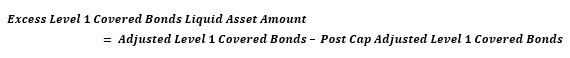

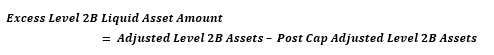

4.3.3.5 Calculating Excess Liquid Asset Amount

The regulation requires banks to maintain the composition of the stock of HQLA as follows:

- A minimum of 60 % should include Level 1 assets.

- A minimum of 30 % should include Level 1 assets excluding extremely high quality covered bonds.

- A maximum of 15% should include Level 2B assets.

The Level 1 covered bonds, Level 2A, and 2B assets more than the composition prescribed by the regulator are excluded from the stock of HQLA. The application computes the excess liquid asset amounts as per the following procedure: