6.2.4.1 Allocation of Deposit Insurance

As part of the BNM Run, the application allocates the deposit insurance to accounts based on the guidelines specified by the PIDM. The insurance limit captured against each deposit insurance scheme is allocated to the insurance eligible accounts under that scheme based on the ownership category and the depositor combination.

The insurance limit, that is the maximum deposit balance covered by an insurance scheme per customer, is captured against each insurance scheme – ownership category combination. Customers having account in multiple legal entities get a separate deposit insurance limit per legal entity. In case of PIDM insurance scheme, the limit amount needs to be provided in Stage Insurance Scheme Master Table at the granularity of insurance scheme.

The insurance limit is allocated to accounts as per the procedure given below:

- The application identifies the established relationship flag at a customer level.

- The accounts are sorted by the specified product type prioritizations.

- The insurance allocation is done based on the principal balance from the highest to the least, in the order of product type prioritization.

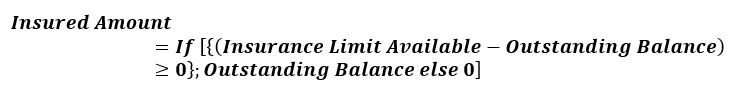

- The insurance limit available, is allocated to account 1 to n – 1 as per the formula given below:

Where,

Insurance Limit Available : Limit available post allocation to previous accounts

= Insurance Limit Availablex-1 – Insured Amount x-1

x : Number of accounts up to the current account to which insured amount is to be allocated

n : Total number of accounts of a customer which are eligible for insurance coverage under a given ownership category

The remaining available insurance is allocated to the last account i.e. account n for which insurance was not allocated.

- If insurance limit is available after allocating to the principal balances, it is allocated to the accrued interest from the highest to the least in the order of Product Type prioritization.

An illustration of this procedure is provided below considering a insurance limit of 2,50000 Malaysian Ringgit for each depositor combination under each ownership category for each legal entity. The inputs to this calculation, including account details and customer details are provided below.

Table 5-1 Insurance allocation

Legal Entity Account Number Account Balance Principal Balance Accrued Interest Account Holding Type Primary Holder Secondary Holder 1 Secondary Holder 2 Insurance Scheme Availability of Joint Account Balance Split Number of Account Holders Principal Balance Per Customer Accrued Interest Per Customer Legal Entity 1 100002 100980 95931 5049 Single Customer A DPA 1 Legal Entity 1 100003 124342 112602 11740 Single Customer A DPA 1 Legal Entity 1 100004 80900 73619 7281 Joint Customer A Customer B DPA Yes 2 Legal Entity 1 100005 55226 55226 Joint Customer A Customer B Customer D DPA No 3 18408.67 0.00 Legal Entity 2 200002 127132 127132 Joint Customer B Customer C DPA No 2 63566.00 0.00 Legal Entity 2 200003 138828 124946 13882 Joint Customer C Customer B DPA Yes 2 Legal Entity 2 200004 135429 135429 Joint Customer B Customer A Customer C DPA No 3 45143.00 0.00 Legal Entity 3 300001 117603 95259 22344 Single Customer B FDIC 1 Legal Entity 3 300002 124775 107121 17654 Single Customer B FDIC 1 Legal Entity 3 300003 76065 76065 Single Customer C FDIC 1 Legal Entity 3 300004 82622 82622 Joint Customer A Customer B FDIC No 2 41311.00 0.00 Legal Entity 3 300005 113340 113340 Joint Customer B Customer A FDIC No 2 56670.00 0.00 Legal Entity 1 100001 959967 959967 Single Customer A DPA 1 Legal Entity 2 200001 713335 713335 Single Customer A DPA 1 The application allocates the insurance limit of Malaysian Ringgit 10,000,000 to all eligible accounts as follows:

Table 5-2 Insurance Allocation for Customer A

Insurance Scheme Legal Entity Account Number Account Type Account Currency Principal Balance Accrued Interest Available Insurance Limit Insured Principal Balance Available Insurance Limit - Interest Insured Accrued Interest Total Insured Amount Uninsured Principal Balance Uninsured Accrued Interest Total Uninsured Amount PIDM Legal Entity 1 100001 Current Account MYR Y Single 959967.00 0.00 250000.00 250000.00 64924.67 0.00 250000.00 709967.00 100002 Savings Account SGD N Single 95931.00 5049.00 250000.00 95931.00 24630.30 5049.00 100980.00 0.00 100005 Current Account MYR Y Joint 18408.67 0.00 83333.33 18408.67 64924.67 0.00 18408.67 0.00 100004 Savings Account MYR N Joint 47852.35 5096.70 162500.00 47852.35 29727.00 5096.70 52949.05 0.00 100003 Term Deposit MYR N Single 112602.00 11740.00 154069.00 112602.00 41467.00 11740.00 124342.00 0.00 Legal Entity 2 200001 Current Account MYR Y Single 713335.00 0.00 250,000 250000.00 0.00 0.00 250000.00 463335.00 200004 Current Account MYR N Joint 45143.00 0.00 83,333 45143.00 38190.33 0.00 45143.00 0.00 Legal Entity 3 300004 Current Account INR N Joint 41311.00 0.00 125,000 41311.00 83689.00 0.00 41311.00 0.00 300005 Current Account INR N Joint 56670.00 0.00 83,689 56670.00 27019.00 0.00 56670.00 0.00 Table 5-3 Insurance Allocation of Customer B

Insurance Scheme Legal Entity Account Number Account Type Account Currency Principal Balance Accrued Interest Available Insurance Limit Insured Principal Balance Available Insurance Limit - Interest Insured Accrued Interest Total Insured Amount Uninsured Principal Balance Uninsured Accrued Interest Total Uninsured Amount PIDM Legal Entity 1 100005 Current Account MYR Y Joint 18408.67 0.00 83333.33 18408.67 64924.67 0.00 18408.67 0.00 100004 Savings Account MYR N Joint 25766.65 2184.30 87500.00 25766.65 61733.35 2184.30 27950.95 0.00 Legal Entity 2 200002 Current Account MYR N Joint 63566.00 0.00 87500.00 63566.00 0.00 0.00 63566.00 0.00 200004 Current Account MYR N Joint 45143.00 0.00 83333.33 45143.00 0.00 0.00 45143.00 0.00 200003 Savings Account MYR N Joint 24989.20 2776.40 23934.00 23934.00 0.00 0.00 23934.00 1055.20 Legal Entity 3 300001 Term Deposit MYR N Single 95259.00 22344.00 250000.00 95259.00 9365.00 9365.00 104624.00 0.00 300002 Savings Account MYR N Single 107121.00 17654.00 154741.00 107121.00 27019.00 17654.00 124775.00 0.00 300004 Current Account INR N Joint 41311.00 0.00 125000.00 41311.00 27019.00 0.00 41311.00 0.00 300005 Current Account INR N Joint 56670.00 0.00 83689.00 56670.00 27019.00 0.00 56670.00 0.00 Table 5-4 Insurance Allocation of Customer C

Insurance Scheme Legal Entity Account Number Account Type Account Currency Principal Balance Accrued Interest Available Insurance Limit Insured Principal Balance Available Insurance Limit - Interest Insured Accrued Interest Total Insured Amount Uninsured Principal Balance Uninsured Accrued Interest Total Uninsured Amount PIDM Legal Entity 2 200002 Current Account THB 63566.00 0.00 1000000 63566.00 780228.60 0.00 63566.00 0.00 0.00 0.00 200003 Current Account THB 45143.00 0.00 936434.00 45143.00 780228.60 0.00 45143.00 0.00 0.00 0.00 200004 Savings Account THB 99956.80 11105.60 891291.00 99956.80 791334.20 11105.60 111062.40 0.00 0.00 0.00 Legal Entity 3 300003 Current Account INR N Single 76065.00 0.00 250000.00 76065.00 173935.00 0.00 76065.00 0.00 Table 5-5 Insurance Allocation of Customer D

Insurance Scheme Legal Entity Account Number Account Type Account Currency Principal Balance Accrued Interest Available Insurance Limit Insured Principal Balance Available Insurance Limit - Interest Insured Accrued Interest Total Insured Amount Uninsured Principal Balance Uninsured Accrued Interest Total Uninsured Amount PIDM Legal Entity 1 100005 Current Account MYR Y Joint 18408.67 0.00 83,333 18408.67 64924.67 0.00 18408.67 0.00