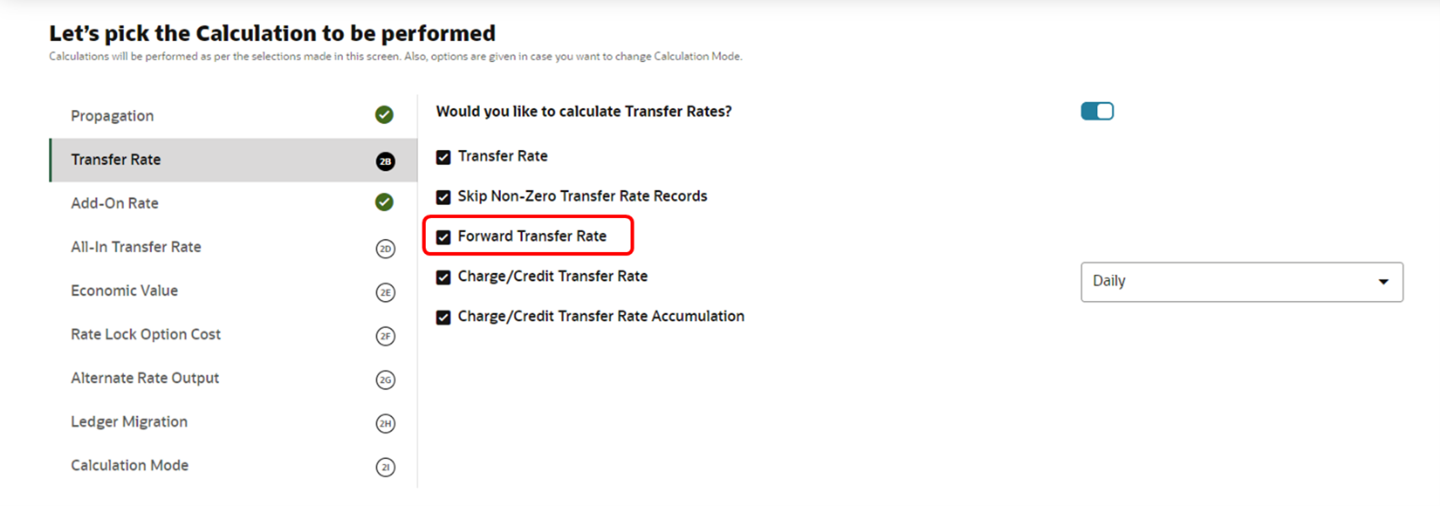

Figure 5-112 Calculation Selection

- Select the following:

- Transfer Rate: This is mandatory selection for the flow. System picks the transfer pricing method defined in TP rule and perform the TP rate calculations accordingly.

- Skip Non-Zero Transfer Rate Records: Select this option if you have already populated Transfer Rates through a separate process. In addition, would like to skip the records where transfer rate is already populated.

- Charges and Credits: Choose the Charge/Credit calculation, to calculate and output the Instrument level TP charges and credits. If you select the Instrument Charge/Credit option, you must also choose between Monthly and Daily charge/credit accrual. The default selection is Monthly. If Daily is selected, another check-box Charge/Credit Transfer Rate Accumulation is displayed. If you want to use the holiday calendar for charge credit calculation, you can define it within the TP rule for each available product/currency to determine the number of days to accrue.

- Charge/Credit Transfer Rate Accumulation: To support

IBOR transition, you can use this Charge/Credit Transfer Rate Accumulation

check-box for Daily Repriced Accounts based on RFR (Risk-Free Rates)

Curves.This is available only for daily accrual; it will propagate

yesterday’s accumulated Charge Credit to today's run based on the Holiday

Calendar defined in TP/Add-On rate rule if any. Today’s Charge Credit will

be added to yesterday’s accumulated Charge Credit and populate the final

value to today’s accumulated Charge Credit.

Charge Credit accumulation is available for all types of (TP, Add-On rate, and All_in_TP Rate).

Users can define the Holiday Calendar in TP or the Add-On rate Rule for each Product/CCY combination. For conditional assumption, Holiday Calendar defined at Node Level will only be considered for accumulation; rather than the one provided at Conditional Assumption level.

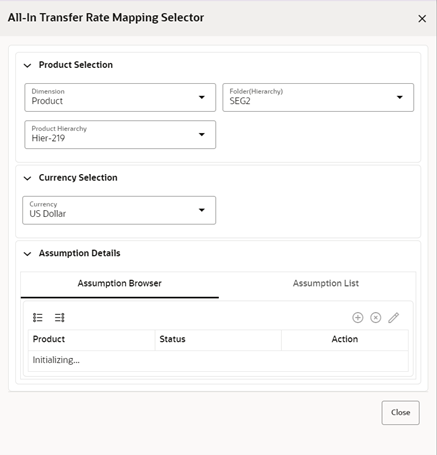

- Calculate All-In Transfer Rates: Choose this option if

you want the TP Process to calculate and post the All-in Transfer Rate for

each Instrument Record. This option allows you to define the aggregation

logic for combining any Add-on Rates on top of base Transfer Rate. In the

product selection widget, when you select the Search

icon, you can define for each product the Rates to include in the

calculation and the related signage for each Rate.

To define the All-in Transfer Rate, enable the Calculate All-In Transfer Rates toggle switch.

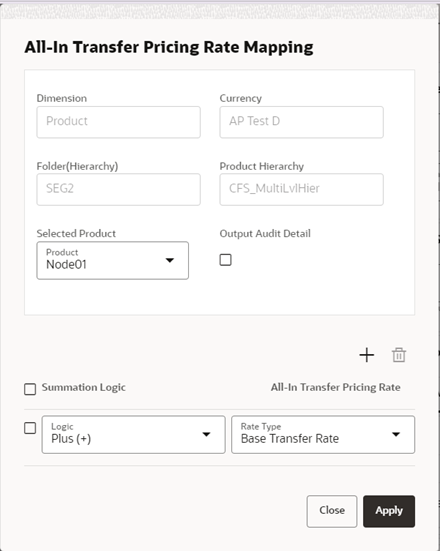

Select the All-in Transfer Rate check-box and then click the Settings icon to display the All-In Transfer Rate Mapping Selector window. Select the Node under Assumption Browser and click the Action icon, and then click Add. The All-In Transfer Pricing Rate Mapping window is displayed.

This window allows you to define different formula for different product and currency combinations.Figure 5-113 All-In Transfer Rate Mapping Selector

Here, you can define, different all-in TP formula for different product, currency combinations.

Here, you can define, different all-in TP formula for different product, currency combinations.Figure 5-114 All-In Transfer Rate Mapping

Click the + button to add a Summation Logic. Select the relevant Logic and Add-On Rate Types and click Apply.

In the Transfer Rate Mapping Selector window, select a different currency and select the Node, and then click the Action icon to add another mapping. Repeat the above steps and create the calculation logic for the selected currency.

- Turn On Alternate Rate Output: This LOV allows you to select an Alternate Rate Output Rule that lets you select the Alternate Columns to output the Transfer Rate, and Add-On Rate Calculation Results for each Instrument Record in an Account Table for a Standard Transfer Pricing Process Run. This functionality allows you to output more than one Transfer Rate, or Add-On Rate Calculation Result for each record in the Instrument Table through multiple Transfer Pricing Process Runs.

- Select the rates need to be migrated: Choose Migration options (optional), if you want to include migration of your Transfer Pricing results to the Management Ledger table.

- Calculation Mode: The default selection is Standard that applies

traditional transfer pricing logic within the process. This entails transfer

pricing fixed rate instruments from the origination date (or TP Effective

Date if provided) and transfer pricing adjustable rate instruments from the

last repricing date. If remaining term is selected the effective date for

transfer pricing all instruments will be the current “as of date”.

- Standard: The Standard calculation mode allows you to calculate transfer/add-on rates for instrument records based on the Origination date or Last Repricing Date of the instruments.

- Remaining Term: The Remaining Term calculation mode allows you to calculate transfer/Add-On rates for instrument records based on the remaining term of the instrument from the calendar period end date of the data, rather than the Origination Date or Last Repricing Date of the instruments.

- Interpolation Mode: A calculation selection parameter, the Interpolation Method allows users to decide between Linear, Cubic Spline, or Quartic Spline interpolation methods. This selection affects how the rate lookups happen for terms that fall between anchor points on your Interest Rate Curves.

- Click Apply to save selected calculations and navigate next to the next screen.

Transfer Rate Calculations based on Forward Curve

Figure 5-115 Forward Transfer Rate