11.2.1 Cash Flow: Average Life

The Average Life method determines the average life of the instrument by calculating the effective term required to repay half of the principal or nominal amount of the instrument. The TP rate is equivalent to the rate on the associated interest rate curve corresponding to the calculated term.

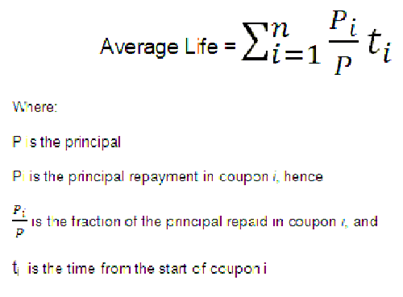

Figure 11-1 Cash Flow: Average Life Formula

Note:

The Average Life TP Method provides the option to Output the result of the calculation to the instrument record (TP_AVERAGE_LIFE). This can be a useful option if you would like to refer to the Average Life as a reference term within an Adjustment Rule.Users also have the choice to populate the TP_AVERAGE_LIFE column directly with a value computed outside of OFSAA FTP. If this value is populated, the FTP engine reads the TP_AVERAGE_LIFE and will look up the FTP rate for the given term. In this case, the TP Engine does not generate cash flows and will not re-compute the Average Life. It simply uses the value that has been provided and lookup the appropriate FTP rate from the specified TP Interest Rate Curve.