11.2.3 Cash Flow: Weighted Term

The Weighted Term method builds on the theoretical concepts of duration. You can use the Cash flow Duration TP method approach to the Cash Flow Weighted Term method. Based on that, the following Cash Flow Discounting Methods are used:

- Multiple Rate

- Single Rate

For more information, see the Transfer Pricing Rules section.

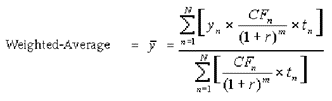

As shown earlier, duration calculates a weighted-average term by weighting each period, n, with the present value of the cash flow (discounted by the rate on the instrument) in that period.

Figure 11-3 Cash Flow: Weighted Term Formula

In this formula:

- N: Total number of payments from Start Date until the earlier of repricing or maturity

- CFn: Cash Flow (such as Regular Principal, Prepayments, and Interest) in period n

- r: Periodic Rate (Current Rate/Payments per year)

- m: Remaining term to Cash Flow n/active payment frequency

- tn: Remaining term to Cash Flow n, expressed in years

- yn: Transfer rate in period n

Within the Cash Flow Weighted Term method definition screen, users can select the Cash Flow type as either Principal + Interest (the default selection) or Principal Only. This selection impacts the CFn in the above formula.

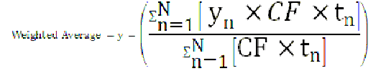

Figure 11-4 Cash Flow: Weighted Term Formula without Discounted Cash Flow

For this method, the following options are also provided:

- Cash Flow Weighted Rate

- Cash Flow and Terms Weighted Rate (by default, this will remain selected for all existing definitions)

If Transfer Rate needs to be weighed only by Cash Flow rather than both Cash Flow and the Cash Flow Weighted Rate can be selected, and the system will not consider terms (tn) for calculations.

If Cash Flow and Terms Weighted Rate is selected, then both terms, as well as Cash Flow, will be used for Weighing Transfer Rate as per calculations shown above.

The discount rate or current rate, r, is defined in one of three ways, based on how the methodology is set up by the user:

- The current rate is defined as the current net rate from the instrument record unless the processing option, "Model with Gross Rates" is selected, in which case, the current gross rate is used. The current rate is used as a constant discount rate for each cash flow.

- The user may directly input while defining the TP rule, a single constant rate to use for discounts. If specified, this rate is used as a constant discount rate for each cash flow.

- The user can select to discount the cash flows using spot rates from a selected interest rate curve. With this approach, a discount rate is read from the selected interest rate curve corresponding to the term of each cash flow.

Note:

When validating the Cash Flow Weighted Term transfer rate, FE 492 (Discount Factor) from detail cash flow output is useful. FE 490 (Discount Rate) however, may be incorrect in the detailed cash flow output if the Current Net Rate is specified as the discount rate. This condition does not affect the accuracy of the calculated discount factor, only the audit table rate output for FE 490. If multiple rate discounting (based on IRC) or a single custom rate is specified, then FE 490 will be correct. For more information on FEs, see the OFS Cash Flow Engine Reference Guide.