- Liquidity Risk Regulatory Calculations for European Banking Authority User Guide

- Liquidity Coverage Ratio Calculation as Per Delegated Act

- Process Flow

- Calculating Operational Amount

4.3.6 Calculating Operational Amount

The application supports a new methodology to compute the operational portion of the EOP balance of deposits and balances with banks classified as operational deposits. The regulation requires banks to apply the preferential rate only on that portion of the operational deposit balance that is truly held to meet operational needs

The following steps are involved in computing the operational balance:

- All deposits and balances with banks classified as operational as per regulatory guidelines are identified. This is a separate process in LRM.

- The EOP balances of eligible operational accounts are obtained over a user-defined historical window including the As of Date. To identify historical observations, the f_reporting_flag must be updated as Y for one execution of the Run per day in the LRM Run Management Execution Summary UI. The application looks up the balance for such accounts against the Run execution for which the Reporting Flag is updated as Y for each day in the past.The historical window is captured in the Setup Master as part of the parameter named DAYS_HIST_OPER_BAL_CALC_UPD.

- A rolling 5-day average is calculated for each account over the historical window.

- The average of the 5-day rolling averages computed in Step 3 is calculated.

- 5. The Operational Balance is calculated as follows:

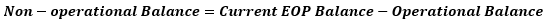

- The Non-Operational Balance is calculated as follows:

- The Operational Insured Balance is calculated as follows:

- The Operational Uninsured Balance is calculated as follows:

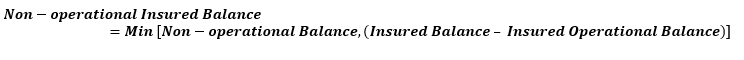

- The Non-Operational Insured Balance is calculated as follows:

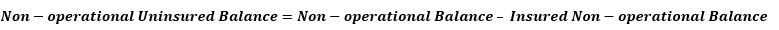

- The Non-Operational Uninsured Balance is calculated as follows:

The operational deposit computation process is illustrated in the following table, assuming a 15-day historical window instead of 90-days and for the As of Date 28th February 2017. The historical balances for 15-days including the As of Date are provided as follows:

The operational deposit computation process is illustrated in the following table, assuming a 15-day historical window instead of 90-days and for the As of Date 28th February 2017. The historical balances for 15-days including the As of Date are provided as follows:Table 3-1 Operational Deposit Computation

Clients With Operational Accounts Eligible Operational Accounts Historical Time Window As of Date 2/14/ 2017 2/15/ 2017 2/16/ 2017 2/17/ 2017 2/18/ 2017 2/19/ 2017 2/20/ 2017 2/21/ 2017 2/22/ 2017 2/23/ 2017 2/24/ 2017 2/25/ 2017 2/26/ 2017 2/27/ 2017 2/28/ 2017 A 10001 102,000 102,125 102,250 102,375 102,500 102,625 102,750 102,875 103,000 103,125 103,250 103,375 103,500 103,625 103,750 10296 23,500 23,550 23,600 23,650 23,700 23,750 23,800 23,850 23,900 23,950 24,000 24,050 24,100 24,150 24,200 B 31652 65,877 59,259 59,234 59,209 59,184 59,159 59,134 59,109 59,084 59,059 59,034 59,009 58,984 58,959 58,934 The rolling averages and cumulative average are computed as follows:Table 3-2 Rolling Average and Cumulative Average Computation

Clients with Operational Accounts Eligible Operational Accounts 5-day Rolling Average Cumulative Average(a) 2/18/ 2017 2/19/ 2017 2/20/ 2017 2/21/ 2017 2/22/ 2017 2/23/ 2017 2/24/ 2017 2/25/ 2017 2/26/ 2017 2/27/ 2017 2/28/ 2017 A 10001 102,250 102,375 102,500 102,625 102,750 102,875 103,000 103,125 103,250 103,375 103,500 95136 10296 23,600 23,650 23,700 23,750 23,800 23,850 23,900 23,950 24,000 24,050 24,100 22721 B 31652 60,553 59,209 59,184 59,159 59,134 59,109 59,084 59,059 59,034 59,009 58,984 56931 The operational and non-operational balances are computed as follows:Table 3-3 Operational and Non-operational Balances Computation

Clients with Operational Accounts Eligible Operational Accounts Current Balance(b) Operational Balance(c = a – b) Non-Operational Balance Insured Balance Uninsured Balance Insured Operational Balance Uninsured Operational Balance Insured Non-Operational Balance Uninsured Non-Operational Balance A 10001 103,750 95,136 8,615 100,000 3,750 95,136 4,865 3,750 10296 24,200 22,721 1,480 24,200 22,721 1,480 B 31652 58,934 56,931 2,003 58,934 56,931 2,003 Note:

- Negative historical balances are replaced by zero for this computation.

- For operational accounts that have an account start date greater than or equal to 90 historical days including the As of Date, missing balances are replaced by previously available balance.

- For operational accounts that have an account start date less than 90 historical days including the As of Date:

- Missing balances between the account start date and As of Date are replaced by previously available balance.

- The rolling average is calculated only for the period from the account start date to the As of Date.