Add Profit or Loss Accounting Definition

To create a Profit/Loss Accounting Definition, perform the following

procedure:

Note:

Fields marked in Asterisk (*) are mandatory.- Click Add in the Profit/Loss Accounting

Definitions pane to open the Profit/Loss Accounting

Definition window.

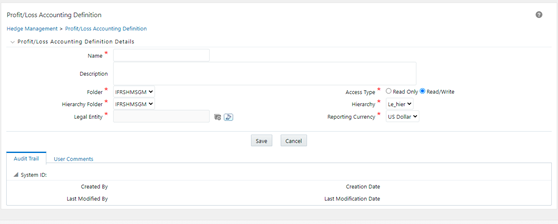

Figure 8-2 The Profit/Loss Accounting Definition Window

The Profit/Loss Accounting Definition window displays the Profit/Loss Accounting Definition Details form.

- Enter the details in the Profit/Loss Accounting Definition

Details form, as tabulated:

Table 8-1 The Profit/Loss Accounting Definition Details Table

Field Description Name* Enter the name of the Profit/Loss Accounting Definition. Description Enter a description for the Profit/Loss Accounting Definition. Folder* Select the folder from the drop-down list. Folders are segments present in the selected Information Domain. Access Type* Select the access type as either Read Only or Read/Write by selecting the appropriate radio button.

This selection determines whether the definition should be made available for edit at a later point in time.

Hierarchy Folder* Select the hierarchy folder from the drop-down list. Hierarchy * Select the appropriate hierarchy from the drop-down list. Legal Entity* Click Browse adjacent to this field and select a legal entity from the Hierarchy Browser window. Reporting Currency* Select the appropriate currency from the drop-down list. - Click Save to save the definition details. The definition

is displayed in the Profit/Loss Accounting Definitions pane of the Profit/Loss

Accounting Definitions Summary window.

Note:

If the Maturity Date of an Instrument is lesser than the as-of-date, such Instruments are included in the Valuations processing, after setting the Fair Value as zero on the as-of-date. Because of this, the application computes the Fair Value Gain or Loss for such Instruments as the difference between zero and the Fair Value as of the Period Start Date.