11.2.15 Risk Free Reference Rates

Risk Free Reference rates (RFR) could be used for following two methodologies, based on what is selected in UI:

- Cumulative Compounded Rate

- Non-Cumulative Compounded Rate

Step 1: Unannualized/ Effective RFR:

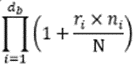

Ki =

N = It will be as per accrual Basis on the record. E.g. if 1 - Then 360 days in an year. ri is the RFR rate for that day and ni - is number of days in interest period.

Step 2: Compounding Factor:

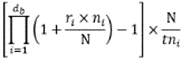

Li =

= (1+ Ki) * (Li-1BD) - Daily Compounding Factor, if user

is directly loading compounding factor, then Step 1 and 2 are skipped.

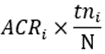

Step 3: Annualized Cumulative Compounded RFRi (ACRi):

ACRi =  = N is days in an Year on Accrual Basis CD. tni = Cumulative days

till nth daily interest period. Here, system performs rounding, based on selected

decimal Points in UI. In UI, decimal points are given in % format.

= N is days in an Year on Accrual Basis CD. tni = Cumulative days

till nth daily interest period. Here, system performs rounding, based on selected

decimal Points in UI. In UI, decimal points are given in % format.

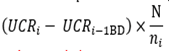

Step 4: Unannualized Cumulative Compounded RFRi:

UCRi =

Step 5: Non-Cumulative Compounded RFRi:

ni is the Number of days in each respective interest period.

N - Number of Days in a year as per the account's accrual Basis CD.

Lag/Lookback will be from - RATE_SET_LAG and RATE_SET_LAG_MULT.

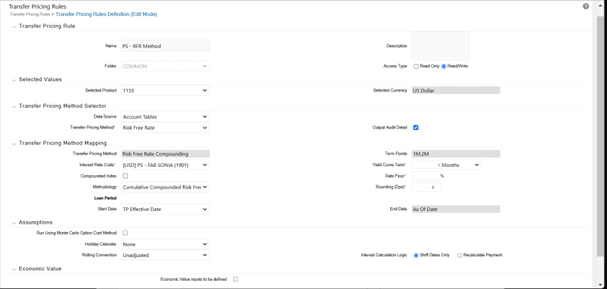

Figure 11-7 Transfer Pricing Rules

Period Start Date: Any of following:

- Last Payment Date (Default)

- Origination Date

- Last Reprice Date

- TP Effective Date

- Add-On Effective Date

Period End Date: As of Date (Maturity Date if it is before As of Date)

If the user selects Cumulative Compounded RFR, then Step 3 will be the output in percentage format and stops.

If the user selects Non-Cumulative Compounded RFR, Step 5 will be the output in percentage format.

Rate Floor (in Percentage): It accepts only integers, between -99.99% to + 99.99%. If RFR is below this rate for any day, the RFR will be used as floor for that date.

To form the Loan/Interest Period, select a holiday from a record. If the holiday is not mentioned in the record, then the system uses whichever day defined in the UI. If nothing is defined, the system considers each day as working day.

Interest Rate Code: A list of all the available IRC for selected CCY or for all CCY curves is displayed and all the yield curve term points for the selected curve are displayed in display only mode.

Yield Curve Term: Enter any integer and multiplier. If user selects term point that is not available on the curve, then system will do the regular interpolation/extrapolation.

If the system searches for particular effective date in IRC and does not find the same, it checks for most recent past available effective date for same curve. If a most recent past effective date for the curve is not found, then system uses the most recent future available effective date for same curve.

Rounding Dps: (Decimal Point for (Annualized Cumulative Compounded Rate) = Integer Inputs. Enter the value in percentage (%).