6.2.13 Calculation of Operational Amount

The regulator prescribed lower outflow rate for operational deposits is to be applied only to that portion of the EOP balance that is truly held to meet operational needs. LRRCBNM supports a new methodology to compute the operational portion of the EOP balance of operational deposits. The steps involved in computing the operational balance are as follows:

- All deposits classified as operational as per regulatory guidelines are identified. This is a separate process in LRRCBNM.

- The EOP balances of eligible operational accounts are obtained over a 90-day historical window including the As of Date i.e. As of Date – 89 days. To identify historical observations, the f_reporting_flag has to be updated as ‘Y’ for one execution of the Run per day in the Liquidity Risk Solution (LRS) Run Management Execution Summary user interface. The application looks up the balance for such accounts against the Run execution for which the Reporting Flag is updated as “Y” for each day in the past.

Note:

The historical time window is captured as a parameter in the SETUP_MASTER table. The default value is 90 days which can be modified by the user. To modify this value, you can update the value under the component code DAYS_HIST_OPER_BAL_CALC_UPD. - A rolling 5 day average is calculated for each account over the historical window.

- The average of the 5-day rolling averages computed in step 3 is calculated.

- The operational balance is calculated as follows:

Note:

The calculation of the operational balance can be either a direct download from the staging tables, or through the historical balance approach.

Note:

The operational balance calculation based on historical lookback is optional. You can choose to compute the operational balances using this method or provide the value as a download. To provide the value as download, update the value in the SETUP_MASTER table under the component code HIST_OPERATIONAL_BAL_CALC_UPD as N . If the value is ‘Y’ then the value would be calculated through historical balance approach. - The non-operational balance is calculated as follows:

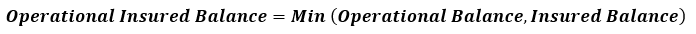

- The operational insured balance is calculated as follows:

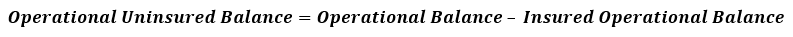

The insured and uninsured balances are calculated as part of a separate process i.e. the insurance allocation process which is explained in detail in the relevant section under each jurisdiction. - The operational uninsured balance is calculated as follows:

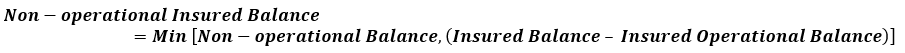

- The non-operational insured balance is calculated as follows:

- The non-operational uninsured balance is calculated as follows:

The operational deposit computation process is illustrated below assuming a 15-day historical window instead of 90-days and for the “as of date” 28th February 2017. The historical balances for 15-days including the “as of date” are provided below.

Table 5-8 Operational deposit computation

| Clients With Operational Accounts | Eligible Operational Accounts | Historical Time Window | As of Date | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | 10001 | |||||||||||||||

| 2/14/2017 | 2/15/2017 | 2/16/2017 | 2/17/2017 | 2/18/2017 | 2/19/2017 | 2/20/2017 | 2/21/2017 | 2/22/2017 | 2/23/2017 | 2/24/2017 | 2/25/2017 | 2/26/2017 | 2/27/2017 | 2/28/2017 | ||

| 102,000 | 102,125 | 102,250 | 102,375 | 102,500 | 102,625 | 102,750 | 102,875 | 103,000 | 103,125 | 103,250 | 103,375 | 103,500 | 103,625 | 103,750 | ||

| 10296 | 23,500 | 23,550 | 23,600 | 23,650 | 23,700 | 23,750 | 23,800 | 23,850 | 23,900 | 23,950 | 24,000 | 24,050 | 24,100 | 24,150 | 24,200 | |

| B | 31652 | 65,877 | 59,259 | 59,234 | 59,209 | 59,184 | 59,159 | 59,134 | 59,109 | 59,084 | 59,059 | 59,034 | 59,009 | 58,984 | 58,959 | 58,934 |

The rolling averages and cumulative average are computed as follows:

Table 5-9 Rolling averages and cumulative average

| Clients with Operational Accounts | Eligible Operational Accounts | 5-day Rolling Average | Cumulative Average(a) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2/18/2017 | 2/19/2017 | 2/20/2017 | 2/21/2017 | 2/22/2017 | 2/23/2017 | 2/24/2017 | 2/25/2017 | 2/26/2017 | 2/27/2017 | 2/28/2017 | |||

| A | 10001 | 102,250 | 102,375 | 102,500 | 102,625 | 102,750 | 102,875 | 103,000 | 103,125 | 103,250 | 103,375 | 103,500 | 95136 |

| 10296 | 23,600 | 23,650 | 23,700 | 23,750 | 23,800 | 23,850 | 23,900 | 23,950 | 24,000 | 24,050 | 24,100 | 22721 | |

| B | 31652 | 60,553 | 59,209 | 59,184 | 59,159 | 59,134 | 59,109 | 59,084 | 59,059 | 59,034 | 59,009 | 58,984 | 56931 |

The operational and non-operational balances are computed as follows:

Table 5-10 Operational and non-operational balances

| Clients with Operational Accounts | Eligible Operational Accounts | Current Balance (b) | Operational Balance (c = a – b) | Non-Operational Balance | Insured Balance | Uninsured Balance | Insured Operational Balance | Uninsured Operational Balance | Insured Non-Operational Balance | Uninsured Non-Operational Balance |

|---|---|---|---|---|---|---|---|---|---|---|

| A | 10001 | 103,750 | 95,136 | 8,615 | 100,000 | 3,750 | 95,136 | 4,865 | 3,750 | |

| 10296 | 24,200 | 22,721 | 1,480 | 24,200 | 22,721 | 1,480 | ||||

| B | 31652 | 58,934 | 56,931 | 2,003 | 58,934 | 56,931 | 2,003 |

Note:

- Negative historical balances are replaced by zero for the purposes of this computation.

- For operational accounts that have an account start date >= historical days including the “as of date”, missing balances are replaced by previous available balance.

- For operational accounts that have an account start date < historical days including the “as of date”:

- Missing balances between account start date and “as of date” are replaced by previous available balance.

- Rolling average is calculated only for the period from account start date to the “as of date”.

- The methodology to compute operational balance is optional. This can be turned On or Off using the Set up master table, where component code = HIST_OPERATIONAL_BAL_CALC_UPD. The option to provide the operational balance as a download is supported by the application.