5.2.9.1.1 Calculation of Contractually Due Collateral

The application computes the value of collateral that a bank is required to post contractually to its derivative counterparty as per the below procedure:

- If Secured Indicator = No, then the contractually due collateral is

0.

OR

- If Secured Indicator = Yes and CSA Type = One way then the contractually due collateral is 0. Else,

- If Secured Indicator = Yes, CSA Type = Two way and Gross Exposure is >= 0, then

the contractually due collateral is 0.

OR

- If Secured Indicator = Yes, CSA Type = Two way and Gross Exposure is <0, the

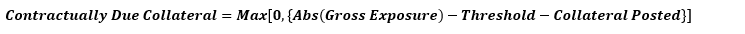

application computes the contractually due collateral as follows:

Figure 4-8 Contractually Due Collateral

Where:

Threshold: Unsecured exposure that a party to a netting agreement is willing to assume before making collateral calls.

The contractually due collateral is assumed to be posted and therefore receives the relevant outflow rate specified by the regulator as part of the pre-configured business assumptions for LCR calculations.