5.2.3.5 Calculation of Adjustments to Stock of HQLA Due to Cap on Level 2 Assets

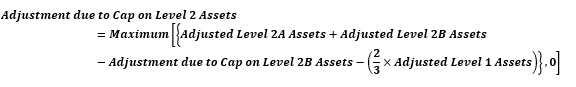

- Adjustment Due to Cap on Level 2B Assets

Level 2B assets can only constitute up to 15% of the stock of HQLA after taking into account the impact of unwinding transactions maturing within the LCR horizon. Adjustment to stock of HQLA due to cap on Level 2B assets i.e. adjustment for 15% cap is calculated as follows:

Figure 4-6 Adjustment due to cap on Level 2B Assets

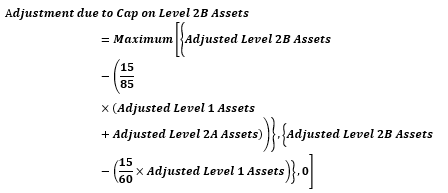

- Adjustment Due to Cap on Level 2 Assets

Level 2 assets can only constitute up to 40% of the stock of HQLA after taking into account the impact of unwinding transactions maturing within the LCR horizon. Adjustment to stock of HQLA due to cap on Level 2 assets i.e. adjustment for 40% cap is calculated as follows:

Figure 4-7 Adjustment due to cap on Level 2 Assets