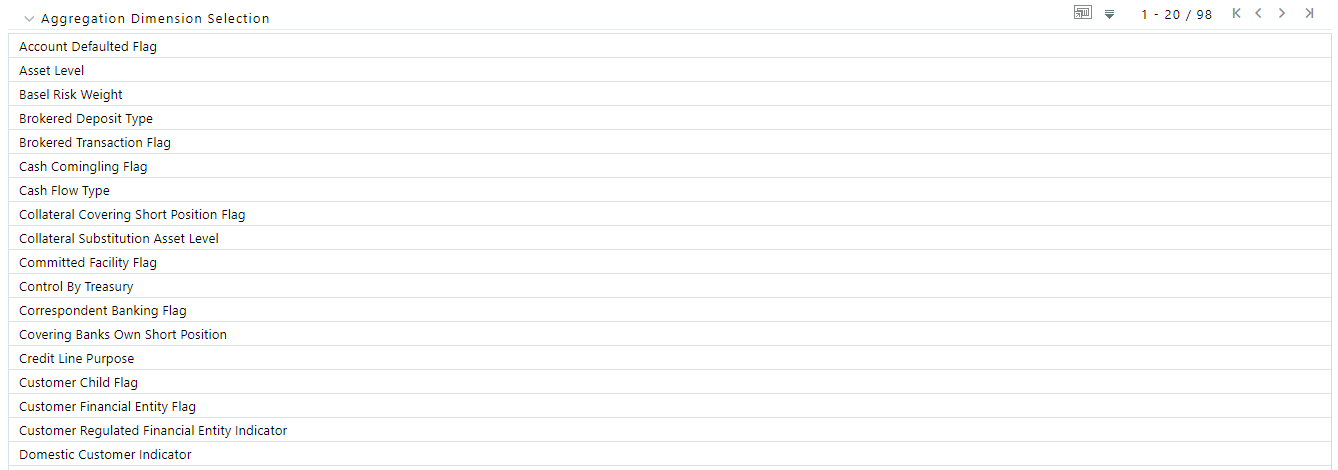

Only the selected dimensions appear under the Dimension browser in BAU window.

Note:

To achieve better performance results, it is recommended to use just as many aggregation dimensions as is needed by the user.

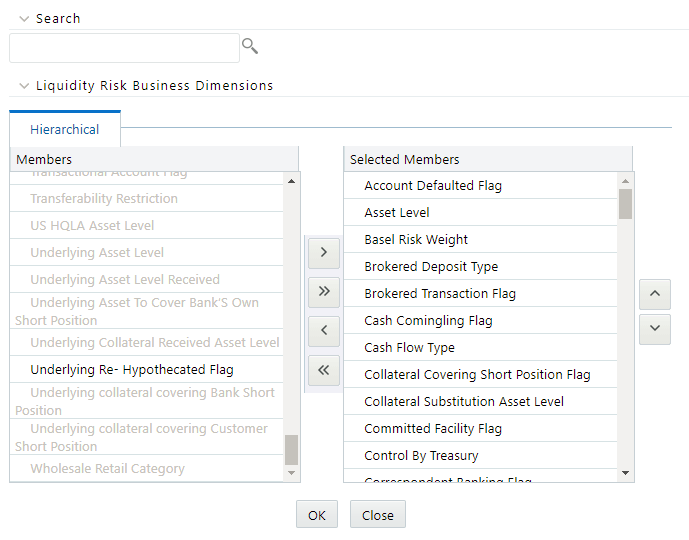

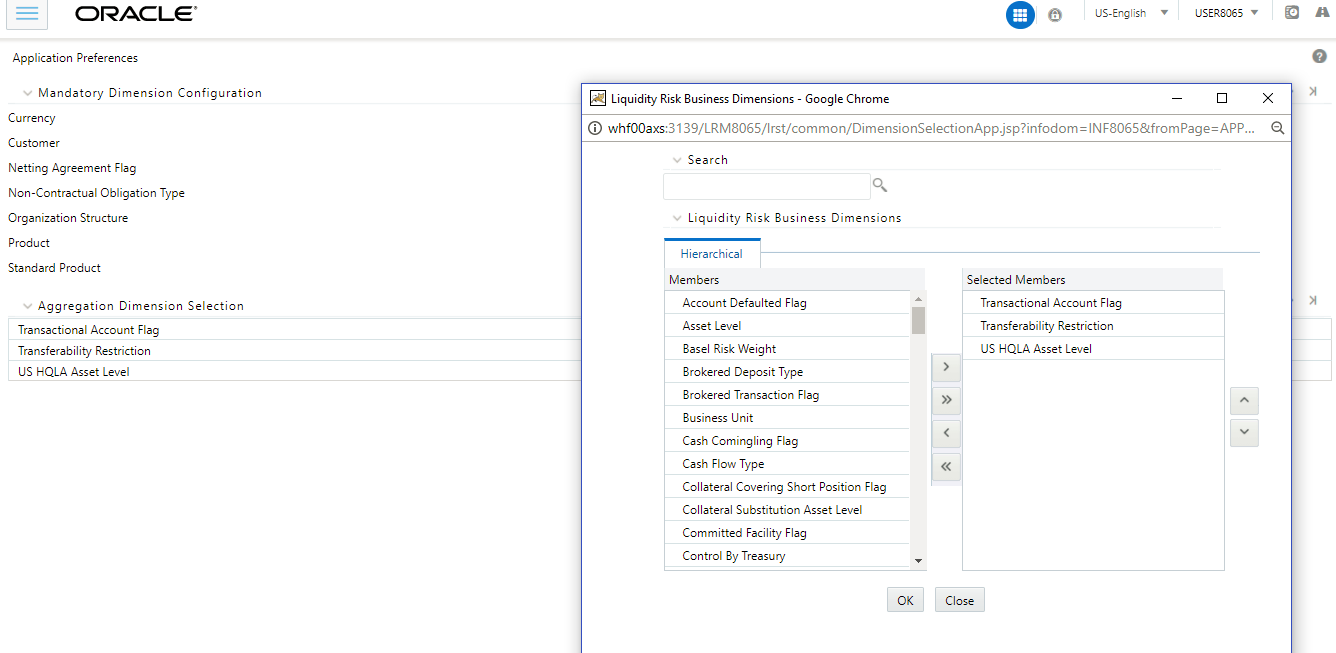

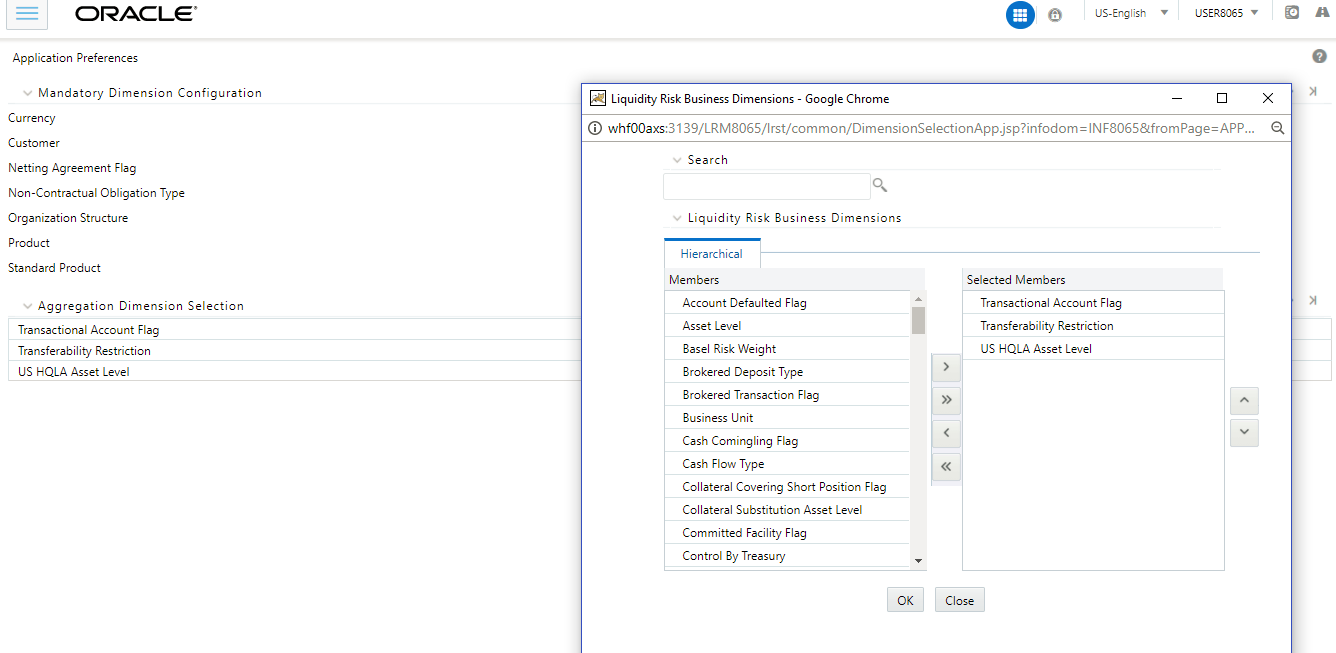

For example, in the following window only three members are selected in the application preferences dimension browser.

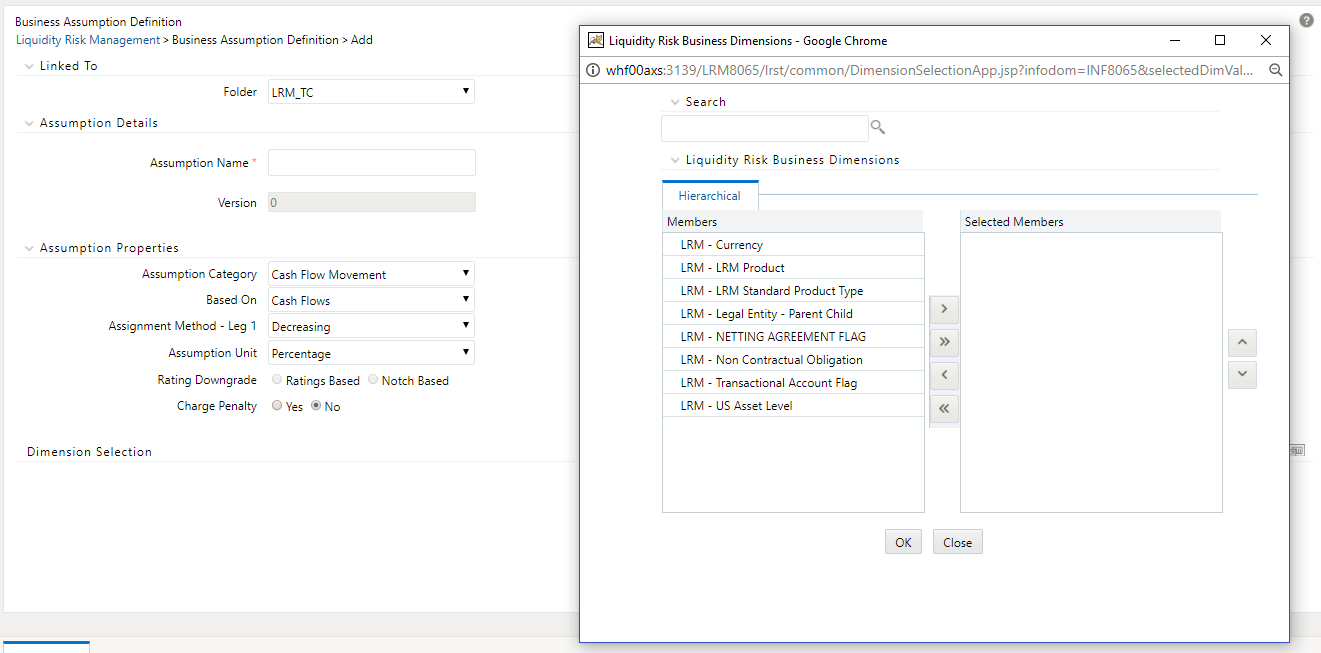

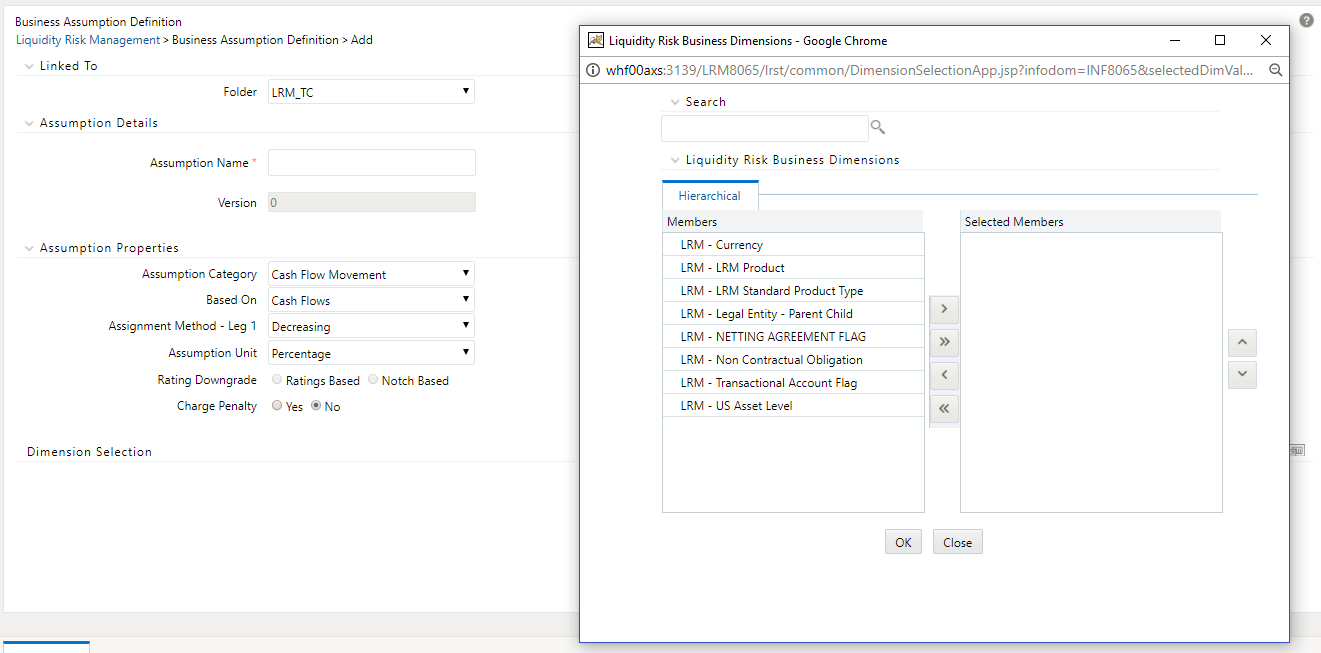

Only the selected aggregation dimensions along with the mandatory dimensions appear under the Dimension Selection section in the Business Assumption window as shown in the following figure:

Note:

- To add a new mandatory or aggregation dimension, it is recommended to add the following seeded data in FSI_LRM_BUSINESS_DIMENSION and fsi_lrm_lookup_tl with Category ID 25:

- f_is_intraday_specific = ‘Y’

- This dimension is used only for intraday Run and it is not displayed in Application Preference window. The f_selection_flag must be ‘N’ in this case as the US LCR Run must not be impacted.

- f_lcr_intraday_flag = ‘Y’

- This dimension is used for both intraday and US LCR Run. This is displayed in Application Preference window.

- f_account_dimension = ‘Y’

- This dimension is an account level attribute and is used only for intraday assumptions. This is displayed in Application Preference window.

- f_transaction_dimension = ‘Y’

- This dimension is a transaction level attribute and is used only for intraday assumptions. This is displayed in Application Preference window.

- While adding new business dimensions, it is recommended to add those which have small range of values. Adding dimensions with large set of list of values such as account, party, date will defeat the purpose of aggregation of cash flows and will affect performance.

The application currently supports the following dimensions for Asset Level classification:

- Asset Level: This dimension is used for specifying business assumptions and classifying assets as HQLA as per guidelines other than US Federal Reserve.

- US Asset Level: This dimension is used for specifying business assumptions and classifying assets as HQLA as per US Federal Reserve guidelines.

Both the dimensions are available for selection as part of the Aggregate Dimension selection section of the Application Preferences window. However, select only one at a particular time.

For instance, to define an assumption, or execute a Run with the Run Purpose Basel III Liquidity Ratios Calculation or RBI Basel III Liquidity Ratio Calculation, select the dimension named Asset Level. If you need to execute a Run with the Run Purpose U.S. Fed Liquidity Ratio Calculation, you need to select the dimension named US Asset Level.

Once a particular Run is executed after selection of the appropriate asset level dimensions, you must not change the asset level dimension till that Run is executed; else it will result in an error.