6.2.2.5 Calculation of Adjusted Stock of HQLA

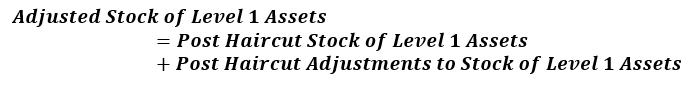

- Adjusted Stock of Level 1 Assets

The formula for calculating adjusted stock of level 1 asset is as follows:

Note:

Adjustments relate to the cash received or paid, and the eligible level 1 assets posted or received as collaterals, or underlying assets as part of secured funding, secured lending and asset exchange transactions. - Adjusted Stock of Level 2A Assets

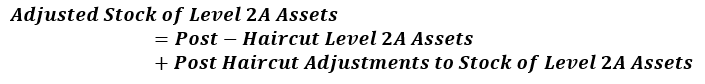

The formula for calculating adjusted stock of level 2A assets is as follows:

Note:

Adjustments relate to eligible level 2A assets posted or received as collaterals, or underlying assets as part of secured funding, secured lending and asset exchange transactions. - Adjusted Stock of Level 2B Assets

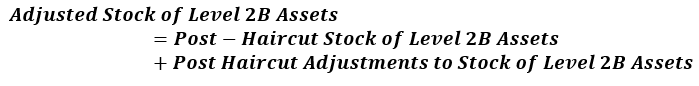

The formula for calculating adjusted stock of level 2B assets is as follows:

Note:

Adjustments relate to eligible level 2B assets posted or received as collaterals, or underlying assets as part of secured funding, secured lending and asset exchange transactions. - Adjusted Stock of Level 2B RMBS Assets

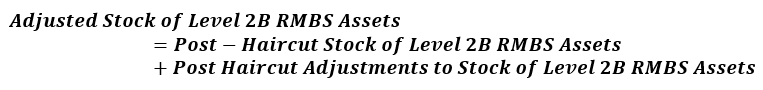

The formula for calculating adjusted stock of level 2B RMBS assets is as follows:

Note:

Adjustments relate to eligible level 2B RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction. - Adjusted Stock of Level 2B Non-RMBS I Assets

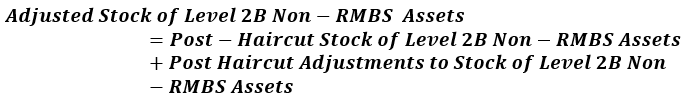

The formula for calculating adjusted stock of level 2B non-RMBS I assets is as follows:

Note:

Adjustments relate to eligible level 2B Non-RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction. - Adjusted Stock of Level 2B Non-RMBS II Assets

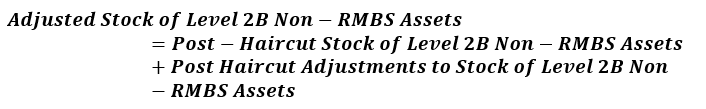

The formula for calculating adjusted stock of level 2B non-RMBS II assets are as follows:

Note:

Adjustments relate to eligible level 2B Non-RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.