6.2.1.1 Identification and Treatment of Level 1 Assets

The application identifies the following as HQLA Level 1 assets:

For placements within the blanks, these include:

- Cash in all currencies, including deposits and reserves at central banks.

Central bank reserves (including required reserves), to the extent that the central bank policies allow them to be drawn down in times of stress. These include,

- Banks’ overnight deposits with the central bank

- Term deposits with the central bank that satisfy the following conditions:

- They are explicitly and contractually repayable on notice from the depositing bank

- They constitute a loan against which the bank can borrow on a term basis or on an overnight but automatically renewable basis (only where the bank has an existing deposit with the relevant central bank)

- The Wadiah acceptances

- The commodity Murabahah program

- Surplus cash balances that are held in the eSPICK and RENTAS accounts

- The bank’s balances that are held under the Statutory Reserve Requirement (SRR)

For Placements with other central banks, these include:

- Overnight and term deposits with other central banks that:

- Are explicitly and contractually repayable on notice

or

- Constitute of a loan against which the bank can borrow on a term basis, or on an overnight basis with an automatic renewal

- Are explicitly and contractually repayable on notice

- Foreign bank branches are allowed to include the RCLF from Bank as HQLA up to 40% of the minimum LCR requirement.

- Debt securities issued in currencies other than Malaysian Ringgit, in the country in which the liquidity risk is being taken or in the bank’s home country where the issuer type is sovereign or central bank and the risk weight assigned to the sovereign is greater than 0%.

- Excess reserves held with foreign central banks, where an international rating agency has assigned a 0% risk weight to the foreign sovereign.

- Excess reserves held with foreign central banks, where an international rating agency has assigned a non-0% risk weight to the foreign sovereign and a 0% risk weight has been assigned at national discretion under Basel II Framework, to the extent these balances cover the bank’s stressed net cash outflows in that specific currency.

- Central bank excess reserves include the balance held by a bank at the central bank directly or through a correspondent bank less any minimum reserve requirement. It also includes overnight deposits or term deposits held with the central bank that meet the regulatory criteria. The value of eligible term deposits that is included is the amount net of any withdrawal penalty.

Note:

The process of identifying the value to be included in the stock of HQLA up to the extent of a bank stressed net cash outflows in a particular currency is documented in the section below - Marketable securities representing claims on or claims explicitly guaranteed by sovereign and central banks, PSEs, the Bank for International Settlements, the International Monetary Fund, the European Commission, or multilateral development banks that satisfy all of the following conditions:

- They have been assigned a rating corresponding to a 0% risk-weight as per the Capital Adequacy Framework or the Capital Adequacy Framework for Islamic Banks (Risk-Weighted Assets) by a recognized external credit assessment institution (ECAI).

- Issuer type or guarantor type is a foreign sovereign

- A rating corresponding to a 0% risk-weight as per the Capital Adequacy Framework or the Capital Adequacy Framework for Islamic Banks (Risk-Weighted Assets) by a recognized external credit assessment institution (ECAI) has been assigned to them.

- Traded in large, deep and active repo or cash markets characterized by a low level of concentration

- Have a proven record as a reliable source of liquidity in the markets (repo or sale) even during stressed market conditions

- Not an obligation of a financial institution or any of its affiliated entities

- Non-0% risk weighted sovereign or central bank debt securities denominated in Malaysian ringgit:

- In the country where the liquidity risk is being taken or in the home country of the banking institution

or

- Where the holdings of the debt and the currency needs of the banking institution’s operations are a match

or

- Where an arrangement has been established between central banks of the country, which enable financial institutions operating in one jurisdiction to obtain liquidity denominated in that jurisdiction’s local currency from the local central bank in which the liquidity risk is being taken by the sovereign or central bank.

To meet this requirement the application identifies and updates the below flag as follows:

- Account country liquidity risk flag:

- The existence of bank’s operations in a particular jurisdiction is identified. If the bank holds either liabilities or non-marketable assets in that jurisdiction, the application assumes that the bank has operations in that specific jurisdiction. This is identified at a country and currency combination.

- The application then identifies whether the asset is held to meet the bank’s net stressed cash outflows in that currency arising from bank’s operations in that specific jurisdiction by checking the following conditions:

- If the issuer’s country is the same as the account country

- If the issuer’s country is the same as the country in which local operations are present in a particular jurisdiction as identified in step (i) above.

- If the account currency is the same as the currency in which local operations are present in a particular jurisdiction as identified in step (i) above.

If all of the above criteria are met, the account country liquidity risk flag is updated as “Yes”. This indicates that the particular asset is held to meet the net cash outflows in a particular jurisdiction.

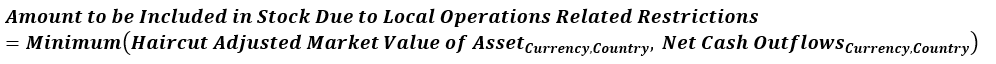

- Finally, the application identifies the amount to be included in the stock of HQLA when account country liquidity risk flag = “Yes” using the following calculation:

- Account and Branch Currency Match Flag

- Identifies all branches in the given solo and consolidated Run.

- Identifies currency of the branches in step (i), which are equal to the account currency.

- If the condition in Step (ii) is fulfilled, then the application updates the flag as "Yes" else "No".

- In the country where the liquidity risk is being taken or in the home country of the banking institution

- Debt securities issued by a non-0% risk-weighted domestic sovereign or central bank denominated in foreign currencies, where the holdings of such debt matches the currency needs of the banking institution’s operations in that jurisdiction

- Debt securities issued in foreign currencies are eligible up to the amount of the bank’s stressed net cash outflows in that specific foreign currency stemming from the bank’s operations in the jurisdiction where the bank’s liquidity risk is being taken, where the issuer type is domestic sovereign or central bank assigned a non-0% risk weight. Such marketable securities are included in the stock of HQLA only up to the extent of the bank’s net stressed cash outflows in that currency arising from bank’s operations in that foreign jurisdiction.

Assets classified as HQLA Level 1 are assigned a 0% haircut under the regulatory scenario prescribed by BNM.