4.2.14.1.2 Calculation of Cash Outflow:

- Retail Funding Outflow

The retail funding outflow amount includes outflows with respect to deposits and other unsecured funding from retail customers, regardless of the maturity of the transaction. These exclude brokered deposits. Retail funding is further classified as stable and less stable based on the regulatory guidelines and receive run-off rates based on this classification. See section Deposit Stability Identification for details.

- Classifying small business customers as retail customers

A business customer is treated as retail customer, if the following conditions are met:

- The banks manages its transactions with the business customer, including deposits, unsecured funding, and credit facility and liquidity facility transactions, in the same way it manages its transactions with individuals;

- Transactions with the business customer have liquidity risk characteristics that are similar to comparable transactions with individuals; and

- The total aggregate funding raised from the business customer is less than $1.5 million

- Classifying Trust customers as retail customers

The agencies have concluded that certain trusts pose liquidity risks substantially similar to those posed by individuals, and the agencies are modifying the final rule to clarify that living or testamentary trusts can be treated as retail customers or counterparties if the following conditions are met:

- Is solely for the benefit of natural persons;

- Does not have a corporate trustee; and

- Terminates within 21 years and 10 months after the death of grantors or beneficiaries of the trust living on the effective date of the trust or within 25 years, if applicable under state law (in states that have a rule against perpetuities).

- Classifying established relationship

The retail deposits that are entirely covered by deposit insurance and:

(1) Is held by the depositor in a transactional account; or

(2) The depositor that holds the account has another established relationship with the bank such as another deposit account, a loan, bill payment services, or any similar service or product provided to the depositor that the bank demonstrates to the satisfaction of the agency would make deposit withdrawal highly unlikely during a liquidity stress event.

- Classifying small business customers as retail customers

- Structured Transaction Outflow

The outflow amount from structured transaction either issued or sponsored by the bank is calculated as the maximum of one of the following values:

- 100% of the structured transactions, issued by the bank, that mature

during the LCR horizon and all commitments made by the bank to

purchase assets during the LCR horizon.

Or

- Maximum contractual amount that the bank may be required to provide to its sponsored entity that issues the structured instrument, through a liquidity facility, a return or repurchase of assets from that entity or other funding agreement.

- 100% of the structured transactions, issued by the bank, that mature

during the LCR horizon and all commitments made by the bank to

purchase assets during the LCR horizon.

- Derivative Cash Outflow

Net derivative cash outflows include all payments that the bank has to make to its counterparty as well as any collateral that is due to be paid by the bank within the LCR horizon. If an ISDA master netting agreement is in place, then the payments and collateral to be received from the counterparty during the LCR horizon are off-set against the cash outflows. If the net exposure value is negative, it is considered a derivatives cash inflow and included in the inflow part of the denominator.

Note:

Any cash flows from forward sales of mortgages and mortgage commitments are excluded from derivative cash flows as they are assigned a different outflow rate. - Mortgage Commitments or Pipelines

A mortgage commitment is a written agreement that the bank is willing to provide a mortgage loan to the buyer in order to complete the purchase formalities. This is not an actual loan but only a commitment to provide the loan. Once the buyer has purchased a property in accordance with the terms of commitment and availed the loan, it gets converted to a mortgage.

As per US Federal Reserve an outflow is captured for retail mortgage commitments.

- Commitment Outflow Amount

The commitment outflow amount includes the undrawn portion of committed credit and liquidity facilities provided by various counterparties. The application deducts the value of any level 1 or 2A asset which is securing the facility from the portion of the undrawn amount of that facility that are drawn down within the LCR horizon, provided the underlying asset is not included in the stock of HQLA. The outflow amount is determined by multiplying the adjusted undrawn amount with the outflow rates specified by the user. These rates vary based on the facility type and the customer type.

- Collateral Outflow

- Changes in financial condition: Derivatives and other transactions may include certain clauses that result in collateral outflows due to change in financial condition of an institution due to a downgrade. The application supports the ability to capture downgrade triggers for derivatives and other transactions. It also supports the ability to activate these triggers through the Ratings Downgrade assumption. For details on this assumption refer Chapter 6 Business Assumptions in the Oracle Financial Services Liquidity Risk Measurement and Management User Guide in the OHC Documentation Library. The collateral outflow due to change in financial condition is supported through calculation and outflow of downgrade impact amount.

- Downgrade Impact Amount for Derivatives

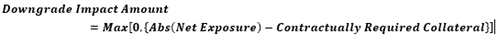

The downgrade impact amount for derivatives is calculated at the netting agreement level as follows:

- The application checks if a downgrade trigger exists for a particular derivative transaction. If there is no downgrade trigger, the downgrade impact amount is 0.

- If a downgrade trigger exists, the application checks for the signage of the net exposure. If the net exposure is positive, that is > 0, the downgrade impact amount is 0.

- If a downgrade trigger exists and the net exposure is negative, the

downgrade impact amount is calculated as follows:

Note:

The ratings downgrade business assumption is defined at the netting agreement level for all accounts that have a netting agreement ID associated with them. The outflow of downgrade impact amount depends on the downgrade specified. For instance, if a 3-notch downgrade is specified, then the downgrade impact amount outflows only for those accounts that have a trigger of 1-notch, 2-notches and 3-notches. If a 2-notch downgrade is specified, then the downgrade impact amount outflows only for those accounts that have a trigger of 1-notch and 2-notches. For details on the ratings downgrade business assumption refer Chapter 6 Business Assumptions in the Oracle Financial Services Liquidity Risk Measurement and Management User Guide in the OHC Documentation Library. - Downgrade Impact Amount for Securitizations

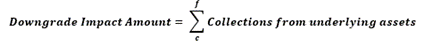

The downgrade impact amount for securitizations is calculated as follows:

- The application checks the commingling indicator value. If the commingling indicator is ‘No’, the downgrade impact amount is 0.

- If commingling indicator is ‘Yes’, the application checks if downgrade trigger exists for such a securitization. If there is no downgrade trigger, the downgrade impact amount is 0.

- If a downgrade trigger exists the application compares the start date of the collections from the underlying assets with the as of date. If collection start date > as of date, the downgrade impact amount is 0.

- If the collection start date <= as of date ,the downgrade impact

amount is calculated as follows:

Where,

c : Collection start date <= as of date

f : As of date

Note:

The ratings downgrade business assumption is defined for securitizations for the outflow of downgrade impact amount. - Downgrade Impact Amount for Other Liabilities

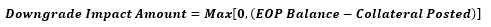

In case of other liabilities, including annuities, that have a downgrade trigger associated with them, the downgrade impact amount is calculated as follows:

- The application checks if a downgrade trigger exists for liabilities other than derivatives and securitizations. If there is no downgrade trigger, the downgrade impact amount is 0. Else,

- If a downgrade trigger exists, the application checks if the product

is derivative or securitization. If it is not a derivative or

securitization, the downgrade impact amount is calculated as

follows:

Note:

The ratings downgrade business assumption is defined for other liabilities for the outflow of downgrade impact amount.

- Potential valuation changes: Collateral outflows may result due to the fall in the fair value of non-level 1 assets securing a transaction. The application provides the ability to specify outflow rates on the fair value of collateral posted.

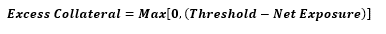

- Excess collateral: Any unsegregated collateral in excess of the amount

contractually required to be provided by the counterparty to the bank is assumed

to be withdrawn during stress conditions. The application calculates the value

of excess collateral and provides the ability to specify outflows on such excess

collateral.

The procedure of calculating excess collateral posted by counterparty is as follows:

- The application checks for signage of net exposure. If net exposure is negative, that is < 0, then the excess collateral is 0. Else,

- If net exposure is positive, the excess collateral is calculated as

follows:

Note:

- Excess collateral mentioned above is computed only for derivatives and not for any other assets.

- The business assumption of outflow of excess collateral is defined at the netting agreement level for all accounts that have a netting agreement ID associated with them.

- For non-derivative transactions , applications computes excess collateral

as:

- Contractually required collateral: Any collateral that is contractually due from

the bank to the counterparty, but has not yet been posted, is assumed to be

demanded by the counterparty during times of stress. The application calculates

the value of contractually due collateral and provides the ability to specify

outflows on such collateral. The procedure of calculating the collateral that a

bank is required to post contractually is as follows:

- The application checks for CSA type of the transaction. If CSA Type = One way then the contractually due collateral is 0. Else,

- If CSA Type = Two way, it checks for signage of net exposure. If net exposure is positive i.e. > 0, then the contractually due collateral is 0. Else,

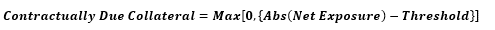

- If net exposure is negative, the contractually due collateral is

calculated as follows:

Where,

Threshold: Minimum exposure amount required to call for additional collateral.Note:

- Contractually due collateral mentioned above is computed only for derivatives and not for any other liabilities.

- The business assumption of outflow of required collateral is defined at the netting agreement level for all accounts that have a netting agreement ID associated with them.

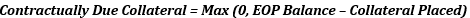

- For non-derivative transactions , application computes the contractually

collateral as:

- Outflow related to collateral substitution: In a stress scenario, any collateral that are substituted by collateral, is assumed to be substituted by the lowest quality of collateral allowed under the substitution clause of the contract. The application provides the ability to capture the substitution details identifies the asset level of each substitutable collateral based on the attributes of the substitutable collateral and determines the lowest quality of substitutable collateral permissible under the terms of the contract. The outflow rates due to collateral substitution are captures through the business assumptions UI.

- Derivative collateral change: The absolute value of the largest LCR horizon cumulative net mark-to-market collateral outflow or inflow resulting from derivative transactions realized during the preceding 24 months.

- Brokered Deposit Outflow

As per US Federal Reserve, brokered deposits are assigned higher Run-offs. A brokered deposit is a deposit that a bank obtains whether directly or indirectly from or through the mediation or assistance of a deposit broker or brokerage house. For instance, a bank may offer a large denomination deposit to a brokerage house which it then sells in smaller chunks to its ultimate customers.

Brokered deposits are further sub-divided into the following categories:- Reciprocal Brokered Deposits

- Brokered Sweep Deposit

- Other Brokered Deposits

Each of the above specified brokered deposit categories are assigned a different Run-off rate.

- Debt Security Outflow

The application defines the debt security outflow amount from retail customers through business assumption. Separate outflow rates are assigned based on the securities issued is structured or not.

- Unsecured wholesale funding outflow amount

Any unsecured funding from wholesale customers, including operational deposits that matures within the LCR horizon is identified by the application. The application identified the operational deposits as those arising from clearing, custody and cash management relationship based on the regulatory guidelines. Separate outflow rates are assigned to such funding based on regulatory or user specified parameters.

- Secured funding and asset exchange outflow amount

Outflows from secured funding transactions maturing within the LCR horizon are based on the collateral securing such transactions. The outflow rates increase in inverse proportion to the quality of the collateral and are related to the liquidity haircuts specified for such assets.

Outflows from asset exchanges are determined based on the difference between the quality of the assets received and posted. If the assets to be posted by the bank to the counterparty at the maturity of the transaction are of higher quality than the assets that will be received from the counterparty, such asset exchanges result in cash outflows to the bank.

The inflow and outflow rates are specified as part of the business assumptions UI.

- Central Bank Borrowings

If a bank has borrowed from a foreign central bank, then such borrowings will get an outflow rate equal to the rate specified by that jurisdiction under its minimum liquidity standard. In the absence of a specific outflow rate from the foreign jurisdiction, the outflow rate is equal to the rates specified for secured funding transactions under of the US Federal Reserve's regulation, Liquidity Coverage Ratio: Liquidity Risk Measurement, Standards, and Monitoring.

The application provides banks the ability to specify multiple outflow rates for borrowings from each foreign central bank.