4.2.17 Calculation of Net Cash Outflows

The net cash outflows are computed after applying the scenario specified by the user, as a set of business assumptions, to the contractual cash flows. The process of computing the net cash outflows is provided below:

- Calculation of Total Cash Inflows

The application applies the business assumptions, specified on products involving cash inflows, selected as part of the Run. The regulatory assumptions specified in section Regulations Addressed through Business Assumptions are pre-defined and packaged as part of the out-of-the-box Run to determine the inflows over the liquidity horizon. The business assumption adjusted cash inflows occurring over the liquidity horizon are summed up to obtain the total cash inflow. These include inflows from earning assets such as loans, assets that are not eligible for inclusion in the stock of HQLA, derivatives inflows and so on.

- Calculation of Total Cash Outflows

The application applies the business assumptions, specified on products involving cash outflows, selected as part of the Run. The regulatory assumptions specified in section Regulations Addressed through Business Assumptions are pre-defined and packaged as part of the out-of-the-box Run to determine the outflows over the liquidity horizon. The business assumption adjusted cash outflows occurring over the liquidity horizon are summed up to obtain the total cash outflow. These include outflows from liabilities, derivatives outflows, outflows due to changes in financial conditions such as ratings downgrade and valuation changes and so on.

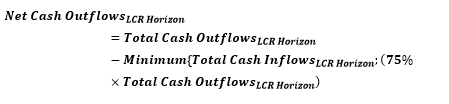

- Calculation of Net Cash Outflow

Net Cash Outflow is computed as follows: