7.1.2 Allocation of Deposit Insurance

As part of the BNM Run, the application allocates the deposit insurance to accounts based on the guidelines specified by the PIDM. The insurance limit captured against each deposit insurance scheme is allocated to the insurance eligible accounts under that scheme based on the ownership category and the depositor combination.

The insurance limit, that is the maximum deposit balance covered by an insurance scheme per customer, is captured against each insurance scheme – ownership category combination. Customers with an account in multiple legal entities get a separate deposit insurance limit per legal entity. For the PIDM insurance scheme, the limit amount must be provided in the Stage Insurance Scheme Master table at the granularity of the insurance scheme.

- The application identifies the established relationship flag at a customer level.

- The accounts are sorted by the specified product type prioritization.

- The insurance allocation is done based on the principal balance from the highest to the least, in the order of product type prioritization.

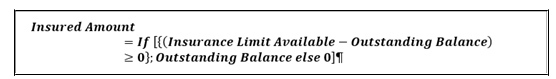

- The insurance limit available is allocated to account 1 to n – 1 as per the following formula:

Where,

Insurance Limit Available: Limit available post allocation to previous accounts = Insurance Limit Availablex-1 – Insured Amount x-1

x: Number of accounts up to the current account to which insured amount is to be allocated.

n: Total number of accounts of a customer which are eligible for insurance coverage under a given ownership category.

The remaining available insurance is allocated to the last account i.e. account n for which insurance was not allocated.

If insurance limit is available after allocating to the principal balances, it is allocated to the accrued interest from the highest to the least in the order of Product Type prioritization.

Following is an illustration of this procedure. It considers an insurance limit of 2,50000 Malaysian Ringgit for each depositor combination under each ownership category for each legal entity. The inputs to this calculation, including account details and customer details, are as follows,

Table 6-1 Illustration: Insurance Allocation

| Legal Entity | Account Number | Account Balance | Principal Balance | Accrued Interest | Account Holding Type | Primary Holder | Seconda ry Holder 1 | Secondar y Holder 2 | Insurance Scheme | Availabili ty of Joint Account Balance Split | Numbe r of Accoun t Holder s | Principa l Balance Per Custom er | Accrued Interest Per Custom er |

| Legal Entity 1 | 100001 | 959967 | 959967 | Single | Customer A | DPA | 1 | ||||||

| Legal Entity 1 | 100002 | 100980 | 95931 | 5049 | Single | Customer A | DPA | 1 | |||||

| Legal Entity 1 | 100003 | 124342 | 112602 | 11740 | Single | Customer A | DPA | 1 | |||||

| Legal Entity 1 | 100004 | 80900 | 73619 | 7281 | Joint | Customer A | Custome r B | DPA | Yes | 2 | |||

| Legal Entity 1 | 100005 | 55226 | 55226 | Joint | Customer A | Custome r B | Customer D | DPA | No | 3 |

18408.6 7 |

0.00 | |

| Legal Entity 2 | 200001 | 713335 | 713335 | Single | Customer A | DPA | 1 | ||||||

| Legal Entity 2 | 200002 | 127132 | 127132 | Joint | Customer B | Custome r C | DPA | No | 2 |

63566.0 0 |

0.00 | ||

| Legal Entity 2 | 200003 | 138828 | 124946 | 13882 | Joint | Customer C | Custome r B | DPA | Yes | 2 | |||

| Legal Entity 2 | 200004 | 135429 | 135429 | Joint | Customer B | Custome r A | Customer C | DPA | No | 3 |

45143.0 0 |

0.00 | |

| Legal Entity 3 | 300001 | 117603 | 95259 | 22344 | Single | Customer B | FDIC | 1 | |||||

| Legal Entity 3 | 300002 | 124775 | 107121 | 17654 | Single | Customer B | FDIC | 1 | |||||

| Legal Entity 3 | 300003 | 76065 | 76065 | Single | Customer C | FDIC | 1 | ||||||

| Legal Entity 3 | 300004 | 82622 | 82622 | Joint | Customer A | Custome r B | FDIC | No | 2 | 41311.00 | 0.00 | ||

| Legal Entity 3 | 300005 | 113340 | 113340 | Joint | Customer B | Custome r A | FDIC | No | 2 |

56670.0 0 |

0.00 |

Table 6-2 Illustration: Insurance Allocation

| Legal Entity | Account Number | Account Balance | Principal Balance | Accrued Interest | Account Holding Type | Primary Holder | Seconda ry Holder 1 | Secondar y Holder 2 | Insurance Scheme | Availabili ty of Joint Account Balance Split | Numbe r of Accoun t Holder s | Principa l Balance Per Custom er | Accrued Interest Per Custom er |

| Legal Entity 1 | 100001 | 959967 | 959967 | Single | Customer A | DPA | 1 | ||||||

| Legal Entity 1 | 100002 | 100980 | 95931 | 5049 | Single | Customer A | DPA | 1 | |||||

| Legal Entity 1 | 100003 | 124342 | 112602 | 11740 | Single | Customer A | DPA | 1 | |||||

| Legal Entity 1 | 100004 | 80900 | 73619 | 7281 | Joint | Customer A | Custome r B | DPA | Yes | 2 | |||

| Legal Entity 1 | 100005 | 55226 | 55226 | Joint | Customer A | Custome r B | Customer D | DPA | No | 3 |

18408.6 7 |

0.00 | |

| Legal Entity 2 | 200001 | 713335 | 713335 | Single | Customer A | DPA | 1 | ||||||

| Legal Entity 2 | 200002 | 127132 | 127132 | Joint | Customer B | Custome r C | DPA | No | 2 |

63566.0 0 |

0.00 | ||

| Legal Entity 2 | 200003 | 138828 | 124946 | 13882 | Joint | Customer C | Custome r B | DPA | Yes | 2 |

Table 6-3 Illustration continued: Insurance Allocation

| Customer A Principal Balance | Customer B Principal Balance | Customer C Principal Balance | Customer D Principal Balance | Customer A Accrued Interest | Customer B Accrued Interest | Customer C Accrued Interest | Customer D Accrued Interest |

| 959967.00 | 0.00 | ||||||

| 95931.00 | 5049.00 | ||||||

| 112602.00 | 11740.00 | ||||||

| 47852.35 | 25766.65 | 5096.7 | 2184.3 | ||||

| 18408.67 | 18408.67 | 18408.67 | 0.00 | 0.00 | 0.00 | ||

| 713335.00 | 0.00 | ||||||

| 63566.00 | 63566.00 | 0.00 | 0.00 | ||||

| 24989.2 | 99956.8 | 2776.4 | 11105.6 | ||||

| 45143.00 | 45143.00 | 45143.00 | 0.00 | 0.00 | 0.00 | ||

| 95259.00 | 22344.00 | ||||||

| 107121.00 | 17654.00 | ||||||

| 76065.00 | 0.00 | ||||||

| 41311.00 | 41311.00 | 0.00 | 0.00 | ||||

| 56670.00 | 56670.00 | 0.00 | 0.00 |

The application allocates the insurance limit of Malaysian Ringgit 10,000,000 to all eligible accounts as follows:

Table 6-4 Insurance Allocation for Customer A

| Insuranc e Scheme | Legal Entit y | Accoun t Numbe r | Accoun t Type | Account Currenc y | Princip al Balance | Accrue d Interes t | Availabl e Insuranc e Limit | Insured Principal Balance | Available Insurance Limit - Interest | Insured Accrued Interest | Total Insured Amoun t | Uninsure d Principal Balance | Uninsur ed Accrued Interest | Total Uninsured Amount |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PIDM | Legal Entit y 1 | 100001 | Current Account | MYR | Y | Single |

959967.0 0 |

0.00 | 250000.00 | 250000.00 | 64924.67 | 0.00 | 250000. 00 | 709967.00 |

| 100002 | Savings Account | SGD | N | Single | 95931.00 | 5049.00 | 250000.00 | 95931.00 | 24630.30 | 5049.00 | 100980.00 | 0.00 | ||

| 100005 | Current Account | MYR | Y | Joint | 18408.67 | 0.00 | 83333.33 | 18408.67 | 64924.67 | 0.00 | 18408.67 | 0.00 | ||

| 100004 | Savings Account | MYR | N | Joint | 47852.35 | 5096.70 | 162500.00 | 47852.35 | 29727.00 | 5096.70 | 52949.05 | 0.00 | ||

| 100003 | Term Deposit | MYR | N | Single | 112602.00 | 11740.00 | 154069.00 | 112602.00 | 41467.00 | 11740.00 | 124342.00 | 0.00 | ||

| LegalEntity 2 | 200001 | Current Account | MYR | Y | Single | 713335.00 | 0.00 | 250,000 | 250000.00 | 0.00 | 0.00 | 250000.00 | 463335.00 | |

| 200004 | Current Account | MYR | N | Joint | 45143.00 | 0.00 | 83,333 | 45143.00 | 38190.33 | 0.00 | 45143.00 | 0.00 | ||

| LegalEntity 3 | 300004 | Current Account | INR | N | Joint | 41311.00 | 0.00 | 125,000 | 41311.00 | 83689.00 | 0.00 | 41311.00 | 0.00 | |

| 300005 | Current Account | INR | N | Joint | 56670.00 | 0.00 | 83,689 | 56670.00 | 27019.00 | 0.00 | 56670.00 | 0.00 |

Insurance Allocation of Customer B

Table 6-5 Insurance Allocation of Customer B

| Insura nce Schem e | Legal Entity | Account Number | Accoun t Type | Accou nt Curren cy | Principal Balance | Accrue d Intere st | Available Insurance Limit | Insured Principal Balance | Available Insurance Limit - Interest | Insured Accrue d Interest | Total Insured Amount | Uninsur ed Principal Balance | Uninsur ed Accrue d Interest | Total Uninsur ed Amount |

| PIDM | Legal Entity 1 | 100005 | Current Account | MYR | Y | Joint | 18408.67 | 0.00 | 83333.33 | 18408.67 | 64924.67 | 0.00 | 18408.67 | 0.00 |

| 100004 | Savings Account | MYR | N | Joint | 25766.65 | 2184.30 | 87500.00 | 25766.65 | 61733.35 | 2184.30 | 27950.95 | 0.00 | ||

| 200002 | Current Account | MYR | N | Joint | 63566.00 | 0.00 | 87500.00 | 63566.00 | 0.00 | 0.00 | 63566.00 | 0.00 | ||

| Legal Entity 2 | 200004 | Current Account | MYR | N | Joint | 45143.00 | 0.00 | 83333.33 | 45143.0 | 0.00 | 0.00 | 45143.0 | 0.00 | |

| 200003 | Savings Account | MYR | N | Joint | 24989.20 | 2776.40 | 23934.00 | 23934.00 | 0.00 | 0.00 | 23934.00 | 1055.20 | ||

| Legal Entity 3 | 300001 | Term Deposit | MYR | N | Single | 95259.00 | 22344.00 | 250000.00 | 95259.00 | 9365.00 | 9365.00 | 104624.00 | 0.00 | |

| 300002 | Savings Account | MYR | N | Single | 107121.00 | 17654.00 | 154741.00 | 107121.00 | 27019.00 | 17654.00 | 124775.00 | 0.00 | ||

| 300004 | Current Account | INR | N | Joint | 41311.00 | 0.00 | 125000.00 | 41311.00 | 27019.00 | 0.00 | 41311.00 | 0.00 | ||

| 300005 | Current Account | INR | N | Joint | 56670.00 | 0.00 | 83689.00 | 56670.00 | 27019.00 | 0.00 | 56670.00 | 0.00 |

Insurance Allocation of Customer C

Table 6-6 Insurance Allocation for Customer C

| Insuranc e Scheme | Lega l Entit y | Accoun t Numbe r | Accoun t Type | Accoun t Currenc y | Principa l Balance | Accrue d Interes t | Available Insuranc e Limit | Insured Principa l Balance | Available Insuranc e Limit - Interest | Insured Accrued Interest | Total Insured Amount | Uninsure d Principal Balance | Uninsure d Accrued Interest | Total Uninsure d Amount |

| PIDM | Legal Entit y 2 | 200002 | Current Accoun t | THB |

63566.0 0 |

0.00 | 1000000 |

63566.0 0 |

780228.6 0 |

0.00 |

63566.0 0 |

0.00 | 0.00 | 0.00 |

| 200003 | Current Account | THB | 45143.00 | 0.00 | 936434.00 | 45143.00 | 780228.60 | 0.00 | 45143.00 | 0.00 | 0.00 | 0.00 | ||

|

20000 4 |

Savings Accoun | THB |

99956.8 0 |

11105.6 0 |

891291.0 0 |

99956.8 0 |

791334.20 | 11105.60 |

111062.4 0 |

0.00 | 0.00 | 0.00 | ||

| Legal Entity 3 | 300003 | Current Account | INR | N | Single | 76065.00 | 0.00 | 250000.00 | 76065.00 | 173935.00 | 0.00 | 76065.00 | 0.00 |

Insurance Allocation of Customer D

Table 6-7 Insurance Allocation for Customer D

| Insuranc e Scheme | Legal Entit y | Accoun t Numbe r | Accoun t Type | Account Currenc y | Princip al Balance | Accrue d Interes t | Availabl e Insuranc e Limit | Insured Princip al Balance | Availabl e Insuranc e Limit - Interest | Insured Accrue d Interest | Total Insured Amount | Uninsure d Principal Balance | Uninsure d Accrued Interest | Total Uninsure d Amount |

| PIDM | Legal Entity 1 | 100005 | Current Accoun t | MYR | Y | Joint | 18408.67 | 0.00 |

83,333 |

18408.6 7 |

64924.6 7 |

0.00 | 18408.67 | 0.00 |