4.5.1.9 Placed Collateral

Secured funding transactions require covered company to place collateral for the borrowings which are received from the counterparty. Secured funding are borrowings from repurchase transactions, Federal Home Loan Bank advances, secured deposits from municipalities or other public sector entities (which typically require collateralization in the United States), loans of collateral to effect customer short positions, and other secured wholesale funding arrangements with Federal Reserve Banks, regulated financial companies, non-regulated funds, or other counterparties. Secured funding could give rise to cash outflows or increased collateral requirements in the form of additional collateral or higher quality collateral to support a given level of secured debt. Collaterals are also placed for some derivatives transactions such as collateral swap, futures, forwards, and securitization and so on.

- Placed collateral are securities or other assets such as credit cards, loans and so on.

- All the attributes required for the HQLA classification and collateral amount is provided as download for each placed collateral.

- The mapping of placed collateral and corresponding secured funding transactions are provided as download.

- The underlying asset level, underlying asset amount, contractually required

collateral amount, downgrade impact amount are computed for each secured funding

transactions.

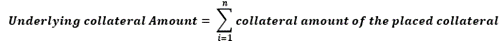

- Collateral posted or the underlying amount is the sum of the value of

all collaterals placed for the secured funding.

- Underlying asset level: the asset level of the placed collateral for the

secured funding. In cases where the multiple collaterals were placed for

a secured funding transaction with varying asset levels, the asset level

corresponding to lowest liquidity value is assigned as underlying asset

level for the secured funding transaction. For example, if Level 1 and

Level 2A assets are placed as collateral for FHLB borrowing, the

underlying asset level for the FHLB borrowings is Level 2A.

Note:

The contractually due collateral calculation for derivative transactions is specified in ‘Net Exposure’ section. - The downgrade impact amount computations are explained in ‘Calculation of Downgrade Impact Amount’ section.

- Collateral posted or the underlying amount is the sum of the value of

all collaterals placed for the secured funding.