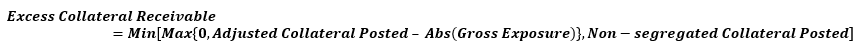

5.2.10.1.2 Calculation of Excess Collateral Receivable

The application computes the value of collateral that the bank has posted to

its derivative counterparty, in excess of the contractually required collateral, and

therefore can be withdrawn by the bank, as per the below procedure: