8.6.3.6 Assignment Method – Leg 1

This option determines how the primary assumption value is allocated to time buckets. There are specific methods in which the assumption value can be distributed across buckets. Assignment methods determine the manner in which the primary assumption values are assigned to multiple buckets in order to determine the cash flows. Leg 1 is applicable when only one leg of the transaction is affected i.e. when the assumption legs field value is selected as One.

The options are as follows:

- Selected Time Bucket - This method assigns the cash flows only to the time buckets against which the assumption value is specified. If the assumption is not specified on Level 0 buckets, then the assignment to the more granular buckets is done proportionately to the bucket size.

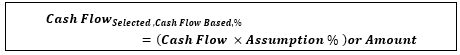

The formula is as follows:

The time buckets used for computation are as follows:

Table 7-72 Time buckets

N_BUCKET_NO V_BUCKET_NAME V_BUCKET_NAME_CATEGORY 1 Overnight Overnight 2 1-10Days 1-15Days 3 11-15Days 1-15Days 4 16-20Days 16-30Days 5 21-25Days 16-30Days 6 26-30Days 16-30Days The example below illustrates allocation of cash flows when the assumption value is specified for a Level 0 bucket

Table 7-73 Assignment Method Leg 1 - Selected Time Bucket Example 1

Assumption Category Assumption Unit Applied to Assignment Method Based On Cash Flow Movement- Run-off Percentage Original Balance Selected Cash Flow Table 7-74 Assignment Method Leg 1 - Selected Time Bucket Example 1

Business Assumption Computation Product Customer From Bucket To Bucket Run-off % Contractual Cash Flow (From Bucket) Contractual Cash Flow (To Bucket) Run-off Revised Cash flow - From Bucket Revised Cash flow -To Bucket Time Deposits Customer 1 10-10Days 5-5Days 10% 30000 23000 3000

(30000* 10%)

33000

(30000+ 3000)

20000

(23000--3000)

However, this allocation differs for Levels other than Level 0 buckets as Illustrated in the following example.

The example below illustrates, the selected Cash Flow assignment method on Level 1 buckets

Table 7-75 Assignment Method Leg 1 - Selected Time Bucket Example 2

Business Assumption Computation Customer From Bucket To Bucket Run-off % Contractual Cash Flow (From Bucket) To Bucket Contractual Cash Flow (To Bucket) Run-off Revised Cash flow - From Bucket Revised Cash flow -To Bucket Customer 1

16-30Days 1-15Days 10% 50000

1-10Days 21000 5000

(50000*10%)

45000

(50000-5000)

24333.33

{21000+(5000*10/15)}

11-15Days 15000 16666.67

{15000+(5000*5/15)}

- Increasing assignment - The cash flows are assigned to each bucket up to the selected bucket in increasing order based on ranks assigned to cash flows. Assignments are made in increasing order to the selected level and further assignment is done until the most granular level.

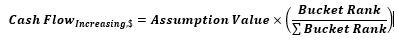

The formulae under different conditions are as follows:

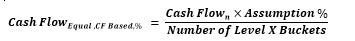

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- When, Assumption Unit = Value

The example below illustrates, Increasing Cash Flow assignment method based on Cash Flow.

Table 7-76 Increasing Cash Flow assignment

Assumption Category Assumption Unit Applied to Assignment Method Based On Cash Flow Movement- Run-off Percentage Original Balance Increasing Cash Flow Table 7-77 Assignment Method Leg 1 - Increasing assignment Example 1

Business Assumption Computation Product Customer From Bucket To Bucket Run-off % To Bucket Bucket Rank Contractual Cash Flow (From Bucket) Contractual Cash Flow (To Bucket) Run-off (Value) Revised Cash flow - From Bucket Revised Cash flow -To Bucket Assets Customer 1 10-10Days 3-3Days 10% Overnight 1 30000 20000 300

=(30000*10%)*1/10

27000

=(30000- 3000)

20300

= (20000+300)

1-1Days 2 21000 600

=(30000*10%)*2/10

21600

== (21000+600)

2-2Days 3 19000 900

=(30000*10%)*3/10

19900

= (19000+900)

3-3Days 4 27000 1200

=(30000*10%)*4/10

28200

= (27000+1200)

- When, EOP Balance Based Assumptions, Assumption Unit = Percentage

The example below illustrates, Increasing Cash Flow assignment method based on EOP Balance. Here, EOP Balance (Time Deposits) is assumed as 300000.

Table 7-78 Increasing Cash Flow assignment method

Assumption Category Assumption Unit Applied to Assignment Method Based On Incremental Cash Flow : Run-off Percentage Original Balance Increasing EOP Balance Table 7-79 Assignment Method Leg 1 - Increasing assignment Example 2

Business Assumption Computation Product Customer From Bucket Run-off % Bucket Rank Primary Bucket Contractual Cash Outflow(Primary Bucket) Run-off Revised Cash Outflow (Primary Bucket) Time Deposits Customer 1

1-1 Days 10 1 Overnight 20000 10000

(300000*10%)*1/3

10000 2 1-1 Days 30000 20000

(300000*10%)*2/3

20000

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- Decreasing Assignment - The Cash flows are assigned to each bucket up to the selected bucket in decreasing order based on ranks assigned to cash flows. Assignments are made in decreasing order to selected level and further assignment is done until the most granular level.

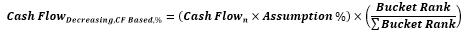

The formulae under different conditions are as follows:

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- When, Assumption Unit = Value

The example below illustrates, Decreasing Cash Flow assignment method based on Cash Flow.

Table 7-80 Decreasing Cash Flow assignment method

Assumption Category Assumption Unit Applied to Assignment Method Based On Cash Flow Movement - Run-off Percentage Original Balance Decreasing Cash Flow Table 7-81 Assignment Method Leg 1 - Decreasing Assignment Example 1

Business Assumption Computation Product Customer From Bucket To Bucket Run-off % To Bucket Bucket Rank Contractual Cash Flow (From Bucket) Contractual Cash Flow (To Bucket) Run-off (Value) Revised Cash flow - From Bucket Revised Cash flow -To Bucket Assets Customer 1 10-10Days 3-3Days 10% Overnight 4 30000 20000 1200

(30000*10%)*4/10

27000

(30000- 3000)

21200

(20000+1200)

1-1Days 3 21000 900

(30000*10%)*3/10

21900

(21000+900)

2-2Days 2 19000 600

(30000*10%)*2/10

19600

(19000+600)

3-3Days 1 27000 300

(30000*10%)*1/10

30000

(27000+300)

- When, EOP Balance Based Assumptions, Assumption Unit = Percentage

Table 7-82 EOP Balance Based Assumptions

Assumption Category Assumption Unit Applied to Assignment Method Based On Incremental Cash Flow : Run-off Percentage Original Balance Decreasing EOP Balance The example below illustrates, Decreasing Cash Flow assignment method based on EOP Balance. Here, EOP Balance (Time Deposits) is assumed as 300000.

Table 7-83 Assignment Method Leg 1 - Decreasing Assignment Example 2

Business Assumption Computation Product Customer From Bucket Run-off % Bucket Rank Primary Bucket Contractual Cash Outflow(Primary Bucket) Run-off Revised Cash Outflow (Primary Bucket) Time Deposits Customer 1

1-1 Days 10

2 Overnight 20000 1 1-1 Days 30000

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- Equal Assignment - The Cash flows are to be assigned equally up to the selected bucket. Assignments are made equally to the selected level and further assignment is done until the most granular level.

The formulae under different conditions are as follows:

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

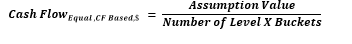

- When, Assumption Unit = Value

The example below illustrates, Equal Cash Flow assignment method based on Cash Flow. Here, Level X buckets are assumed as higher granular bucket.

Table 7-84 Equal Cash Flow assignment

Cash Flow Movement- Run-off Percentage Original Balance Equal Cash Flow Cash Flow Movement- Run-off Percentage

Original Balance Equal

Cash Flow Table 7-85 Assignment Method Leg 1 - Equal Assignment Example 1

Business Assumption Computation Product Customer From Bucket To Bucket Run-off % To Bucket Bucket Rank Contractual Cash Flow (From Bucket) Contractual Cash Flow (To Bucket) Run-off (Value) Revised Cash flow - From Bucket Revised Cash flow -To Bucket Assets Customer 1 10-10Days 5-5 Days 10% Overnight 30000 20000 500

(30000*10%)/6

27000

=(30000- 3000)

20500

(20000+500)

1-1Days 21000 500

(30000*10%)/6

21500

(21000+500)

2-2Days 19000 500

(30000*10%)/6

19500

(19000+500)

3-3Days 27000 500

(30000*10%)/6

27500

(27000+500)

4-4Days 13000 500

(30000*10%)/6

13500

(13000+500)

5-5Days 11000 500

(30000*10%)/6

11500

(11000+500)

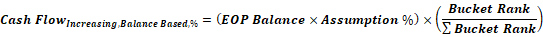

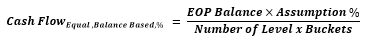

- When, EOP Balance Based Assumptions, Assumption Unit = Percentage.

The example below illustrates, Equal Cash Flow assignment method based on EOP Balance. Here, EOP Balance (Time Deposits) is assumed as 500000.

Table 7-86 Equal Cash Flow assignment method

Assumption Category Assumption Unit Applied to Assignment Method Based On Incremental Cash Flow : Run-off Percentage

Original Balance

Equal

EOP Balance Table 7-87 Assignment Method Leg 1 - Equal Assignment Example 2

Business Assumption Computation Product Customer From Bucket Run-off % Primary Bucket Contractual Cash Outflow(Primary Bucket) Run-off Revised Cash Outflow (Primary Bucket) Time Deposits Customer 1

1-1 Days 10 Overnight 20000 50000

(500000*10%)

45000

20000+(50000/2)

1-1 Days 30000 55000

30000 + (50000/2)

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- Proportionate Assignment - The Cash flows are assigned to each bucket up to the selected bucket in proportion to the bucket size. Assignments are made proportionately to the selected level and further assignment is done until the most granular level.

The formulae under different conditions are as follows.

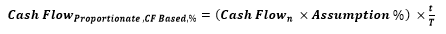

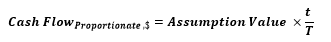

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage

- When, Assumption Unit = Value

The example below illustrates, Proportionate Cash Flow assignment method based on Cash Flow.

Here,

t = Number of days in the given Level x bucket

T= Total number of days up to the selected bucket

Table 7-88 Proportionate Cash Flow assignment

Assumption Category Assumption Unit Applied to Assignment Method Based On Cash Flow Movement- Run-off Percentage Original Balance Proportionate Cash Flow The time buckets which are considered for the computation are as follows:

Table 7-89 Time buckets

N_BUCKET_NO V_BUCKET_NAME 1 Overnight 2 1-10Days 3 11-15Days 4 16-20Days 5 21-25Days 6 26-30Days Table 7-90 Assignment Method Leg 1 - Proportionate Assignment Example 1

Business Assumption Computation Product Customer From Bucket To Bucket Run-off % To Bucket Contractual Cash Flow (From Bucket) Contractual Cash Flow (To Bucket) Run-off (Value) Revised Cash flow - From Bucket Revised Cash flow -To Bucket Assets Customer 1 26-30Days 11-15Days 10% Overnight 30000 20000 0

(30000*10%)*0/15

27000

=(30000- 3000)

20000 1-10Days 21000 2000

(30000*10%)*10/15

23000

(21000+2000)

11-15Days 19000 1000

(30000*10%)*5/15

20000

(19000+1000)

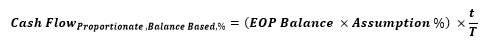

- When, EOP Balance Based Assumptions, Assumption Unit = Percentage

The example below illustrates, Proportionate Cash Flow assignment method based on EOP Balance. Here, EOP Balance (Time Deposits) is assumed as 300000.

Table 7-91 Proportionate Cash Flow assignment

Assumption Category Assumption Unit Applied to Assignment Method Based On Incremental Cash Flow :Run-off Percentage Original Balance Proportionate EOP Balance Table 7-92 Assignment Method Leg 1 - Proportionate Assignment Example 2

Business Assumption Computation Product Customer Primary Bucket Run-off (%) BucketRank Primary Bucket Contractual CashOutflow(Primary Bucket) Run-off Revised Cash Outflow (Primary Bucket) Customer 1

1-10Days 10 1 Overnight 20000 0(300000*10%)*0/10 20000 2 1-10Days 30000 30000

(300000*10%)*10/10

60000

(30000 + 30000)

- When, Cash Flow Based Assumptions, Assumption Unit = Percentage