6.2.2 Computing Available Amount of Stable Funding

The Available Stable Funding factor is a pre-determined weight ranging from 0% to 100% which is applied through business assumptions for accounts falling under the dimensional combinations defined. The weights are guided by the NSFR Standard. The available stable funding is then taken as a total of all the weighted amounts where an ASF factor is applied.

Foreign Bank branches can account for the undrawn contractual committed facilities from its head office or other branches, which are the same entity and are regional hubs as ASF up to 40% of the minimum ASF is required to meet the minimum requirement of NSFR.

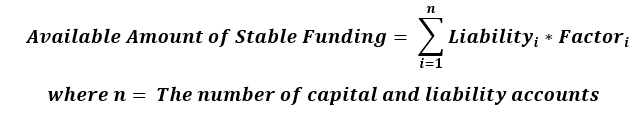

The formula for calculating the Available Amount of Stable Funding is as follows:

Figure 5-2 Available Amount of Stable Funding

The following is an example of applying the ASF factor:

Consider an assumption defined with the following dimensional combination and ASF factors, based on the measure being Total Stable Balance.

Table 5-1 Illustration – Application of ASF Factor

| Product | Retail/Wholesale Indicator | Residual Maturity Band | ASF Weighted Amount |

|---|---|---|---|

| Deposits | R | <= 6 months | 95% |

| Deposits | R | 6 months - 1 year | 95% |

| Deposits | R | >= 1 year | 95% |

If five accounts are falling under this combination, then after the assumption is applied, the resulting amounts with the application of ASF factors is as follows:

Table 5-2 Illustration continued– Application of ASF Factor

| Account | Stable Balance | ASF Weighted Amount |

|---|---|---|

| A1 | 3400 | 3230 |

| A2 | 3873 | 3679.35 |

| A3 | 9000 | 8550 |

| A4 | 1000 | 950 |

| A5 | 100 | 95 |

If OFS Basel is not installed, then the following items must be provided as a download in the STG_CAP_INSTR_POSITIONS table.

- Gross Tier 2 Capital

- Deferred Tax Liability related to Other Intangible Asset

- Deferred Tax Liability related to Goodwill

- Deferred Tax Liability related to MSR

- Deferred Tax Liability related to Deferred Tax Asset

- Deferred Tax Liability related to Defined Pension Fund Asset

- Net CET1 Capital post-Minority Interest Adjustment

- Net AT1 Capital post-Minority Interest Adjustment

- Total Minority Interest required for NSFR