2.5.1.3 Defining PSA Prepayment Method

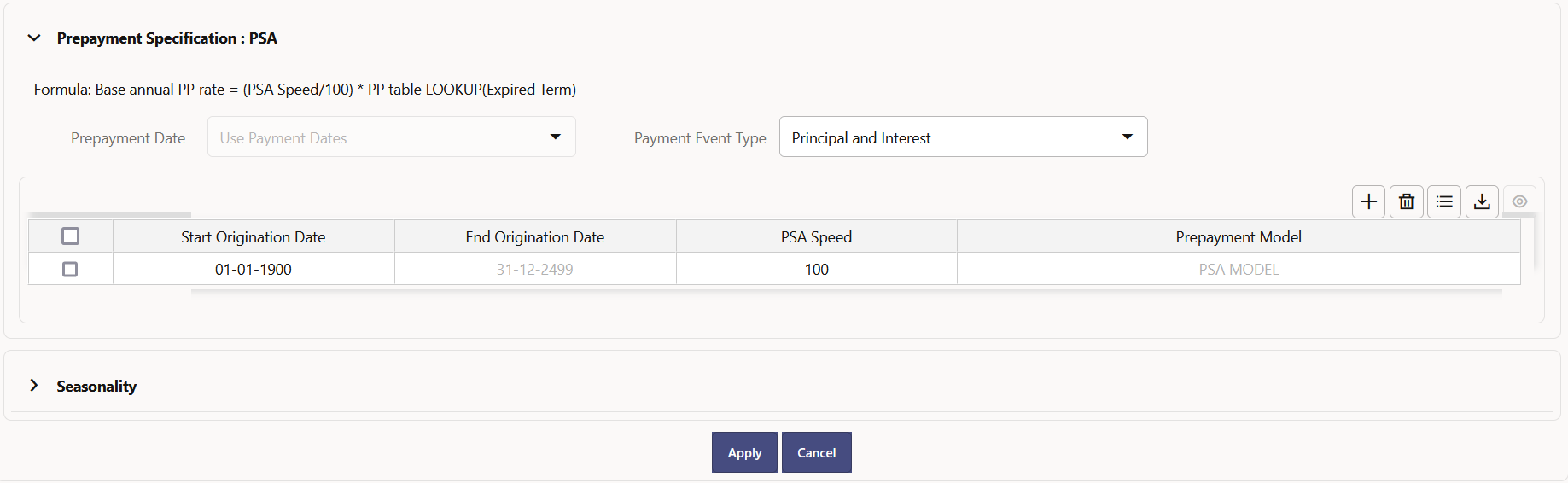

Use this procedure to define Prepayment Assumptions using the PSA Prepayment Method. The PSA Prepayment method (Public Securities Association Standard Prepayment Model) is a Standardized Prepayment Model that is built on a single dimension, expired term. The PSA Curve is a schedule of prepayments which assumes that prepayments will occur at a rate of 0.2 percent CPR in the first month and will increase an additional 0.2 percent CPR each month until the 30th month and will prepay at a rate of 6 percent CPR thereafter ("100 percent PSA"). PSA Prepayment Speeds are expressed as a multiple of this base scenario. For example, 200 percent PSA assumes Annual Prepayment Rates will be twice as fast in each of these periods - 0.4 percent in the first month, 0.8 percent in the second month, reaching 12 percent in month 30 and remaining at 12 percent after that. A zero percent PSA assumes no prepayments. You can create your own Origination Date ranges and assign a particular PSA Speed to all the instruments with origination dates within a particular Origination Date range. PSA Speed inputs can be between 0 and 1667.

Figure 2-5 PSA Prepayment Method

Prerequisites

Performing basic steps for creating or updating a Prepayment Rule.

Procedure

Prepayment under this method occurs on Payment Dates only.

- Select the Payment Event Type option.

- Select the Start Origination Date using the date picker. Alternatively, you

can enter the Start Origination Date in the space provided.

The first cell in the Start Origination Date Column and all the cells in the End Origination Date Column are Read-Only. This ensures that all possible Origination Dates have supporting reference values when Prepayment Assumption Lookups occur. Each row in the End Origination Date Column is filled in by the system when you click Add Row or save the Rule.

The first Start Origination Date (in row 1) has a default value of January 1, 1900. When you enter a Start Origination Date in the next row, the system inserts a date that is a day before the previous End Origination Date Field.

- Enter the PSA Speed that you want to apply to the instruments having Origination

Dates in a particular Start Origination-End Origination Date range. The PSA Method

is based on a standard PSA curve. You can view the seeded model by selecting the

View Prepayment Model icon.

The default value is 100 PSA and inputs can range from 0 to 1667.

- Click Add Row to add additional rows and click the corresponding

Delete Option to delete a row.

You can add as many rows as possible in this table using Add Multiple Row Option. However, you need to enter relevant parameters for each new row.

- You can also use the Download Excel Feature to export the Prepayment Rate Information that is displayed on screen, modify, and copy-paste it back in the grid.

- Define Seasonality Assumptions as required to Model Date specific adjustments to the Annual Prepayment Rate. Inputs act as a multiplier, For example, an input of 2 will double the Prepayment Rate in the indicated month.