6.1.3 Lines of Business Overview Tab

The Lines of business overview tab includes reports that focus on an overview of Key Performance Indicators for Lines of businesses. The filters for this tab allow the report results to be focused on selected lines of business for comparison and targeted analysis.

The filters are:

- Time

- Company

- Lines of Business

- Region

The various reports available under this tab are discussed in the following sections.

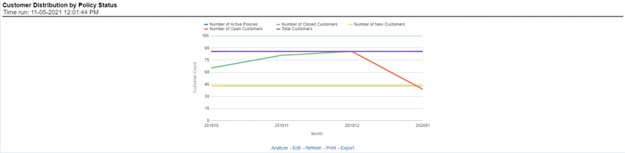

Customer Distribution by Policy Status

Figure 6-24 Customer Distribution by Policy Status

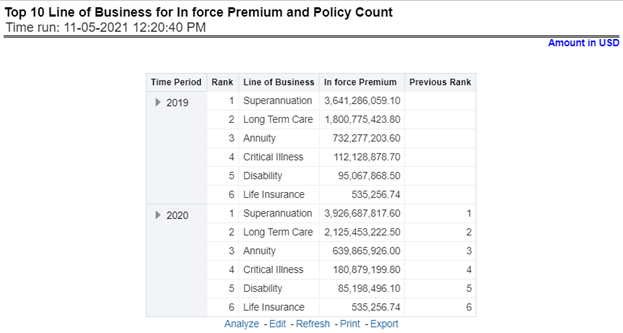

Top 10 Lines of Business for In-force Premium and Policy Count

Figure 6-25 Top 10 Lines of Business for In-force Premium and Policy Count

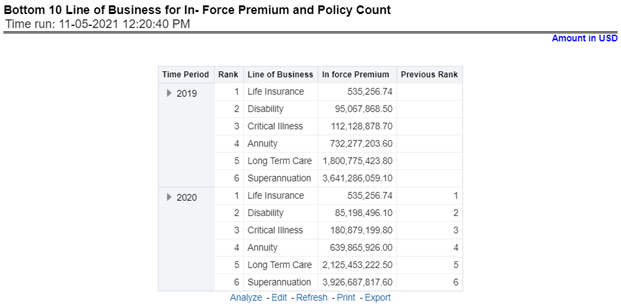

Bottom 10 Lines of Business for In-force Premium and Policy Count

Figure 6-26 Bottom 10 Lines of Business for In-force Premium and Policy Count

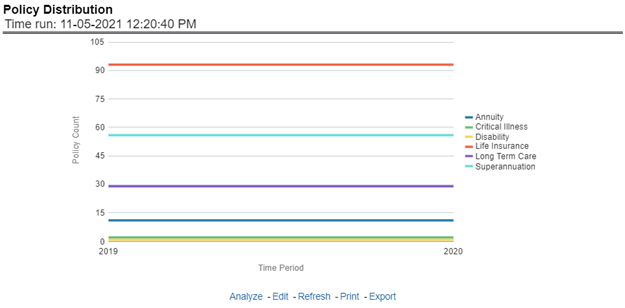

Policy Distribution

Figure 6-27 Policy Distribution

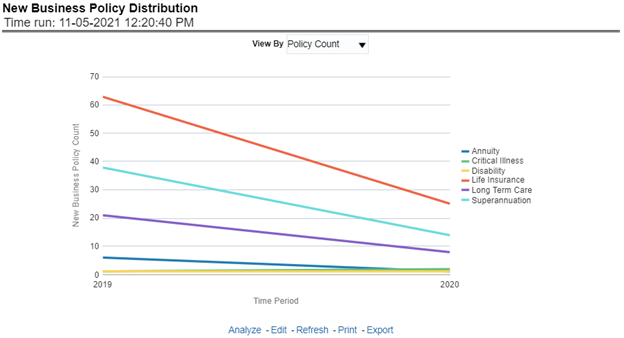

New Business Policy Distribution

Figure 6-28 New Business Policy Distribution

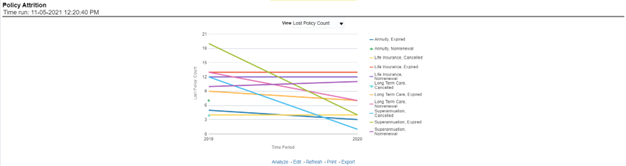

Policy Attrition

Figure 6-29 Policy Attrition

Quote Declines

Figure 6-30 Quote Declines

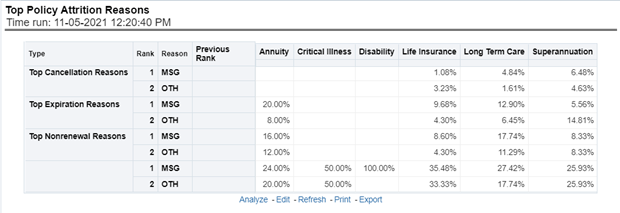

Top Policy Attrition Reasons

Figure 6-31 Top Policy Attrition Reasons

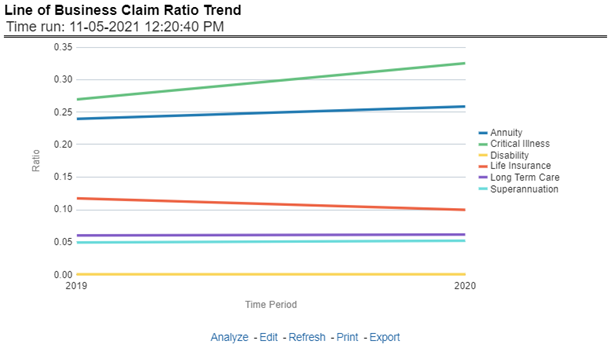

Lines of Business Claim Ratio Trend

Figure 6-32 Lines of Business Claim Ratio Trend

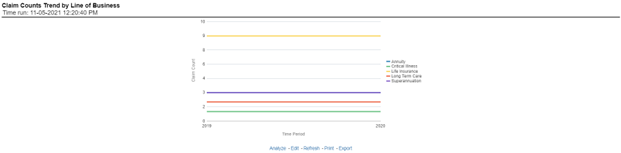

Claim Counts Trend by Lines of Business

Figure 6-33 Claim Counts Trend by Lines of Business