Creating a Fair Value Definition

- In the Fair Value Process Definitions form, click

Add to open the Fair Value Determination

Process Definition window.

Figure 6-2 The Fair Value Determination Process Definition pane

- Populate the Fair Value Process Definition Details pane

as tabulated.

Table 6-2 The Fair Value Process Definition Details Table

Field Name Description Name Enter a name for the definition. Description Enter a description. Folder Select the Folder from the drop-down list. Access Type Select either Read Only or Read/Write. - In the Instrument Type to Fair Value Process Definition

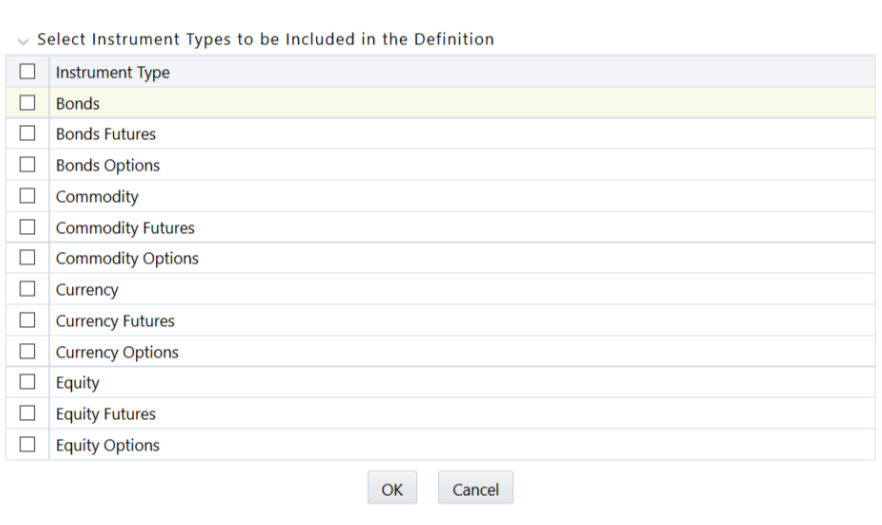

Mapping form, click Add to open the

Select Instrument Types to be included in the

Definition window.

Figure 6-3 The Select Instrument Types to be included in the Definition Window

- Select the required Instrument Types by selecting the checkboxes adjacent to the Instrument Type names and click OK. The selected Instrument Types are displayed under the Instrument Type to Fair Value Process Definition Mapping form. This pane displays those processes which are already checked. These processes can be modified according to the requirement. However, for instruments such as Loans and Advances, only a particular process is allowed to be selected as these may not be traded in the market. Click Delete to remove the Instrument types by selecting the checkbox adjacent to the Instrument type. To remove all the Instrument types present in the Instrument Type to Fair Value Process Definition Mapping form, select the checkbox present in the column header in the Instrument Type to Fair Value Process Definition Mapping form.

- Select the value for the Market Data Provider, from the drop-down list, for each

Instrument Type.

Note:

The list of market data providers is expected as a download. You can enter the values to be listed in the Market Data Provider drop down through the AMHM module of OFSAAI. This data is received by the Financial Data Provider dimension and the same is later used to the populate Stage Market Center Quotes table. For more information on AMHM, see the Oracle Financial Services Analytical Application Infrastructure User Guide. - Define the Fair Value Determination Order by selecting

the checkboxes present in the following columns:

- Ascertain Market Value (Level 1)

- Ascertain Near Market Value (Level

2)

Process Cash flows (Level 3)

- Click the Details link adjacent to the Ascertain Near Market Value field. The Ascertain Near Market Value feature stores information of instruments that are used in arriving at a Fair Value, as part of the Level 2 logic. Example: If the Level 2 process was executed and resulted in 100 instruments that matched the parameters as defined under Level 2, these processes then get reduced into a Fair Value for the instrument being looked up. Checking the Audit near market data on the application UI retains such 100 records for future reference. You have the option to not check this feature on the application. In such cases, the application does not retain the near-market instruments that were used in arriving at the Fair Value. The Specify Parameters for Near Market/Proxy Value Determination window is displayed. The Instrument Type field displays the name of the instrument type.

- Specify the number of days up to which historical market value can be looked up, in the Specify the number of days up to which historical market value can be looked up field.

- Select the checkboxes adjacent to the required Attributes under Specify Attributes based on which a near market or proxy value has to be ascertained field. This is to specify the parameters for similar Instruments whose current market value can be used as a proxy for the Instrument that does not meet the criteria in the preceding step. The Dimensions and Measures field is displayed here. This field is enabled only if you have selected Bonds as the Instrument Type.

- (Optional) Enter the value for a Haircut percentage in the text field adjacent

to Specify a Haircut Percentage field.

Note:

If a haircut value is entered, the output is categorized as Level 3 and not Level 2, as per IFRS 9 guidelines. - Click OK.

- Click Save.

The saved definition is displayed under the Fair Value Definitions by Instrument Types pane in the Fair Value Definitions Summary window.

The Audit Trail section at the bottom of the Fair Value Determination Process Definition window displays the metadata related to the definition such as Created By, Creation Date, Last Modified By, and Last Modification Date with a System ID. The User Comments section facilitates you to add or update additional information as comments.