5.2.5.15.1 Significant Currency Liquidity Coverage Ratio Calculation

Liquidity coverage ratio is also calculated for each legal entity at the level of each significant currency in order to identify potential currency mismatches. This is done by first identifying significant currencies for a legal entity, at a solo or consolidated level as specified in the Run, as follows:

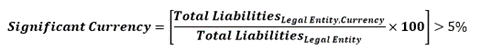

According to the BOT announcement as below, significant currency indicates aggregate of liabilities denominated in that currency amount including off market balance sheet, foreign exchange forward and cross currency swap to 5% or more of the bank’s total liabilities.

The application further computes and reports the stock of HQLA, net cash outflows and LCR for each currency identified as significant in the manner detailed in the earlier sections. This calculation is done on both solo and consolidated basis.