1.21.3 Create Discount Method Rule

You create a Discount Methods rule to assign Discounting Methods to your products. To create a Discount Method Rule, follow these steps:

- Navigate to the Discount Methods Rule Summary Page.

- Click Add. The Discount Method Rule Page is displayed.

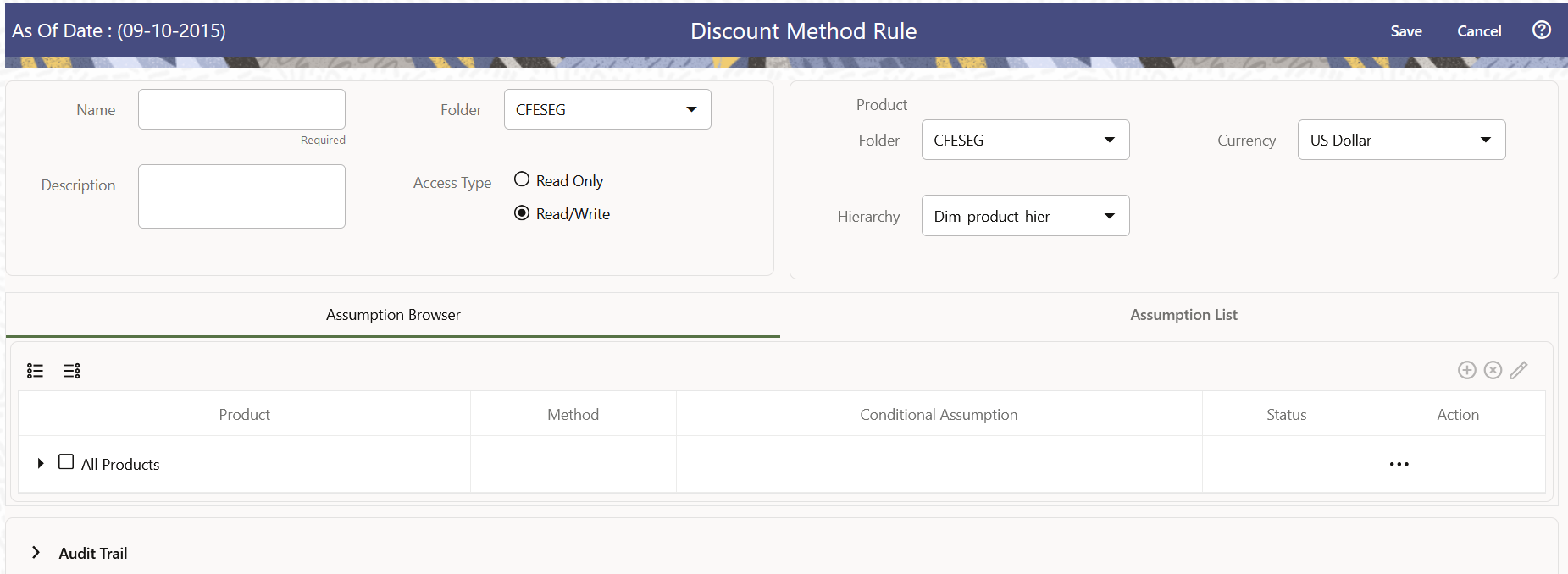

Figure 1-83 Discount Method Rule

- Enter the following details:

Table 1-58 Discount Method Details

Fields Description Name Enter the name of the Discount Method Rate Rule. Description Enter the description of the Discount Method Rule. This is an optional field. Folder Select the Folder where the Discount Method Rule needs to be saved. Access Type Select the Access Type as Read-Only or Read/Write. - Select a Product Hierarchy. You can define methodologies at any level of the

hierarchical product dimension. The hierarchical relationship between the nodes

allows inheritance of methodologies from Parent Nodes to Child Nodes. Enter the

following details for Product Hierarchy selection:

Table 1-59 Product Hierarchy Details section

Fields Description Folder Select the Folder where Product Hierarchy is previously created Hierarchy Select the Hierarchy of the product Currency Select the Currency. - Navigate to Assumption Browser Section to define the Discount Method for your

product-currency combination.

Note:

Node Level Assumptions allow you to define assumptions at any level of the Product dimension Hierarchy. The Product dimension supports a hierarchical representation of your chart of accounts, so you can take advantage of the parent-child relationships defined for the various nodes of your product hierarchies while defining rules. Children of parent nodes on a hierarchy automatically inherit the assumptions defined for the parent nodes. However, assumptions directly defined for a child take precedence over those at the parent level.

- Select the product(s) and the currency for which you want to define a discount method(s).

- Select the Add icon to launch the Discount Method Details Window..

Note:

Using the Default Currency to setup assumptions can save data input time. At Run Time, the calculation engine uses assumptions explicitly defined for a Product Currency combination. If assumptions are not defined for a currency, the engine uses the assumptions defined for the product and the default currency. If the assumptions are the same across some or all currencies for a specific product, you can input assumptions for the Default Currency. Be careful using this option on screens where an Interest Rate Code is a required input. In most cases, you will want to use a currency specific discount curve for discounting instruments within each specific Base Currency. The Default Currency option, if used will apply a selected Interest Rate Code across all currencies. - Navigate to Discount Method Section.

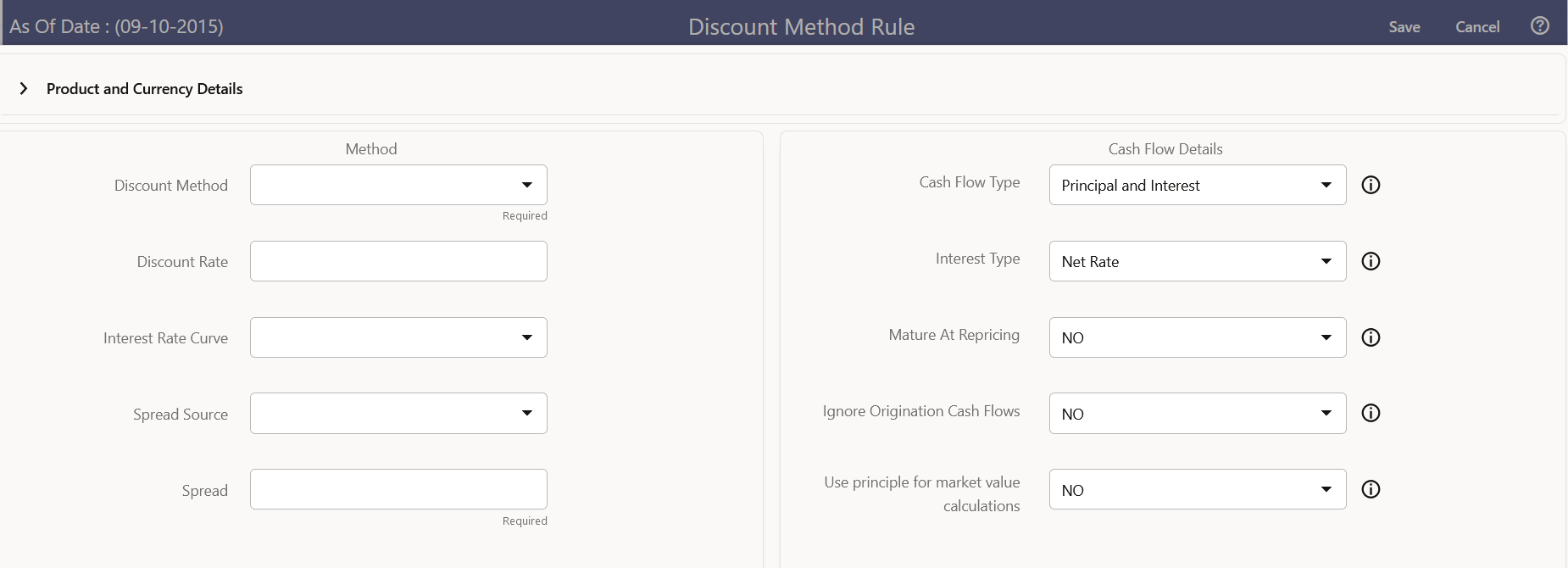

Figure 1-84 Discount Method Section

- Enter the following details:

Table 1-60 Discount Method Section

Fields Description Discount Method Select the Discount Method from Discount Method List Discount Rate Enter Discount Rate if Spot Input Method is selected Interest Rate Curve From Interest Rate Code List, select an appropriate Interest Rate Code.

The list of Interest Rate Codes depends on the selected currency. If the selected currency is the default currency, all Interest Rate Codes appear. For other currency selections, the list of interest rate codes includes only interest rate codes whose reference currency is the same as the selected currency.

Spread Source You can optionally choose to add a spread of margin over the Interest Rate derived from IRC. Spread can be defined in the Discount Method Rule or it can be given along with Instrument record.

You can select source of the spread as Discount Rule or Account Data is method is Spot IRC, Forecast (Original Term) and Forecast (Remaining Term).

Spread When Discount Rule is selected as Spread Source then you can specify the amount of spread/margin here.

Type the percentage difference (+ or -) between the selected rate index and the value you want to use for the discount rate(s) within market value calculations.

Input a Rate Spread, type 1.0000.

A spread of 1% returns a discount rate of 1.00% above the reference interest rate. Type a negative number for a spread below the reference interest rate.

- Navigate to Cash Flow Details section. The Cash Flow Definition Details Section is used in unique instances to specify the portion of the Cash Flow that is used to calculate a Market Value.

- Enter the following details:

Table 1-61 Cash Flow Details Section

Fields Description Cash Flow Type - Interest Only - ignores all principal runoff for market value purposes. Use this option for Off-balance sheet items where principal is equal to Notional Principal and is therefore not a true Cash Flow.

- Principal & Interest - calculates principal and interest both for Market Value purposes.

- Principal Only - ignores all interest rate Runoff for market value purposes.

Interest Type The Cash Flow Interest Type determines which interest component is included in the cash flow definition. The Cash Flow Interest Type can be one of three values:

- Net Rate

- Gross Rate

For typical processing, you will use the Net Rate for the interest component of the cash flow. Special processing objectives, such as valuation of the funding center, may require you to use the other cash flow interest types.

Mature at Repricing Calculates a market value and YTM for a given transaction up to the repricing date. For market value and YTM purposes the transaction is assumed to mature on the repricing date. Duration is always calculated to the next reprice date, not to maturity, regardless of the mature at repricing selection. Ignore Origination Cash Flows for Forward-Starting Instruments This feature allows the cash flow engine to ignore the origination Principal Cash Flows of any forward-starting instrument. The corresponding market value, duration, convexity and yield calculations will not reflect the Origination Amount. Origination principal Cash Flow will still be reported. Use Principal in Market Value Calculations (Off-Balance Sheet Only) This feature allows the Cash Flow Engine to consider principal in the calculation of market value, duration, convexity and yield calculations, even if principal is not actually exchanged. - Click Apply.