15.2.2.3 Calculation of Stock of High Quality Liquid Asset

SHQLA is calculated at legal entity and currency granularity. This is performed by the rule LRM - BIS SHQLA Computation. All unencumbered assets classified as Level 1, 2A or 2B, which meet the HQLA eligibility criteria, are included in the stock of high quality liquid assets (SHQLA).

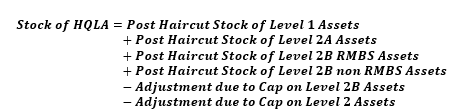

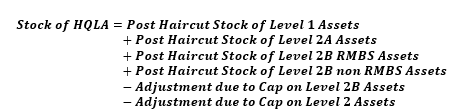

The formula for calculating SHQLA is as follows:

Figure 14-1 Formula for calculating SHQLA

The application applies the relevant liquidity haircuts to the market value of each

eligible HQLA based on the haircuts specified as part of a business assumption. The sum

of haircut adjusted market value of all assets which are not ‘other assets’ and which

are classified as ‘eligible HQLA’ comprises of the stock of HQLA. The stock includes

bank’s own assets which are unencumbered, i.e. not placed as collateral; as well assets

received from counterparties where the bank has a re-hypothecation right and where such

assets are not re-hypothecated.

Note:

All calculations are based on the market value of assets.