All reports on this tab focus on the policy performance perspective. The

reports represent business performance through a policy performance perspective.

The filters of this tab include:

The various reports available under this tab are discussed in the following sections.

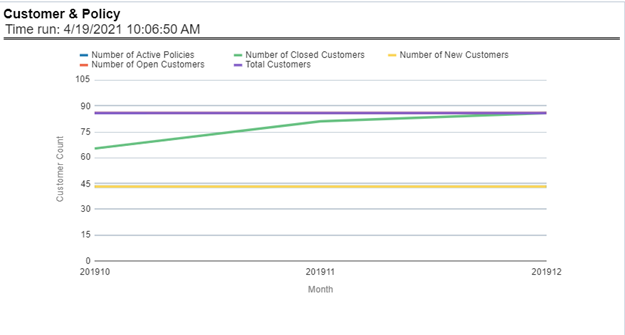

Customer and Policy

This report provides enterprise-wide performance with customer and policy information

overtime a period. Various performance metrics-based measures, for example, the

number of New Customers, Number of Closed Customers, and so on for the reporting

period selected, are compared with the previous periods and displayed. It shows

enterprise performance through customers and policies. This report can be viewed and

tracked through control areas like Time, Company, and Geography. The values are in

the Line Graph.

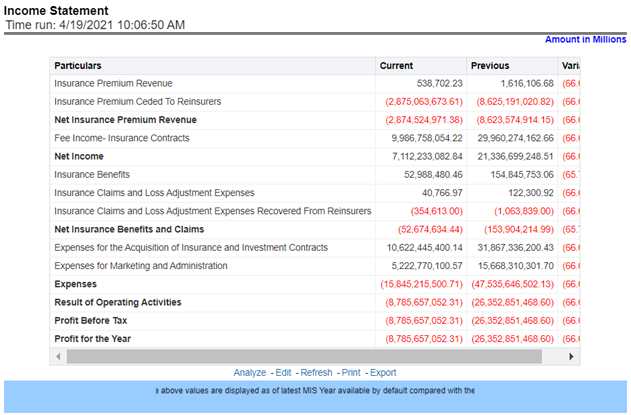

Income Statement

At an enterprise level, performance through various financial indicators can be

tracked through an Income Statement. This helps to understand the company's

financial position at a given point in time. This report can be analyzed over

various periods, entities, and geographies selected from page-level prompts. The

values are in a table.

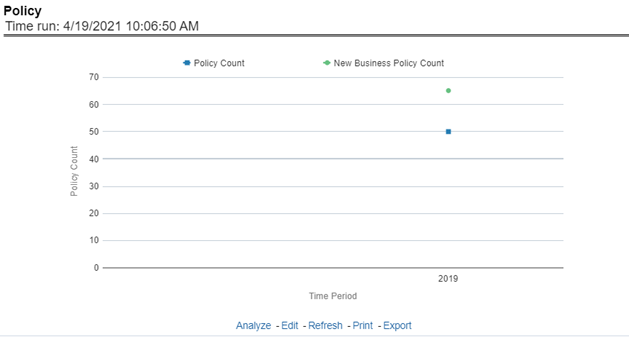

Policy

This report shows counts of policies for all lines of businesses and underlying

products through a time series. This report can be analyzed over various periods,

entities, and geographies selected from page-level prompts.

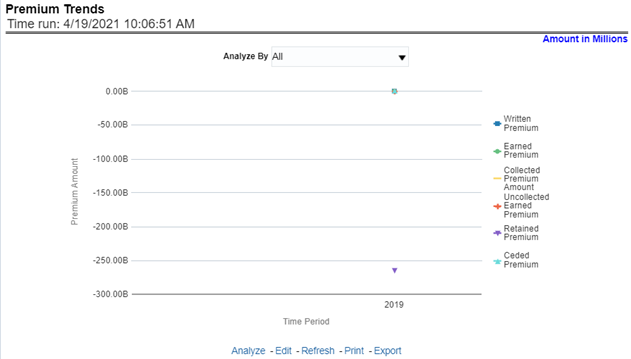

Premium Trends

This report shows a trend in revenue through different types of premium, for example,

Written Premium, Earned Premium, and Ceded Premium, at an enterprise level, for all

lines of businesses and underlying products through a time series. The Premium

Trends report contains the following report level filters:

- Written Premium

- Earned Premium

- Collected Premium

- Uncollected Earned Premium

- Retained Premium

- Ceded Premium

This report can be viewed by individual premium type or all types together through a

line graph. This report can be analyzed over various periods, entities, and

geographies selected from page-level prompts.

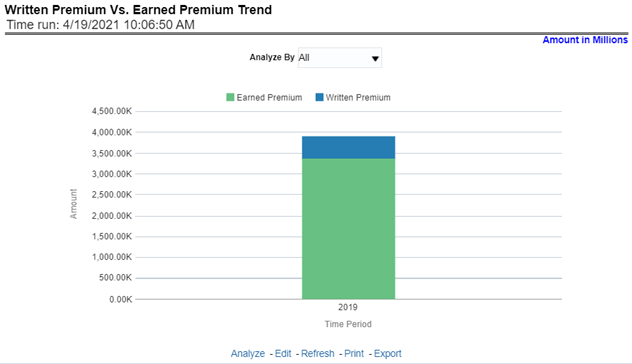

Written Premium versus Earned Premium Trend

This report shows the trend in revenue and a comparison between Written Premium and

Earned Premium, at an enterprise level, for all lines of businesses and underlying

products through a time series. This Trend can further be viewed and analyzed

through report level filters like Lines of business and Products for more

granularities, through a stacked bar graph. This report can be analyzed over various

periods, entities, and geographies selected from page-level prompts.

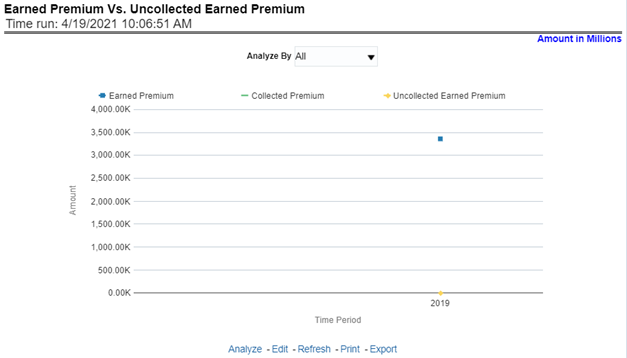

Earned Premium versus Uncollected Earned Premium

This report shows a trend in the actual collection of earned premium through a

comparison between earned premium, collected premium, and uncollected earned

premium. This report shows at an enterprise level, for all lines of businesses and

underlying products through a time series. This Trend can further be viewed and

analyzed through report level filters like Lines of business and Products for more

granularities. The values are in a stacked bar graph. This report can be analyzed

over various periods, entities, and geographies selected from page-level

prompts.

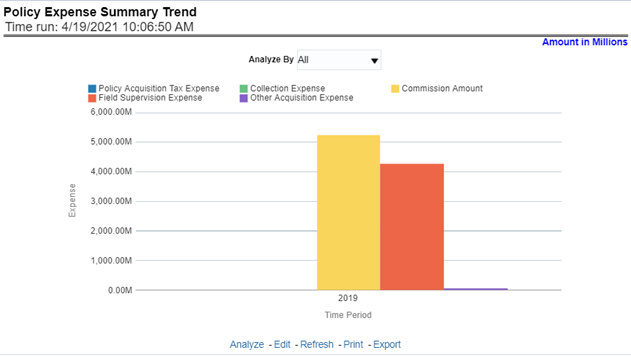

Policy Expense Summary Trend

This report shows policy-related expenses under different expense heads at an

enterprise level, for all lines of businesses and underlying products through a time

series. This Trend can further be viewed and analyzed through report level filters

like Lines of business and Products for more granularities. The values are in a

clustered bar graph. This report can be analyzed over various periods, entities, and

geographies selected from page-level prompts.

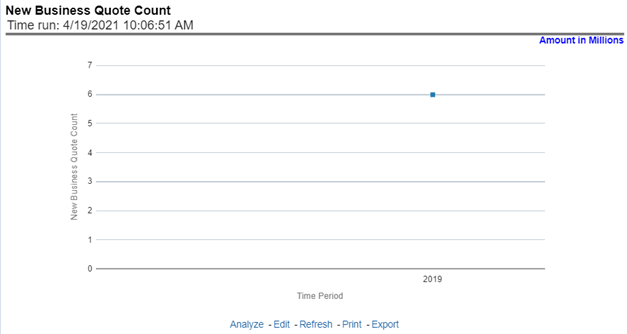

New Business Quote Count

This report shows the number of quotes generated for new business, at an enterprise

level, for all lines of businesses and underlying products through a time series.

This report can be analyzed over various periods, entities, and geographies selected

from page-level prompts.

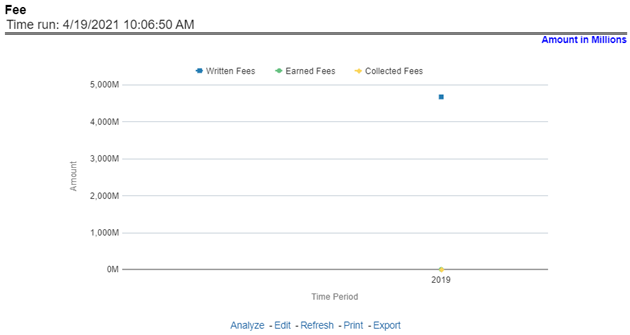

Fee

This report shows fee income generated, earned, collected, and refunded, at an

enterprise level, for all lines of businesses and underlying products through a time

series. This report can be analyzed over various periods, entities, and geographies

selected from page-level prompts.

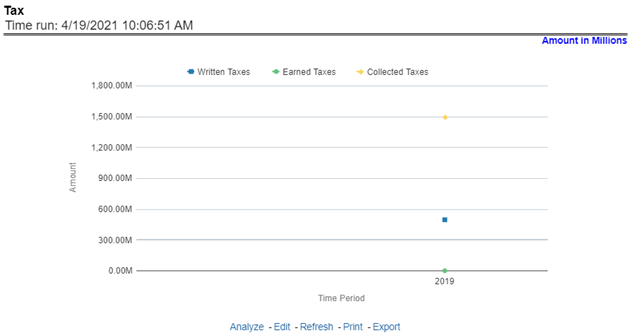

Tax

This report shows the premium tax trend for tax generated, earned, and collected, at

an enterprise level, for all lines of businesses and underlying products through a

time series. This report can be analyzed over various periods, entities, and

geographies selected from page-level prompts.

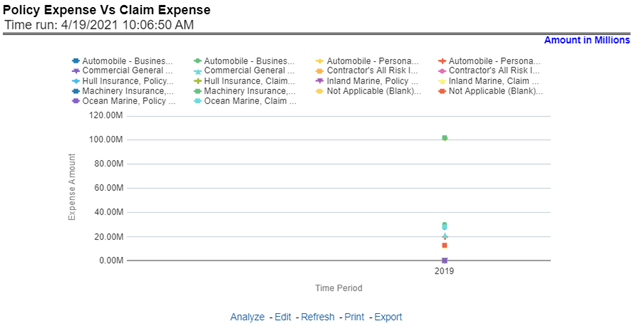

Policy Expense versus Claim Expense

This trend report shows a comparison between policy expenses and claim expenses, at

an enterprise level, for all lines of businesses and underlying products through a

time series. This report can be analyzed over various periods, entities, and

geographies selected from page-level prompts.

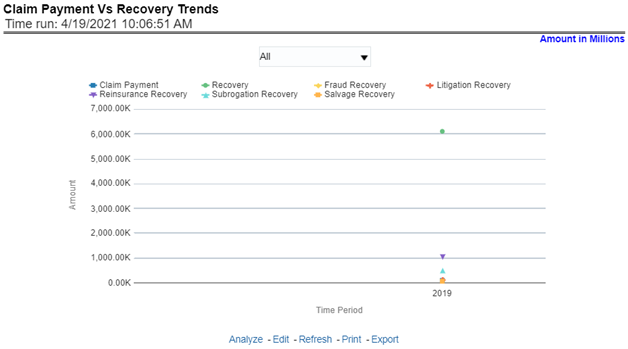

Claim Payment versus Recovery Trends

This report shows a comparison between claim payments and recoveries made as well as

the trend in various types of recoveries at an enterprise level, for all lines of

businesses and underlying products through a time series. This Trend can further be

viewed and analyzed through the following report level filters for more

granularities:

- Claim Payments

- All recovery Payments

- Fraud Recovery

- Litigation Recovery

- Reinsurance Recovery

- Subrogation Recovery

- Salvage Recovery

The values are in a line graph. This report can also be analyzed over various

periods, entities, and geographies selected from page-level prompts.

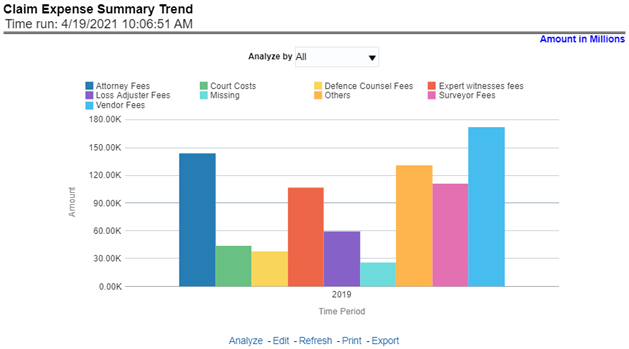

Claim Expense Summary Trend

This report shows a trend and comparison between various types of claim expenses at

an enterprise level, for all lines of businesses and underlying products through a

time series. This Trend can further be viewed and analyzed through the report level

filters, Lines of business and products, for more granularities. The values are in a

clustered bar graph. This report can also be analyzed over various periods,

entities, and geographies selected from page-level prompts.

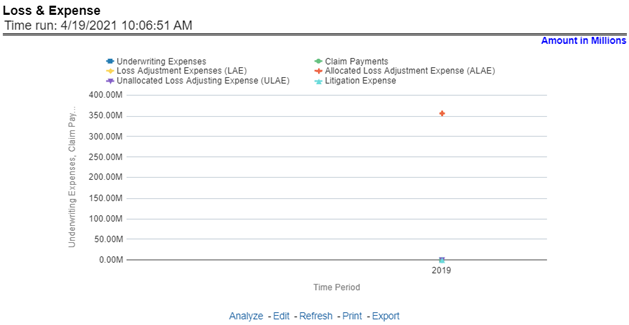

Loss and Expense

This report shows a trend and comparison between underwriting expense and various

types of loss adjustment expenses along with actual claim payments and litigation

expenses at an enterprise level, for all lines of businesses and underlying products

through a time series. The values are in a line graph. This report can also be

analyzed over various periods, entities, and geographies selected from page-level

prompts.

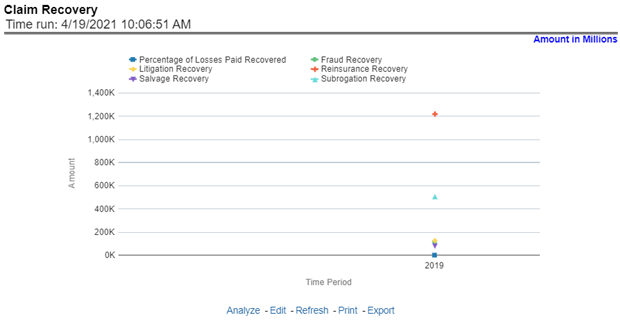

Claim Recovery

This report shows a trend in various types of recoveries as well as the extent of

recoveries against paid losses, at an enterprise level, for all lines of businesses

and underlying products through a time series. The values are in a line graph. This

report can also be analyzed over various periods, entities, and geographies selected

from page-level prompts.

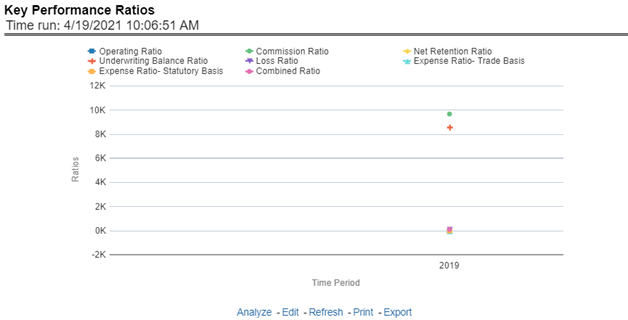

Key Performance Ratios

This report shows the trend in various key performance metrics, that is, combined

ratio, operating ratio, commission ratio, loss ratio, and so on for all lines of

businesses and underlying products over a selected period. Values are in a line

graph. This report can also be analyzed over various periods, entities, and

geographies selected from page-level prompts.

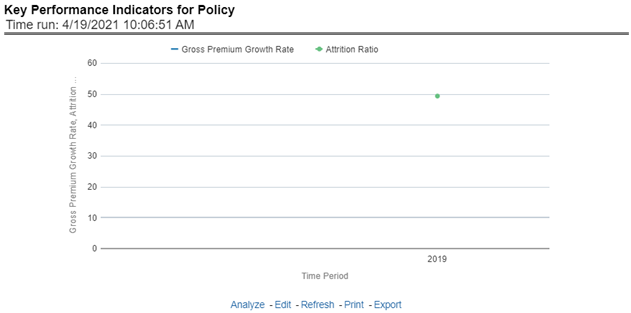

Key Performance Indicators for Policy

This report shows the trend in two key policy performance indicators that is the

gross premium growth rate and attrition ratio, for all lines of businesses and

underlying products through a time series. The values are in a line graph. This

report can also be analyzed over various periods, entities, and geographies selected

from page-level prompts.

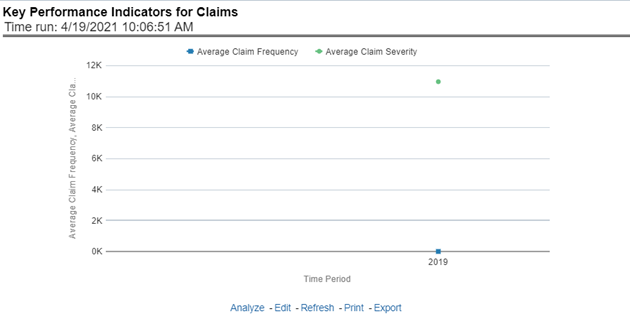

Key Performance Indicators for Claims

This report shows a trend in two key claim performance indicators, average values of

claim frequency and claim severity, for all lines of businesses, and underlying

products through a time series. The values are in a line graph. This report can also

be analyzed over various periods, entities, and geographies selected from page-level

prompts.