4.6.1.6.1 Computation of Buffer Requirement for US BHCs

The application computes buffer requirement for US BHCs and all its subsidiaries as

follows:

- The application obtains the contractual cash flows.

- Intercompany transactions are identified separately and eliminated during calculations.

- The cash flows from internal and external sources are bucketed based on the time bucket definition selected as part of the Contractual Run.

- The application computes all the other measures supported as part of US LCR calculations such a downgrade impact amount, contractually due collateral, excess collateral and so on. These are calculated and stored for the purpose of applying business assumptions.

- The BAU and stress assumptions are applied to bucketed cash flows as part of the BAU or Stress Run. OFS LRM supports a range of business assumptions for the purpose of defining BAU and Stress Runs. The application does not provide pre-configured scenario values for the Regulation YY Liquidity Risk Calculation, but requires users to create their own assumptions, as part of Business Assumption window, with the relevant inflow and outflow rates. For detailed information on each business assumption supported by OFS LRM, refer Chapter 6 Business Assumption; section Business Assumption Definition in the Oracle Financial Services Liquidity Risk Measurement and Management User Guide in the OHC Documentation Library.

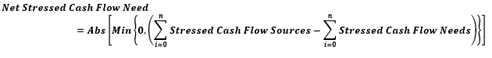

- The net stressed cash flow need is computed for each user-specified stress

horizon as follows:

Where,

i = Period from open maturity to horizon

n = Horizon in days

Cash Flow Sources = Cash inflows post business assumptions

Cash Flow Needs = Cash outflows post business assumptions

The liquidity buffer requirement is equal to the net stressed cash flow need calculated for each stress horizon.

The net stressed cash flow need calculation for BHCs is illustrated below considering 3 stress horizons 1 day, 5 days and 10 days:

Table 3-13 Net stressed cash flow need calculation for BHCs

| Level 0 Time Buckets | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Day 7 | Day 8 | Day 9 | Day 10 | |

| Cash Flow Sources (Inflows) | ||||||||||

| Housing Loan | 20 | 18 | 11 | 24 | 17 | 19 | 14 | 10 | 19 | 23 |

| Credit Card | 13 | 15 | 15 | 12 | 13 | 15 | 10 | 12 | 13 | 11 |

| Balances With Banks | 12 | 10 | 12 | 9 | 9 | 5 | 10 | 6 | 12 | 11 |

| Total Cash Flow Sources | 45 | 43 | 38 | 45 | 39 | 39 | 34 | 28 | 44 | 45 |

| Cumulative Cash Flow Sources (a) | 45 | 88 | 126 | 171 | 210 | 249 | 283 | 311 | 355 | 400 |

| Cash Flow Needs (Outflows) | ||||||||||

| Deposits | 15 | 23 | 24 | 30 | 28 | 17 | 19 | 11 | 21 | 12 |

| Borrowings | 16 | 6 | 16 | 10 | 23 | 10 | 17 | 20 | 14 | 18 |

| Funding Lines | 6 | 6 | 5 | 5 | 6 | 7 | 6 | 7 | 5 | 5 |

| Total Cash Flow Needs | 37 | 35 | 45 | 45 | 57 | 34 | 42 | 38 | 40 | 35 |

| Cumulative Cash Flow Needs (b) | 37 | 72 | 117 | 162 | 219 | 253 | 295 | 333 | 373 | 408 |

| Net Stressed Cash Flow Need For Each Horizon (Abs(Min(0,a – b)) | 0 | 9 |

8

|

|||||||