13.4.1 Approximation of Interest Cash Flows

- Business assumption values are applied to both principal and interest cash flows

- · Assumption values are applied to principal cash flows only and interest is approximated

- If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Principal, then assumption is applied only to the principal cash flows.

- If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Interest, then assumption impacts only Interest cash flows.

- If you have selected Cash Flow Type as a dimension in the business assumption and the dimension member as Principal and Interest, then assumption is applied to both principal and interest cash flows.

- If you have not selected Cash Flow Type as a dimension in the business assumption, then assumption is applied to both principal and interest cash flows.

If Include Interest Cash Flow parameter is selected as No, only principal cash flows are considered and interest cash flows are ignored.

- Obtain the principal and interest cash flows under contractual terms.

- Bucket the contractual cash flows based on the user specified time buckets while distinguishing between interest and principal cash flows in each time bucket.

- Calculate the outstanding balance in each bucket under contractual

terms. The outstanding balance in the first time bucket will be the EOP balance.

The formula for calculating the outstanding balance for each subsequent bucket

is as follows:

Where,

O/S Balance : Outstanding Balance

CF : Cash Flows

- Apply the business assumption to estimate principal cash flows. In case of balance based assumptions, this applies to the EOP balance. In case of cash flow based assumptions, this applies to the principal cash flows in a given bucket.

- Calculate the outstanding balance in each bucket under

business-as-usual or stress terms. The outstanding balance in the first time

bucket will be the EOP balance. The formula for calculating the outstanding

balance for each subsequent bucket is as follows:

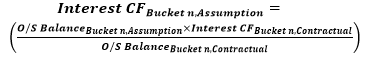

- Calculate the impact on interest cash flows in each bucket under

business-as-usual or stress terms as per the following formulas:

Table 12-1 Example giving the UI Specification for Run-off Assumption

Run-off From Bucket To Bucket Assignment Method Assumption Unit Assumption Value Based On Product 1-3 Months 1-7 Days Selected Percentage 10 Cash Flow Loan In the following Illustration both Principal and Interest are downloads.

Table 12-2 Example

Measure Contractual Cash Flows Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Principal 150 250 330 700 610 Outstanding Balance

(Refer Point 3)

2000 1850

(2000-150)

1600

(1850-250)

1270

(1600-330)

570

(1270-700)

Interest 20 40 45 80 70 Table 12-3 Example showing Impact on Interest Cash Flows under Run-off Assumption

Measure Business Assumption Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Assumption impacted Principal Nil (+) 61 Nil Nil (-) 61

(610*10%)

Revised Principal CF (post business assumption) 150

(150 + Nil)

311

(250 + 61)

330

(330+Nil)

700

(700 + Nil)

549

{610 + (-)61}

Outstanding Balance

(Refer Point 5)

2000 1850

(2000 – 150)

1539

(1850 – 311)

1209

(1539-330)

509

(1209-700)

Interest

(Refer Point 6)

20 40 43.28

(45/1600*1539)

76.16

(80/1270*1209)

62.5

(70/570*509)

Impact on Interest Cash Flows under Growth Assumption

Table 12-4 Example giving the UI Specification for Growth Assumption

Run-off From Bucket To Bucket Assignment Method Assumption Unit Assumption Value Based On Product 1-7 Days Overnight - - 0 EOP Balance Loan 16-30 Days Equal Percentage 20 In the following Illustration both Principal and Interest are downloads.

Table 12-5 Download Data

Contractual Cash Flows EOP Balance 2000 Table 12-6 Example

Measure Contractual Cash Flows Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Principal 150 250 330 700 610 Outstanding Balance

(Refer Point 3)

2000 1850

(2000-150)

1600

(1850-250)

1270

(1600-330)

570

(1270-700)

Interest 20 40 45 80 70 Table 12-7 Example showing Impact on Interest Cash Flows under Growth Assumption

Measure Business Assumption Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Assumption impacted Principal Nil -400 200 200 Nil Revised Principal CF (post business assumption) 150

(150 + Nil)

-150

{250 + (-) 400}

530

(330+200)

900

(700 + 200)

610

(610 + Nil)

Outstanding Balance 2000 1850

(2000-150)

2000

{1850- (-150)}

1470

(2000-530)

570

(1470-900)

Total Interest 20 40 56.25

(45/1600*2000)

92.59

(80/1270*1470)

70 Change in Interest Nil Nil 11.25

( 56.25-45)

12.59

(92.59-80)

Nil Table 12-8 Example giving the UI Specification for Growth Assumption (Cash Flow Based)

Run-off From Bucket To Bucket Assignment Method Assumption Unit Assumption Value Based On Product 1-7 Days Overnight - - 0 Cash Flow Loan 16-30 Days Equal Percentage 20 In the following Illustration both Principal and Interest are downloads.

Table 12-9 Example

Measure Contractual Cash Flows Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Principal 150 250 330 700 610 Outstanding Balance

(Refer Point 3)

2000 1850

(2000-150)

1600

(1850-250)

1270

(1600-330)

570

(1270-700)

Interest 20 40 45 80 70 Table 12-10 Example showing Impact on Interest Cash Flows under Growth Assumption (Cash Flow Based)

Measure Business Assumption Overnight 1-7 Days 8-15 Days 16-30 Days 1-3 Months Assumption impacted Principal Nil (-) 50

(250*20%)

25 25 Nil Revised Principal CF (post business assumption) 150

(150 + Nil)

200

{250 + (-) 50}

355

(330+25)

725

(700 + 25)

610

(610 + Nil)

Outstanding Balance

2000 1850

(2000-150)

1650

(1850-200)

1295

(1650-355)

570

(1295-725)

Total Interest

20 40 46.41

(45/1600*1650)

81.57

(80/1270*1295)

70 Change in Interest Nil Nil 1.41

(46.41-45)

1.57

(81.57-80)

Nil The application supports the inclusion or exclusion of interest cash flows based on the Run parameters selected by the user. This is also impacted by the inclusion or exclusion of cash flow type as a dimension in the business assumption. The next section details multiple scenarios with different combination of parameters and their impact on interest cash flows.

- Do not include Cash Flow Type as a dimension in the business assumption (Principal + Interest will be considered).

- In Run Definition window,

- Select Yes in Include Interest Cash Flow and,

- Select Yes in Approximate Interest.

In the above scenario, only Principal cash flows will be impacted. Interest cash flows will be approximated based on change to principal.

- Do not include Cash Flow Type as a dimension in the business assumption (Principal + Interest will be considered).

- In Run Definition window,

- Select Yes in Include Interest Cash Flow and,

- Select No in Approximate Interest.

In the above scenario, both Principal and Interest cash flows will be impacted.

- Do not include Cash Flow Type as a dimension in the business assumption (Principal + Interest will be considered).

- In Run Definition window, select No in Include Interest Cash Flow.

In the above scenario, no impact on Interest cash flows as they are not considered for computation and reporting.

- Include Cash Flow Type as a dimension and select Principal in the business assumption.

- In Run Definition window,

- Select Yes in Include Interest Cash Flow and,

- Select Yes in Approximate Interest.

In the above scenario, only Principal will be impacted. Interest cash flows will be approximated based on change to principal.

- Include Cash Flow Type as a dimension and select Principal in the business assumption.

- In Run Definition window,

- Select Yes in Include Interest Cash Flow and,

- Select No in Approximate Interest.

In the above scenario, Principal will be impacted because only Principal is selected as a dimension. There will be no change in the interest cash flow amounts.