8.2.2.1 Ratings Downgrade

In a bank, because of some financing transactions or derivatives with embedded downgrade triggers, downgrade in a bank’s rating by a recognized credit rating institution will require the bank to post additional collateral. This assumption impacts the numerator of LCR that is, decrease in the market value of HQLA.

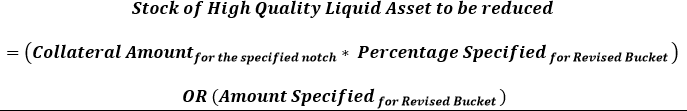

For some financing transactions or derivatives with embedded downgrade triggers, downgrade in a bank’s rating by a recognized credit rating institution will require the bank to post additional collateral. The encumbrance assumption category assumes that the asset required to be posted as additional collateral is already available with the bank and will be encumbered. This results in deduction of the relevant amount from the stock of high quality liquid assets as it is now no longer unencumbered.

Note:

The assumption specification and computation method for this sub category corresponds to that available as part of the Additional Collateral - Rating Downgrade Decrease in Asset assumption type. This assumption is renamed as Ratings Downgrade in this version.See Defining a New Business Assumption, for information on the steps involved in specifying this assumption.

The steps involved in applying the delay in cash flow timing assumption to cash flows are as follows: