4.3.10.1.2 Calculating Excess Collateral Receivable

The application computes the value of the collateral that the bank has posted to its derivative counterparty, over the contractually required collateral, and therefore can be withdrawn by the bank, as follows:

- If Secured Indicator is No, then the excess collateral receivable is 0.

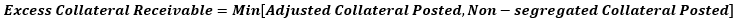

- If Secured Indicator is Y and Gross Exposure are greater than or equal to 0, the

application computes the excess collateral receivable as follows:

Figure 3-13 Excess Collateral Receivable

Where:

Adjusted Collateral Posted: Collateral posted by the bank less firm withdrawable collateral.

Firm Withdrawable Collateral: Collateral provided under re-hypothecation rights that can be contractually withdrawn by the bank within the LCR horizon without a significant penalty associated with such a withdrawal.

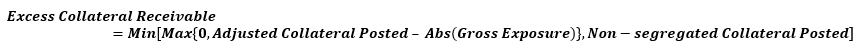

- If Secured Indicator is Y and Gross Exposure are less than 0, the application

computes the excess collateral receivable as follows:

Figure 3-14 Excess Collateral Receivable

The excess collateral receivable does not receive a pre-specified inflow rate from the regulator and therefore, excluded from the LCR calculations. However, the application computes this to report.