4.6.1.7.1 Calculation of Consolidated Buffer Assets

The transferability restrictions on buffer assets of subsidiaries are taken into account while computing consolidated liquidity buffer. Restricted subsidiary assets designated as liquidity buffer are available to the parent company only to the extent that they are required to off-set cash flow needs of its subsidiary on a consolidated basis. The unrestricted subsidiary assets are freely available for the parent company’s use.

- The application eliminates all intercompany transactions at an account level up

to the immediate parent as per the approach followed in US LCR for Foreign

subsidiaries. Refer section Identification of Intercompany, Internal and External Transactions

for information on intercompany transactions identification process for

BHCs and FBOs. The internal cash flows must not be eliminated. It is possible to

perform the following:

- To view all intercompany transactions separately for each consolidation level.

- To view internal and external cash outflows and inflows for US IHC, US Branches and US Agencies of FBOs after excluding intercompany transactions.

- To view cash outflows and inflows for US BHCs after excluding intercompany transactions

- The application computes the net stressed cash flow needs for each legal entity, for leaf level on a solo basis and each node level on a consolidated basis. The method for computing net stressed cash flow needs varies for BHCs and FBOs. Refer section Calculation of Buffer Requirement for more information.

- The application identifies the transferable portion of restricted buffer assets.

The application transfers the restricted portion of liquidity buffer of a legal

entity to parent to the extent of its net stressed cash flow needs. The out of

the box transfer sequence for restricted assets is as follows:

- Cash

- Security issued or guaranteed by US Government, US Government Agency or US Government Sponsored Enterprise (GSE) that is liquid and readily marketable

- Other buffer assets classified as HQLA Level 1 Assets

- Other buffer assets classified as HQLA Level 2A Assets

- Other buffer assets classified as HLQA Level 2B Assets

- Other buffer assets classified as Other Assets

This is done at each level of the consolidation entity's organization structure.

You can view the transferable and non-transferable portion of restricted buffer assets from each subsidiary entity.

You can change the sequence of restricted assets consideration in the table DIM_LIQ_BUFFER_COMPONENTS, column N_RANK.

The ranks in the column N_RANK are considered in ascending order, with the lowest rank being considered first.

- The application transfers the unrestricted portion of liquidity buffer fully to the parent. This is done at each level of the consolidation entity's organization structure. You can view the unrestricted buffer assets transferred from each subsidiary entity.

- You must perform steps (1) to (4) till the highest consolidation level is reached.

- The approach to consolidation is similar to that followed in US LCR. However, the computation of buffer and buffer requirement is based on YY guidelines.

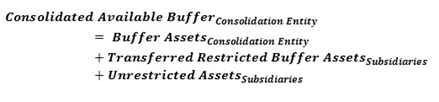

- The consolidated buffer is calculated at each consolidation entity as per the

following formula:

- You can view the consolidated buffer assets and their corresponding HQLA asset

level at the following levels:

- Restricted buffer assets of each entity that are consolidated with the parent entity and their corresponding HQLA asset level

- Restricted buffer assets of each entity that are not consolidated with the parent entity and their corresponding HQLA asset level

- Unrestricted buffer assets of each entity that are consolidated with the parent entity and their corresponding HQLA asset level

- All of the above calculations across multiple stress scenarios