9.3.1 Defining a Contractual Run

The Run Management window allows you to define a new Run or create a new Run definition.

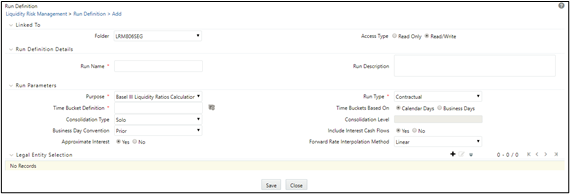

Figure 8-8 Run Definition - Contractual Run

To define a Contractual Run, perform the following steps:

- Click the Add icon on the Run Management window.

The Run Definition window is displayed where you can define a Run.

- In Linked To section,

- Select the Folder from the drop-down list, which is specific to the Run definition. The Run definitions are linked to a segment.

- Select the Access Type. It is either Read/Write or Read Only option.

- In Run Definition Details section.

- Enter the Run Name which is unique across infodoms.

- Enter the Run Description.

Note:

Both the Run Name and Run Description fields allow special characters.

- In Run Parameters section,

- Select the Purpose from the drop-down list. The drop-down list displays the following:

- Basel III Liquidity Ratios Calculation

- EBA Delegated Act Liquidity Ratio Calculation

- FR 2052 a Report Generation

- FR 2052 b Report Generation

- Intra-Day Metrics Calculation

- Long Term Gap Calculation

- RBI Basel III Liquidity Ratio Calculation

- RBI Short-Term Dynamic Liquidity Report Generation

- RBI Structural Liquidity Report Generation

- Regulation YY Liquidity Risk Calculation

- U.S Fed Liquidity Ratio Calculation

- BOT Liquidity Ratio Calculation

- BNM Liquidity Ratio Calculation

- MAS Liquidity Ratio Calculation

- Minimum Liquid Asset Calculation

- HKMA Liquidity Ratios for Category 1 Institutions

- HKMA Liquidity Ratios for Category 2 Institutions

Note:

Run purposes for the SKUs licensed only, will be displayed.

- Select the Run Type as Contractual from the drop-down list. The drop-down list displays the following:

- Contractual

- Business-as-Usual

Note:

If the Purpose is selected as Intra-Day Metrics Calculation, Run Type is selected as Contractual by default

- Select the Purpose from the drop-down list. The drop-down list displays the following:

- When the Run type is selected as Contractual and the purpose is selected as Basel III Liquidity Ratios Calculation or Long Term Gap Calculation perform the following steps:

Figure 8-9 Run type -Basel III Liquidity Ratios Calculation or Long Term Gap Calculation

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

- In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

- Select Consolidation Type from the drop-down list. It is either Consolidated or Solo.In case you have selected Consolidation Type as Consolidated, in the Consolidation Level field, clickto launch the Legal Entity browser for selecting the consolidation level. Select a legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled.

- Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

- Prior

- Conditional Prior

- Following

- Conditional Following

- No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

- Select the Include Interest Cash Flows as either Yes or No.

Note:

- The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

- Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

- When the Run type is selected as Contractual and the purpose is selected as FR 2052 a Report Generation or FR 2052 b Report Generation perform the following steps:

Figure 8-10 Contractual Run

- Select the Consolidation Type from the drop-down list. It is either Consolidated or Solo.

- In case you have selected Consolidation Type as Consolidated, in the Consolidation Level field, click Browser to launch the Legal Entity browser for selecting the consolidation level. Select a legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser. This is selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated.

- If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled.

- Select the Include Interest Cash Flows as either Yes or No.

Note:

- The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

- Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

- When the Run type is selected as Contractual and the purpose is selected as Intra-Day Metrics Calculation perform the following steps:

Figure 8-11 Contractual - Intra-Day Metrics Calculation

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

Note:

Only intraday buckets are listed under the list time bucket definitions section.

- Select Legal Entity Consolidation Type from the drop-down list. It is either Consolidated or Solo.

- In case you have selected Legal Entity Consolidation Type as Consolidated, in the Legal Entity Consolidation Level field, click Browser to launch the Legal Entity browser for selecting the consolidation level. Select a legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Legal Entity Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Legal Entity Consolidation Level field is disabled.

- Select Payment System Consolidation Type as either Consolidated or Standalone.

By default, Standalone is selected.

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

- When the Run type is selected as Contractual and the purpose is selected as RBI Basel III Liquidity Ratio Calculation or RBI Short-Term Dynamic Liquidity Report Generation or RBI Structural Liquidity Report Generation perform the following steps:

Figure 8-12 Contractual - RBI selection

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

Note:

- When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, RBI DLR Time Bucket is selected as the default time bucket.

- When RBI Structural Liquidity Report Generation is selected as the purpose, RBI SLR Assumption Time Bucket is selected as the default time bucket.

- In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

Note:

- When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, Calendar Days is selected as the default.

- When RBI Structural Liquidity Report Generation is selected as the purpose, Calendar Days is selected as the default.

- Select Consolidation Type from the drop-down list. It is either Consolidated or Solo.

- In case you have selected Consolidation Type as Consolidated, in the Consolidation Level field, click Browser to launch the Legal Entity browser for selecting the consolidation level. Select a legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled.

- Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

- Prior

- Conditional Prior

- Following

- Conditional Following

- No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

Note:

- When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, this field is not applicable.

- When RBI Structural Liquidity Report Generation is selected as the purpose, this field is not applicable.

- Select the Include Interest Cash Flows as either Yes or No.

Note:

- The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

- When RBI Short-Term Dynamic Liquidity Report Generation is selected as the purpose, Include Interest Cash Flows is selected as Yes by default.

- When RBI Structural Liquidity Report Generation is selected as the purpose, Include Interest Cash Flows is selected as Yes by default.

- Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

- When the Run type is selected as Contractual and the purpose is selected as EBA Delegated Act Liquidity Ratio Calculation or Regulation YY Liquidity Risk Calculation or U.S Fed Liquidity Ratio Calculation, BOT Liquidity Ratio Calculation, BNM Liquidity Ratio Calculation, MAS Liquidity Ratio Calculation, or Minimum Liquid Asset Calculation perform the following steps:

Figure 8-13 Contractual run - other selection

- In the Time Bucket Definition field, click Browser to select the time bucket definition. The Time Bucket Definition browser displays the list of computational time buckets defined as part of the Time Bucket screen. Select the required time bucket definition and then click OK.

- In the Time Bucket Definition Based On field, select either Calendar Days or Business Days.

- Select Consolidation Type from the drop-down list. It is either Consolidated or Solo.

- In case you have selected Consolidation Type as Consolidated, in the Consolidation Level field, click Browser to launch the Legal Entity browser for selecting the consolidation level.

Select a legal entity, at which the consolidated liquidity risk measures are to be calculated, from the list of legal entities available in the Legal Entity browser.

This selection is applicable only when the Run Type is selected as Contractual Run and Consolidation Type is selected as Consolidated. If you have selected the Consolidation Type as Solo, then Consolidation Level field is disabled.

- Select the Business Day Convention from the drop-down list. The drop-down list displays the following:

- Prior

- Conditional Prior

- Following

- Conditional Following

- No Adjustment

This is applicable only when Run Type is selected as Contractual Run.

- Select the Include Interest Cash Flows as either Yes or No.

Note:

The Approximate Interest field is disabled if you select Include Interest Cash Flows as No.

- Select the Forward Rate Interpolation Method from the drop-down list. It is either Linear or Log Linear. This is applicable only when the Run type is selected as Contractual.

- When the Purpose is selected as U.S Fed Liquidity Ratio Calculation, select Include Forward Date Calculations as either Yes or No. In case you select Yes, the following options are enabled:

- The Forward Balance Method Mapping Rule displays LRM - Balance Method Reclassification – Forecast selected as default.

- The Forward Cash Flow Method Mapping Rule displays LRM – Cash Flow Method Reclassification – Forecast selected by default.

- Select the Exclude Holidays as either Yes or No.

- Select the Balance Sheet Adjustment as either Yes or No.

- When you select Balance Sheet Adjustment as Yes, the Balance Sheet Adjustment Method option is enabled. Select one of the following from the drop-down list, Current Profile Based Increase, Current Profile Based Decrease, Cash Adjustment, Manual Adjustment.

- The Balance Sheet Adjustment Rule displays LRM - Manual Balance Adjustment – Forecast is selected by default when the Balance Sheet Adjustment Method is selected as Manual Adjustment.

- Select the Fixed Interval Forward Date as either Yes or No.

- In First Forward Day Interval field, enter a value in terms of days.

- In the Forward Date Frequency field, enter a value which is a whole number greater than 0. From the drop-down list choose Days, Months or Weeks.

- In the Number of Forward Calculations field, enter a value which is a whole number greater than 0.

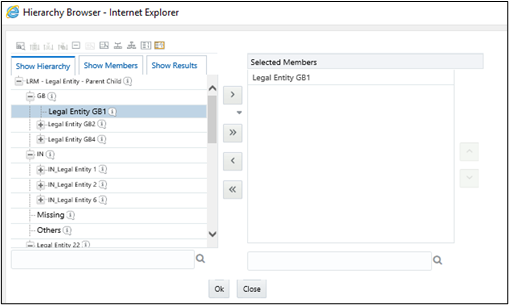

In case you have selected consolidation type as Solo, in the Legal Entity Selection section, click

to select one or multiple legal entities from the Hierarchy browser and then click OK. The selected legal entities are listed under the Legal Entity Selection section. In case you wish to add or edit the legal entities click.

to select one or multiple legal entities from the Hierarchy browser and then click OK. The selected legal entities are listed under the Legal Entity Selection section. In case you wish to add or edit the legal entities click.

Figure 8-14 Run Definition – Hierarchy Browser

- When the Purpose is selected as EBA delegated Act Liquidity Ratio, the field Time Bucket Type is displayed. Select either Actual or Calendar Based.

- When the Purpose is selected as U.S Fed Liquidity Ratio Calculation or BIS III Liquidity Ratio Calculations and you have included the Include Forward Date LCR Calculations, perform these additional steps:

- When the Fixed Interval Forward Date is selected as No, the Ad Hoc Forward Date Selection section is available for selection. Perform the following steps:

- Click

to add one or multiple dates.

- Click

to select the calendar dates.

Note:

This section is enabled only when the Fixed Interval Forward Date is selected as No.

- Click

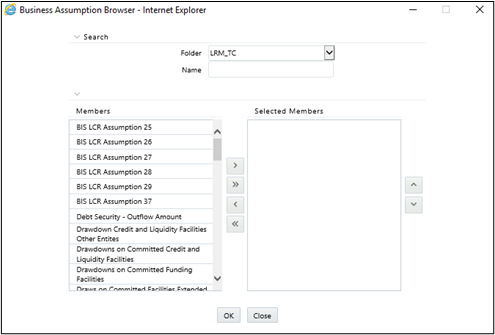

- When Include Forward Date Calculations is selected as Yes and all the other parameters are selected the Forward Cash Flow Calculation Business Assumptions section is available for selection. Perform the following steps:

- Click

to select one or multiple business assumptions from the Business Assumptions browser and then click OK. The selected business assumptions are listed under the Forward Cash Flow Calculation Business Assumptions section. In case you wish to add or edit the business assumptions click

.

.

Figure 8-15 Business assumptions

- Click

- When the Fixed Interval Forward Date is selected as No, the Ad Hoc Forward Date Selection section is available for selection. Perform the following steps:

- For Purpose HKMA Liquidity ratios for Category 1 institutions, Deposit Insurance scheme selection is available with one option Hong Kong Deposit Protection Board. The selection is optional. If you select it, then no DIC prerequisites selection is required during execution. If not selected, then during execution, select DIC Run and DIC Run Execution ID as a prerequisite.

- Click Save. The Run is saved in the Run Framework of Oracle Financial Services Analytical Applications Infrastructure. A Run is available for execution only after it has been approved. Once approved, Run parameters cannot be edited.