7.1.4 Computation of Forward Balances

The application provides the ability to compute the forward balance of assets and liabilities for multiple future dates as part of its forward liquidity calculation capability. It supports multiple methodologies for computing these forward balances which include:

- Contractual Run Off

- Equally Changing Balance

- Balance Download

- Balance Change Download

- Constant Balance

- Cash Flow Download Method

The application allows users to map the forward balance calculation methods to the desired dimensional combinations such as product-currency or simply a single dimension such as product through a rule defined as part of the Rule Run Framework. This mapping is to be done for all assets and liabilities, other than derivatives, based on a combination of the download dimensions supported for them for forward calculation. The list of download dimensions supported for forward calculations is detailed as part of section Granularity of Forward Records above.

The application supports a pre-configured rule for mapping the forward balance calculation methods named “LRM - Balance Method Reclassification - Forecast”. This has default values mapped for assets and liabilities. These default mappings can be changed by the users and the rule can be re-saved to reflect these changes. Alternatively, users can create their own mapping rules in the Rules Framework to address regulatory and risk management needs. However, only one mapping rule is allowed to be selected in the Run Management window for a given forward liquidity Run, based on which all further calculations are done as part of that forward Run.

The forward balance calculation methods supported by the application are explained in detail below:

1. Contractual Run Off

The steps involved in calculating balances at a forward date under contractual terms when the method is selected as “contractual run off” are as follows:

- The un-bucketed contractual cash flows based on the current date are obtained as a download. The current date is equal to the As of Date selected during Run Execution.

- The current balance of each account as of the “As of Date” is received. This is the starting balance for forward date calcuations.

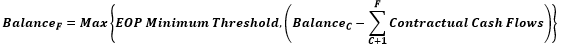

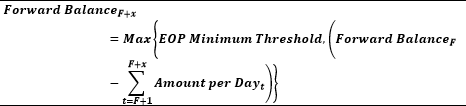

- The application calculates the forward balance as of the first forward date as follows:

Where:

F: First forward date

C: Current date i.e. As of Date selected in the Run Management window

EOP Minimum Threshold: Floor for the account balance i.e. the minimum balance to be maintained at all times

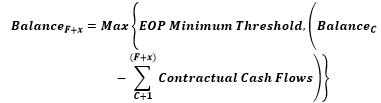

- The application calculates the forward balance for each subsequent forward date

as follows:

Where:

F + x: Each subsequent forward date

x: Interval between each forward date

Note:

- If a EOP minimum threshold is specified, the contractual cash flows are run-off only till the minimum threshold is reached. Any contractual cash flows which results in the forward balance dropping below the minimum threshold will not be run-off. Once the minimum threshold is reached, it is maintained as constant balance for all subsequent forward dates for that Run and dimensional combination. For instance the forward balance as of 31st December is 5200, minimum threshold is 5000 and contractual cash outflow between 31st December and the next forward date which is 31st January is 500. In this case, the balance as of 31st January is 5000 i.e. (minimum of 5000, 5200-500).

- If no minimum threshold is specified, then the application runs off the contractual cash flows till balance equals zero.

The contractual run-off method is illustrated below. The inputs required for this method are provided below considering the spot date as 03/01/2015. All values are in terms of US Dollars.

Table 6-4 Contractual run-off method

| Product | Spot Balance | EOP Minimum Threshold |

|---|---|---|

| Loan 1 | 1,000 | |

| Loan 2 | 2,000 | |

| XYZ ( TD) | 1,000 | |

| ABC ( Retail Lending ) | 2,000 | |

| Loan 3 | 5,000 | |

| Advances | 10,000 | |

| Demand Deposit | 3,000 | |

| Loan 4 | 20,000 | 2,000 |

| Loan 5 | 20,000 | 10,000 |

| Loan 6 | 20,000 | 40,000 |

The contractual cash flow position as of the spot date for each product is as follows:

Table 6-5 Contractual cash flow position

| Product | Cash Flow Date | Cash Flow Type | Outflow Amount | Inflow Amount |

|---|---|---|---|---|

| Loan 1 | 2-Mar-15 | Outflow | 1,000 | |

| Loan 2 | 2-Mar-15 | Outflow | 500 | |

| Loan 2 | 15-Mar-15 | Outflow | 400 | |

| Loan 2 | 1-Apr-15 | Outflow | 200 | |

| Loan 2 | 16-Apr-15 | Outflow | 600 | |

| Loan 2 | 1-May-15 | Outflow | 300 | |

| XYZ ( TD) | 31-Mar-15 | Outflow | 1,000 | |

| ABC ( Retail Lending ) | 3-Apr-15 | Inflow | 500 | |

| ABC ( Retail Lending ) | 10-Apr-15 | Inflow | 800 | |

| ABC ( Retail Lending ) | 25-Apr-15 | Inflow | 700 | |

| Loan 3 | 1-Jan-18 | Inflow | 5,000 | |

| Demand Deposit | 2-Mar-15 | Outflow | 3,000 | |

| Advances | 1-May-15 | Outflow | 1,500 | |

| Advances | 5-May-15 | Outflow | 800 | |

| Advances | 10-Jul-15 | Outflow | 500 | |

| Advances | 11-Aug-15 | Outflow | 200 | |

| Advances | 1-Dec-15 | Outflow | 5,000 | |

| Loan 4 | 4-Apr-15 | Outflow | 5,000 | |

| Loan 4 | 1-Aug-16 | Outflow | 2,000 | |

| Loan 5 | 1-Aug-16 | Outflow | 7,000 | |

| Loan 5 | 1-Sep-16 | Outflow | 7,000 | |

| Loan 6 | 1-Aug-16 | Outflow | 7,000 | |

| Loan 6 | 1-Sep-16 | Outflow | 7,000 |

The forward balances under different scenarios are explained as follows:

- Scenario I : Entire balance is run off during the forecasting horizon

- Scenario II : No run-off during the forecasting horizon

- Scenario III: Balance is run-off partially during the forecasting horizon

- Scenario IV : Entire balance has run-off prior to the first forward date

- Scenario V: Balance runs-off on the first forward date after the spot date

- Scenario VI: Run-offs are happening on the forward dates

- Scenario VII: Run off is not happening till EOP minimum threshold

- Scenario VIII: Balance runs-off till EOP minimum threshold

- Scenario IX: EOP minimum threshold is more than spot EOP

Table 6-6 Forward balances under different scenarios

| Forward Date | Scenario | Scenario II | Scenario III | Scenario IV | Scenario V | Scenario VI | Scenario VII | Scenario VIII | Scenario IX | |

|---|---|---|---|---|---|---|---|---|---|---|

| Retail Lending | Loan 3 | Advances | Demand Deposit | XYZ(TD) | Loan 1 | Loan 2 | Loan 4 | Loan 5 | Loan 6 | |

| 1-Apr-15 | 2,000 | 5,000 | 10,000 | 900 | 20,000 | 20,000 | 20,000 | |||

| 1-May-15 | 5,000 | 8,500 | 15,000 | 20,000 | 20,000 | |||||

| 1-Jun-15 | 5,000 | 7,700 | 15,000 | 20,000 | 20,000 | |||||

| 1-Jul-15 | 5,000 | 7,700 | 15,000 | 20,000 | 20,000 | |||||

| 1-Aug-15 | 5,000 | 7,200 | 13,000 | 13,000 | 13,000 | |||||

| 1-Sep-15 | 5,000 | 7,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Oct-15 | 5,000 | 7,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Nov-15 | 5,000 | 7,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Dec-15 | 5,000 | 2,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Jan-16 | 5,000 | 2,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Feb-16 | 5,000 | 2,000 | 13,000 | 10,000 | 6,000 | |||||

| 1-Mar-16 | 5,000 | 2,000 | 13,000 | 10,000 | 6,000 | |||||

2. Equally Changing Balance

The steps involved in calculating balances at a forward date under contractual terms when the method is selected as “equally changing balance” are as follows:

- The following parameters are obtained as inputs:

- First Forward Date Balance: This is the forward balance as of the first forward date. If this parameter is not provided, the application considers the spot balance as the first forward balance as well.

- Forecasting Period: This is the number of calendar days over which the balance is changing equally i.e. either reducing or increasing in an equal manner. This is a mandatory parameter.

- Last Forward Balance: This is the balance as of the last forward

date and is an optional parameter. If this value is not provided,

the balance is run-off equally to zero.

Note:

You are required to provide this parameter if an increase in forward balance vis-a-vis the spot balance is to be calculated.

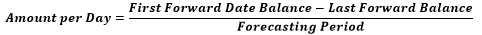

- The application calculates the equally changing amount on each day as follows:

- When holidays are included:

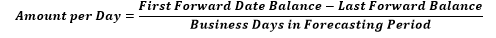

- When holidays are excluded:

Note:

The equally changing amount computed here is the forward cash flow as of each calendar or business day depending on whether holidays are included or excluded. In case holidays are excluded for calculating the equally changing amount, the cash flows on such excluded days are 0.

- When holidays are included:

- The balance for each dimensional combination on each forward date

is calculated as follows:

Where

F: Previous forward balance. The balance as of the first forward date is provided as a download.

x: Interval between each forward date

t: Time period between previous forward date (exclusive) to next forward date (inclusive)

The equally changing balance method is illustrated below. The inputs required for this method are provided below. All values are in terms of US Dollars.

Table 6-7 Equally changing balance method

Input Calculation of Amount Per Day Product Name First Forward Balance (a) First Forward Date (b) Forecasting Period (in Days) (c) Last Forward Balance (d) Last Forward Date (b + c) Business Days in Forecasting Period (e) Amount Per Calendar Day (f = (a - d) ¸ c) Amount Per Business Day (g = (a - d) ¸ e) Loan 1 5,000 1-Apr-15 4 1,000 5-Apr-15 3 1000 1333 Demand Deposit 3,000 1-Apr-15 7 1,000 8-Apr-15 6 286 333 Advances 10,000 1-Apr-15 15 16-Apr-15 12 667 833 Loan 2 10,000 1-Apr-15 5 15,000 6-Apr-15 4 -1000 -1250 The calculation of forward balances is illustrated under the following scenarios:

- Scenario I: When holidays are Excluded, Forecasting Period < Forecasting Horizon and EOP Balance is Reducing

- Scenario II: When holidays are Included, Forecasting Period < Forecasting Horizon and EOP Balance is Reducing

- Scenario III: When holidays are Excluded, Forecasting Period > Forecasting Horizon and EOP Balance is Reducing

- Scenario IV: When holidays are Excluded, Forecasting Period > Forecasting Horizon and EOP Balance is Increasing

Table 6-8 Calculation of forward balances

Forward Date Holiday Scenario I Scenario II Scenario III Scenario IV Loan 1 Balance Demand Deposit Balance Loan 1 Balance Demand Deposit Balance Advances Balance Loan 2 Balance 1-Apr-15 N 5,000 3,000 5,000 3,000 10,000 10,000 2-Apr-15 N 3,667 2,667 4,000 2,714 9,167 11,250 3-Apr-15 N 2,333 2,333 3,000 2,429 8,333 12,083 4-Apr-15 Y 2,333 2,333 2,000 2,143 8,333 12,083 5-Apr-15 Y 2,333 2,333 1,000 1,857 8,333 12,083 6-Apr-15 N 1,000 2,000 1,000 1,571 7,500 12,917 7-Apr-15 N 1,000 1,667 1,000 1,286 6,667 13,750 8-Apr-15 N 1,000 1,000 1,000 1,000 5,833 15,000

3. Balance Download

The steps involved in calculating balances at a forward date under contractual terms when the method is selected as “balance download” are as follows:

- The forward balances for multiple forward dates are received as a download across dimensional combinations.

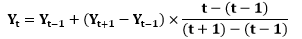

- The application computes the forward balance for missing forward dates as follows:

- If forward balance is not available for each forward date The missing forward balance is interpolated using the balances available on the dates immediately prior and immediately following the missing forward date as follows:

Figure 6-1 Yt

Where

Yt: Missing forward balance

Yt-1: Known balance on forward date immediately preceding the missing forward date

Yt+1: Balance on forward date immediately succeeding the missing forward date

t: Cumulative time, in days, from first forward date to each subsequent forward date. The cumulative time is based on business days if holidays are to be excluded and based on calendar days if holidays are to be included.

An example of interpolation when frequency of forward dates is a week and holidays are included is as follows.

Table 6-9 Interpolation when frequency of forward dates

Input Calculation Forward Date Forward Balance Download Value Period Start Period End Cumulative Calendar Days Missing Forward Balance 31-Jan-14 742 31-Jan-14 31-Jan-14 1 07-Feb-14 438 01-Feb-14 07-Feb-14 8 14-Feb-14 08-Feb-14 14-Feb-14 15 521 21-Feb-14 604 15-Feb-14 21-Feb-14 22 28-Feb-14 859 22-Feb-14 28-Feb-14 29 07-Mar-14 426 01-Mar-14 07-Mar-14 36 14-Mar-14 268 08-Mar-14 14-Mar-14 43 21-Mar-14 379 15-Mar-14 21-Mar-14 50 28-Mar-14 22-Mar-14 28-Mar-14 57 546 04-Apr-14 29-Mar-14 04-Apr-14 64 712 11-Apr-14 05-Apr-14 11-Apr-14 71 879 18-Apr-14 1045 12-Apr-14 18-Apr-14 78 An example of interpolation when frequency of forward dates is a week and holidays are excluded is as follows:

Table 6-10 Interpolation when frequency of forward dates

Input Calculation Forward Date Forward Balance Download Value Period Start Period End Cumulative Calendar Days Missing Forward Balance 31-Jan-14 742 31-Jan-14 31-Jan-14 1 07-Feb-14 438 01-Feb-14 07-Feb-14 6 14-Feb-14 08-Feb-14 14-Feb-14 11 521 21-Feb-14 604 15-Feb-14 21-Feb-14 16 28-Feb-14 859 22-Feb-14 28-Feb-14 21 07-Mar-14 426 01-Mar-14 07-Mar-14 26 14-Mar-14 268 08-Mar-14 14-Mar-14 30 21-Mar-14 379 15-Mar-14 21-Mar-14 35 28-Mar-14 22-Mar-14 28-Mar-14 39 506 04-Apr-14 29-Mar-14 04-Apr-14 44 664 11-Apr-14 05-Apr-14 11-Apr-14 48 791 18-Apr-14 1045 12-Apr-14 18-Apr-14 56 Note:

Business days exclude weekends and other holidays. - If a forward balance is not available on the last forward date

The missing forward balance is extrapolated using the forward balances available on the two dates immediately prior to the missing forward date as follows:

Where

Yt: Missing observation i.e. value of the forward balance to be forecasted at time ‘t’

Yt-1: Known value of observation at time‘t-1’

Yt-2: Known value of observation at time‘t-2’

t: Cumulative time, in days, from start date of the first observation period to the end of each observation period

An example of extrapolation when frequency of forward dates is a month and holidays are included is as follows:

Table 6-11 Extrapolation when frequency of forward dates

Input Calculation Forward Date Forward Balance Download Value Period Start Period End Cumulative Calendar Days Missing Forward Balance 31-Jan-14 742 31-Jan-14 31-Jan-14 1 28-Feb-14 438 01-Feb-14 28-Feb-14 29 31-Mar-14 724 01-Mar-14 31-Mar-14 60 30-Apr-14 603 01-Apr-14 30-Apr-14 90 31-May-14 859 01-May-14 31-May-14 121 30-Jun-14 426 01-Jun-14 30-Jun-14 151 31-Jul-14 268 01-Jul-14 31-Jul-14 182 31-Aug-14 379 01-Aug-14 31-Aug-14 213 30-Sep-14 01-Sep-14 30-Sep-14 243 486 31-Oct-14 01-Oct-14 31-Oct-14 274 597 30-Nov-14 01-Nov-14 30-Nov-14 304 705 31-Dec-14 01-Dec-14 31-Dec-14 335 816 An example of extrapolation when frequency of forward dates is a month and holidays are excluded is as follows:

Table 6-12 Frequency of forward dates

Input Calculation Forward Date Forward Balance Download Value Period Start Period End Cumulative Business Days Missing Forward Balance 31-Jan-14 742 31-Jan-14 31-Jan-14 1 28-Feb-14 438 01-Feb-14 28-Feb-14 21 31-Mar-14 724 01-Mar-14 31-Mar-14 42 30-Apr-14 603 01-Apr-14 30-Apr-14 64 31-May-14 859 01-May-14 31-May-14 86 30-Jun-14 426 01-Jun-14 30-Jun-14 107 31-Jul-14 268 01-Jul-14 31-Jul-14 130 31-Aug-14 379 01-Aug-14 31-Aug-14 151 30-Sep-14 01-Sep-14 30-Sep-14 173 495 31-Oct-14 01-Oct-14 31-Oct-14 196 617 30-Nov-14 01-Nov-14 30-Nov-14 216 723 31-Dec-14 01-Dec-14 31-Dec-14 239 844 Note:

- If there is only 1 known observation, then the missing observation is estimated as the value of the preceding known observation.

- If the balance is not provided for the first forward date in the forecasting horizon, the application will not compute the forward balance for such a dimensional combination. First forward balance is mandatory.

- If the last forward date and corresponding balance provided as a download occurs after the last date in the forecasting horizon, only those balances missing till the end of the forecasting horizon are interpolated.

- The application supports only the Balance Download Method or Constant Balance Method for computing forward balances for liquidity pool assets i.e. those assets which are controlled by treasury.

- If forward balance is not available for each forward date The missing forward balance is interpolated using the balances available on the dates immediately prior and immediately following the missing forward date as follows:

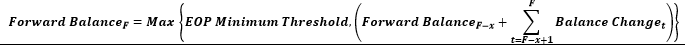

4. Balance Change Download

The steps involved in calculating balances at a forward date under contractual terms when the method is selected as “balance change download” are as follows:

- The balance change for multiple forward dates is received as a download across dimensional combinations. A positive value indicates an increase in balance while a negative value indicates reduction.

- The spot balances are identified for the same dimensional combination as the balance change download.

- The application calculates the forward balance as of each day as follows:

Where:

F: Each forward date for which balance is calculated

F – x: Previous forward date for which calculations are done

x: Interval between each forward date

t: Time period between previous forward date (exclusive) to next forward date (inclusive)

Note:

- If no balance change is specified for time period between previous forward date to next forward date, then the balance calculated as of the previous forward date is assumed to continue “as-is”.

- If no balance change is specified for the first forward date, the spot balance is assumed to continue.

The following is an example for Balance Change Download:

Input:

Table 6-13 Balance Change Download

Product Currency N_EOP_BAL N_EOP_BAL_RCY N_EOP_BAL_LCY N_AS_OF_DATE Term Deposit USD 10000 10000 10000 12/31/2014 Term Deposit INR 2000000 33333 2000000 12/31/2014 Table 6-14 Balance Change Download

Product Currency Balance Change Amount Balance Change Amount Date Forward Date Term Deposit USD 26 1/1/2015 2/1/2015 Term Deposit USD 66 1/2/2015 2/1/2015 Term Deposit USD 21 1/5/2015 2/1/2015 Term Deposit USD -52 1/6/2015 2/1/2015 Term Deposit USD 62 1/7/2015 2/1/2015 Term Deposit USD -95 1/8/2015 2/1/2015 Term Deposit USD 0 1/9/2015 2/1/2015 Term Deposit USD 0 1/12/2015 2/1/2015 Term Deposit USD 0 1/13/2015 2/1/2015 Term Deposit USD 0 1/14/2015 2/1/2015 Term Deposit USD 78 1/15/2015 2/1/2015 Term Deposit USD 43 1/16/2015 2/1/2015 Term Deposit USD -79 1/19/2015 2/1/2015 Term Deposit USD 57 1/20/2015 2/1/2015 Term Deposit USD 29 1/21/2015 2/1/2015 Term Deposit USD -56 1/22/2015 2/1/2015 Term Deposit USD 22 1/23/2015 2/1/2015 Term Deposit USD 61 1/26/2015 2/1/2015 Term Deposit USD 93 1/27/2015 2/1/2015 Term Deposit USD -73 1/28/2015 2/1/2015 Term Deposit USD 5 1/29/2015 2/1/2015 Term Deposit USD 42 1/30/2015 2/1/2015 Term Deposit USD 10 2/1/2015 2/1/2015 Term Deposit USD 11 2/2/2015 3/1/2015 Term Deposit USD 12 2/3/2015 3/1/2015 Term Deposit USD 13 2/4/2015 3/1/2015 Term Deposit USD 14 2/5/2015 3/1/2015 Term Deposit USD 15 2/6/2015 3/1/2015 Term Deposit USD 23 2/9/2015 3/1/2015 Term Deposit USD 17 2/10/2015 3/1/2015 Term Deposit USD 18 2/11/2015 3/1/2015 Term Deposit USD 34 2/12/2015 3/1/2015 Term Deposit USD 20 2/13/2015 3/1/2015 Term Deposit USD 21 2/16/2015 3/1/2015 Term Deposit USD 22 2/17/2015 3/1/2015 Term Deposit USD 23 2/18/2015 3/1/2015 Term Deposit USD 24 2/19/2015 3/1/2015 Term Deposit USD 3 2/20/2015 3/1/2015 Term Deposit USD 26 2/23/2015 3/1/2015 Term Deposit USD 27 2/24/2015 3/1/2015 Term Deposit USD 28 2/25/2015 3/1/2015 Term Deposit USD 29 2/26/2015 3/1/2015 Term Deposit USD 3 2/27/2015 3/1/2015 Term Deposit USD -10 3/1/2015 3/1/2015 Term Deposit INR -41020 1/1/2015 2/1/2015 Term Deposit INR 80810 1/2/2015 2/1/2015 Term Deposit INR 35960 1/5/2015 2/1/2015 Term Deposit INR -36810 1/6/2015 2/1/2015 Term Deposit INR 76760 1/7/2015 2/1/2015 Term Deposit INR -79960 1/8/2015 2/1/2015 Term Deposit INR -15000 1/9/2015 2/1/2015 Term Deposit INR -15000 1/12/2015 2/1/2015 Term Deposit INR -15000 1/13/2015 2/1/2015 Term Deposit INR -15000 1/14/2015 2/1/2015 Term Deposit INR -93350 1/15/2015 2/1/2015 Term Deposit INR -58280 1/16/2015 2/1/2015 Term Deposit INR -64150 1/19/2015 2/1/2015 Term Deposit INR 72180 1/20/2015 2/1/2015 Term Deposit INR 43710 1/21/2015 2/1/2015 Term Deposit INR -40990 1/22/2015 2/1/2015 Term Deposit INR 36810 1/23/2015 2/1/2015 Term Deposit INR 75630 1/26/2015 2/1/2015 Term Deposit INR 108470 1/27/2015 2/1/2015 Term Deposit INR -58170 1/28/2015 2/1/2015 Term Deposit INR 20060 1/29/2015 2/1/2015 Term Deposit INR 56580 1/30/2015 2/1/2015 Term Deposit INR 25000 2/1/2015 2/1/2015 Term Deposit INR 26000 2/2/2015 3/1/2015 Term Deposit INR 27000 2/3/2015 3/1/2015 Term Deposit INR -28000 2/4/2015 3/1/2015 Term Deposit INR -28000 2/5/2015 3/1/2015 Term Deposit INR 280000 2/6/2015 3/1/2015 Term Deposit INR -280000 2/9/2015 3/1/2015 Term Deposit INR -28000 2/10/2015 3/1/2015 Term Deposit INR -28000 2/11/2015 3/1/2015 Term Deposit INR -50000 2/12/2015 3/1/2015 Term Deposit INR -50000 2/13/2015 3/1/2015 Term Deposit INR -50000 2/16/2015 3/1/2015 Term Deposit INR 50000 2/17/2015 3/1/2015 Term Deposit INR -50000 2/18/2015 3/1/2015 Term Deposit INR -50000 2/19/2015 3/1/2015 Term Deposit INR -50000 2/20/2015 3/1/2015 Term Deposit INR -50000 2/23/2015 3/1/2015 Term Deposit INR -50000 2/24/2015 3/1/2015 Term Deposit INR -50000 2/25/2015 3/1/2015 Term Deposit INR 44000 2/26/2015 3/1/2015 Term Deposit INR 18000 2/27/2015 3/1/2015 Term Deposit INR 5000 3/1/2015 3/1/2015 Table 6-15 Output

Product Currency N_EOP_BAL N_EOP_BAL_LCY N_EOP_BAL_RCY D_FORWARD_DATE Term Deposit USD 10260 10260 10260 2/1/2015 Term Deposit INR 2099240 2099240 34987 2/1/2015 Term Deposit USD 10633 10633 10633 3/1/2015 Term Deposit INR 1707240 1707240 28454 3/1/2015

5. Constant Balance

The current contractual balance is held constant for each of the forward dates.

The application calculates the forward dates required for a particular run using the forward date calculation. Once forward dates are determined the forecasted balance is calculated for all forward dates.

The constant balance method is illustrated below. The spot information is as follows:

Table 6-16 Constant balance method

| As of Date | 31-Dec-14 |

|---|---|

| Product | Term Deposit |

| Currency | USD |

| Current Balance | 1,000 |

The forward balance, in case of the constant balance method, is calculated as follows:

Table 6-17 Forward balance

| Forward Date | Forward Balance |

|---|---|

| 1-Jan-15 | 1,000 |

| 1-Feb-15 | 1,000 |

| 1-Mar-15 | 1,000 |

| 1-Apr-15 | 1,000 |

| 1-May-15 | 1,000 |

6. Cash Flow Download Method

This method computes the balances for each forward date by summing up the forward cash flows received as download for that forward date. Refer to section Forward Cash Flow Method Mapping Rule in Run Parameters section of the OFS Liquidity Risk Measurement and Management User Guide on OHC Documentation Library for more details.