15.2.2.16 Alternative Liquidity Approaches

- Option 1 – Contractual committed liquidity facilities from the relevant central bank, with a fee

- Option 2 – Foreign currency HQLA to cover domestic currency liquidity needs

- Option 3 – Additional use of Level 2 assets with a higher haircut

An assessment is conducted by each jurisdiction to determine if each of the alternative liquidity approaches may be adopted by banks within that jurisdiction. Additionally, the maximum usage of the options is specified by regulators for each jurisdiction. This can be specified individually, at the level of each alternative approach, or collectively for all approaches.

In the current liquidity risk application this is captured at “Legal Entity” level.

Table 14-9 Level 1 HQLA Limit

| Legal Entity | Level 1 Asset (Required HQLA) | Alternative approaches |

|---|---|---|

| LE 1 | 25% | 75% |

| LE 2 | 40% | 60% |

- Option 1 – Contractual committed liquidity facilities from the relevant

central bank, with a fee

Option 1 increases the Stock of HQLA. For currencies in which sufficient HQLA is not available, the bank can add the amount to Stock of HQLA from Product Type Contractual Committed Liquidity Facilities from the Central Bank. This computation happens in LRM LCR Option1 Computation Process.

Data is first inserted in the table with Option Type as Option 1 and then a set of Rules are executed which updates the Option 1 Amount, the Stock of HQLA, and then recalculates the Liquidity Coverage Ratio post Options 1.

Banks should adhere to the following criteria in order to able to adopt option 1. They should have drawdown facility that is, should be receiving lines of credit by central bank on committed liquidity facilities. This should fulfill the following conditions:- Should not be regular central bank standing arrangements that is, these are contractual arrangements between the central bank and commercial bank.

- These contractual arrangements mature outside the 30 day LCR Horizon.

- These arrangements are irrevocable prior to maturity and involve no ex-post credit decision by the central bank.

- These facilities are charged for a fee irrespective of the amount, if any, drawn down and the fee is set so that banks which claim the facility line to meet the LCR, and banks which do not, have similar financial incentives to reduce their exposure to liquidity risk.

Note:

The type of collateral that is acceptable for securing these facilities is indicated by the respective central bank - Option 2– Foreign currency HQLA to cover domestic currency liquidity needs

Option 2 increases the Stock of HQLA. For currencies in which sufficient HQLA is not available, the bank can add the amount to Stock of HQLA from foreign currency. Stock of HQLA from foreign currencies can only be added if there is extra Stock of HQLA available in foreign currency. This computation happens in LRM LCR Option2 Computation Process.

Data is first inserted in the table with Option Type as Option 2 and then a set of Rules are executed which brings in the extra Stock of HQLA from foreign Currency and adds it to the Stock of HQLA of the currency where the funds are insufficient. Once the Option amount and New Stock of HQLA is updated then Liquidity Coverage Ratio is recalculated.

This option allows HQLA in foreign currencies to be used to cover the net cash outflows in domestic currency. These currencies are classified as Major currencies and Other Currencies.

In order to account for the foreign exchange risk, banks are expected to apply a minimum haircut of 8% on the major currencies and higher on other currencies.

Other Currencies haircut is considered at a minimum of 10%.

Haircuts are specified against each currency pair. Example: Haircut for USD and GBP 8%, Haircut for GBP and AUD 10% and so on. These haircuts are applicable only to that portion of the foreign currency HQLA that is in excess of a threshold specified by each regulator.

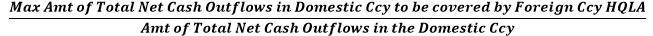

For every Legal Entity there would be a threshold for applying haircuts which is calculated by the following formula:Figure 14-35 Threshold formula

Where,

Domestic Ccy = Currency in which the HQLA is insufficient to cover net cash outflows

This threshold cannot exceed 25% for a given Legal Entity. The sequence of the currencies is specified by the concerned bank.Note:

While applying this threshold the first foreign currency is considered and then the threshold is applied. - Option 3– Additional use of Level 2 assets with a higher haircut

Option 3 increases the Stock of HQLA for currencies in which sufficient HQLA is not available, banks can take the additional amount from Asset 2 if available. This computation happens in LRM LCR Option3 Computation process.

Data is first inserted in the table with Option Type as Option 3 and then a set of Rules are executed which updates the Option 3 Amount, Stock of HQLA and then recalculates the Liquidity Coverage Ratio post Options 3.

This option applies when Level 1 assets are insufficient to cover the liquidity needs of a bank in domestic currency, but there are sufficient level 2A assets. The level 2A assets used as part of this option must have a quality similar to that of Level 1 assets. In order to achieve this there are additional criteria imposed such as:- Such Assets must have a minimum credit rating of AA or AA+ and,

- Additional level 2A assets used will be subject to a minimum of 20%

haircut which is 5% more than that applied to the level 2A assets

falling within the 40% cap.

Note:

- Level 2B assets are not considered for this purpose

- 15% Cap on level 2B assets remains unchanged regardless of additional level 2A assets used as part of this option

- The Haircut can be different across jurisdictions and also across banks within a single jurisdiction depending on the level of usage.

An Example to calculate option 3 amount: Say suppose the below mentioned information is available.

Table 14-10 Example to calculate Option 3 HQLA Amount

Legal Entity Account Level 2A Flag Level2A Assets Used Level2A Assets Unused Credit Rating Qualified Option 3 Asset Haircut LE1 ACCT1 Y 200000 500000 AA+ Y 25% LE1 ACCT1 Y 0 250000 B N Only ACCT1 fulfills additional criteria that is,

- Credit rating of AA+ so we have to consider the amount which is unused and apply a higher haircut in this case its 25% .

- So the option 3 amount will be calculated as Level 2A assets Unused *(1-haircut) that is, 500000*(1-.25) = 375000.

Note:

Different processes have been created in the Run for all three Options. You are allowed to specify the sequence in which these options are to be executed. The sequence of execution is available as part of the Run.