5.2.10.9 Consolidation

The approach to consolidation as per LCR approach followed by OFS LRRCRBI is detailed below:

- Identification and Treatment of Unconsolidated Subsidiary

The application assess whether a subsidiary is to be consolidated or not by checking the regulatory consolidated flag F_REGULATORY_ENTITY_IND against each legal entity. OFS LRM considers the cash inflows and outflows of a subsidiary as part of the consolidated LCR calculation, only if the subsidiary is identified as a consolidated subsidiary for the purposes of regulatory calculations. If the entity is an unconsolidated subsidiary, the cash inflows and outflows from the operations of such subsidiaries are ignored (unless otherwise specifically included in the denominator of LCR per regulations) and only the equity investment in such subsidiaries is considered as the bank’s asset and appropriately taken into the numerator or denominator based on the asset level classification.

For instance, legal entity 1 has 3 subsidiaries, legal entity 2, legal entity 3 and legal entity 4. The flag F_REGULATORY_ENTITY_IND for legal entity 4 is ‘No’. In such a case, legal entity 4 is treated as a third party for the purpose of consolidation and its assets and cash flows are completely excluded from calculations. Legal entity 1’s interest in legal entity 4 including common equity of legal entity 4 and assets and liabilities where legal entity 4 is the counterparty will not be eliminated as legal entity 4 is considered a third party during consolidation.

- HQLA Consolidation by Subsidiary Type

The process of consolidating HQLA differs slightly based on whether the subsidiary is a material entity that is expected to report LCR separately from the parent or not. This is done to ensure consistency in the results when consolidating at a parent level and when calculating the LCR at the material subsidiary level as well. The methods followed for consolidating HQLA are:

- In case of a material subsidiaries subject to individual LCR

requirements, consolidation is done as follows:

- The application identifies whether the subsidiary is a consolidated subsidiary.

- If condition (a) is fulfilled, it identifies whether the consolidated subsidiary is subject to LCR requirement that is, whether the subsidiary in question is a regulated entity.

- If condition (b) is fulfilled, then it calculates the net cash outflow by eliminating inter-company transactions at the level of the consolidated subsidiary.

- The application consolidates post-haircut restricted HQLA to the extent of the consolidated subsidiary’s net cash outflow that is, to the extent required to satisfy minimum LCR requirements of that subsidiary as part of the covered company’s HQLA. Restricted HQLA are the assets that have a restriction on their transferability to the parent entity. They are allowed to be included in the stock of HQLA to the extent required to meet that entity’s net cash outflows, but the surplus HQLA is not allowed to be used to meet the parent’s LCR requirements.

- It consolidates the entire amount of post-haircut unrestricted HQLA held at the consolidated subsidiary as part of the covered company’s HQLA.

- It consolidates all cash inflows and outflows which are part of the net cash flow calculation.

- In case of subsidiaries not subject to individual LCR requirements,

consolidation is done as follows:

- The application identifies whether the subsidiary is a consolidated subsidiary.

- If condition (a) is fulfilled, it identifies whether the consolidated subsidiary is subject to minimum LCR requirement that is, whether the subsidiary in question is a regulated entity.

- If condition (b) is not fulfilled, it eliminates all inter-company transactions till the level of the immediate parent of the consolidated subsidiary and then calculates the net cash outflow.

- The application consolidates post-haircut restricted HQLA to the extent of the consolidated subsidiary’s net cash outflow and the entire amount of post-haircut unrestricted HQLA as part of the covered company’s HQLA.

- It consolidates all cash inflows and outflows which are part of the net cash flow calculation.

- In case of a material subsidiaries subject to individual LCR

requirements, consolidation is done as follows:

- Consolidated LCR Calculation

Consolidation is done on a step by step basis based on each level of the organization structure starting from the most granular level. This indicates that intercompany transactions are eliminated at each sub-consolidation level till the final level of the consolidation (generally BHC) is reached. The consolidated HQLA calculated at the level of the immediate subsidiary of the BHC is added to the HQLA held by the BHC. All intercompany cash flows are eliminated and the LCR is calculated in accordance with the LCR approach.

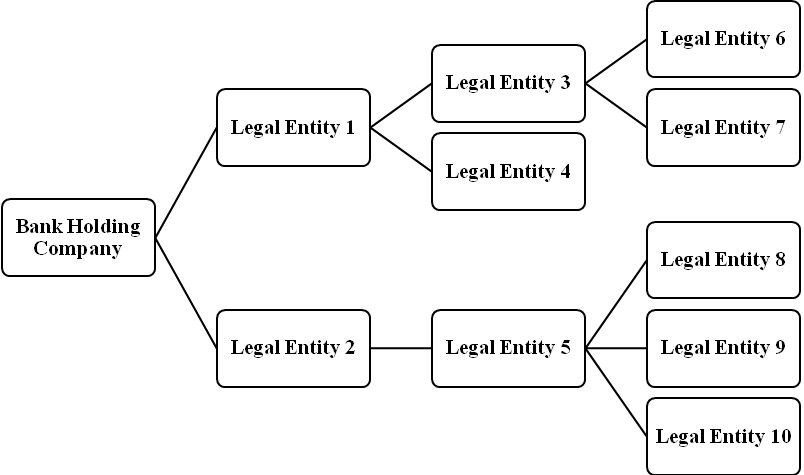

For instance a bank’s organization structure is as follows:

Figure 4-17 Bank's Org Structure

In this case, at the first level of consolidation, calculation of net cash outflows and HQLA is done on a solo basis for legal entities 6, 7, 8, 9 and 10 as they do not have any subsidiaries. In case of regulated entities i.e. material entities, intercompany transactions are not eliminated; whereas in case of non-regulated entities, intercompany transactions are eliminated to the next level of consolidation that is, legal entities 3 and 5. The restricted HQLA from entities 6 and 7 are consolidated to the extent of their net cash outflows, while the unrestricted HQLA is transferred fully to legal entity 3. The cash inflows and outflows are consolidated to the full extent.

At the second level of consolidation that is, legal entity 3, intercompany transactions are eliminated till legal entity 1, if LE 3 is a non-regulated entity. The HQLA is calculated as a sum of the consolidated restricted and unrestricted HQLA of entities 6 and 7 and the HQLA of legal entity 3. The net cash outflow is calculated based on the cash flows of entities 3, 6 and 7, post elimination of intercompany transactions if applicable. The consolidated HQLA is calculated based on the procedure detailed in point 2 above.

This process continues in a step-by-step manner till the highest parent level i.e. the bank holding company in this example.