6.3 Interdependent Assets and Liabilities

As per BIS and HKMA Guidelines, certain assets and liabilities can be paired together and called interdependent, if they satisfy the following criteria:

- The individual interdependent asset and liability items are identifiable.

- The maturity and the principal amount of the liability and its interdependent asset must be the same.

- The bank is acting solely as a pass-through unit to channel the funding received (the interdependent liability) into the corresponding interdependent asset.

- The counterparties for each pair of interdependent liabilities and assets must not be the same.

LRS considers loans on the asset side and deposits on the liabilities side in this feature. A result flag called ‘Interdependent Asset-Liability Flag’ is updated for each such pair, which has a possibility of being linked. When Interdependent Asset-Liability Flag is set to Yes, the asset receives a 0% RSF and the liability receives a 0% ASF. In effect, given that the asset and liability are matched, they do not pose a liquidity risk and therefore are excluded in the NSFR Calculation. When Interdependent Asset- Liability Flag is No, the asset or liability receives appropriate RSF or ASF factors depending on other attributes.

The details of these interdependent assets and liabilities are reported in the Annexure 4 of MA (BS) 26 return of Stable Funding Position, subject to regulatory approval.

Note:

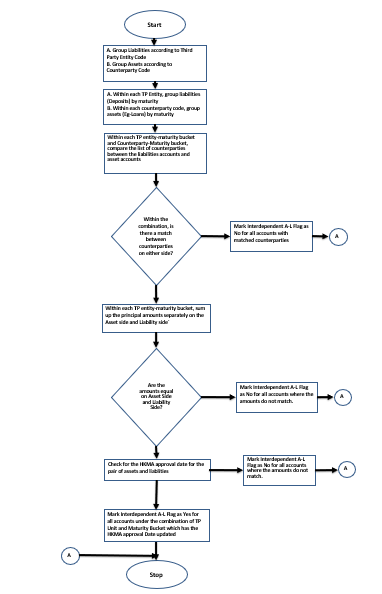

OFS LRRCHKMA supports one to one mapping of accounts for interdependent assets and liabilities.Here is the process flow for the pair identification:

Figure 5-5 Process Flow for the Pair Identification