6.2.9.1.1 Calculation of Excess Collateral Due

The application computes the value of collateral that a derivative counterparty has posted to the bank, in excess of the contractually required collateral, and therefore can be withdrawn by the counterparty, as per the below procedure:

- If Secured Indicator = No, then the excess collateral due is 0. Else,

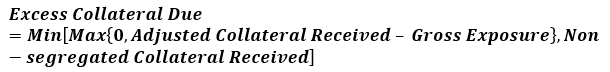

- If Secured Indicator = Y and Gross Exposure is <=0, the application computes the excess collateral due as follows:

Where,

Adjusted collateral received:Collateral received from the counterparty less customer withdrawable collateral

Customer withdrawable collateral: Collateral received under re-hypothecation rights that can be contractually withdrawn by the customer within the LCR horizon without a significant penalty associated with such a withdrawal

- If Secured Indicator = Y and Gross Exposure is >0, the application computes the excess collateral due as follows:

The excess collateral due is assumed to be recalled by the counterparty and therefore receives the relevant outflow rate specified by the regulator as part of the pre-configured business assumptions for LCR calculations.