4.4.3.8.3 Calculation of Net Cash Outflows

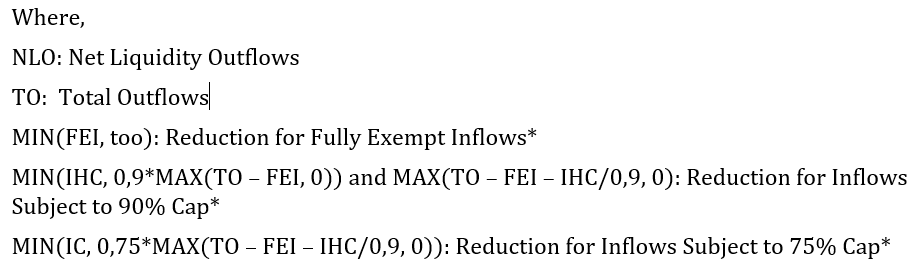

The total net cash outflows are defined as the total expected cash outflows minus total expected cash inflows for the LCR horizon, that is, subsequent 30 calendar days. Total expected cash outflows are calculated by multiplying the outstanding balances of various categories or types of liabilities and off-balance sheet commitments by the rates at which they are expected to run off or be drawn down. Total expected cash inflows are calculated by multiplying the outstanding balances of various categories of contractual receivables by the rates at which they are expected to flow in up to an aggregate cap of 75% of total expected cash outflows. This requires that a bank must maintain a minimum amount of stock of HQLA equal to 25% of the total cash outflows.

Total expected cash inflows are calculated by multiplying the outstanding balances of various categories of contractual receivables by the rates at which they are expected to flow in are capped up to total expected outflows as mentioned in section Calculation of Total Cash Inflows.

will not be permitted to double count items, that is if an asset is included as part of the stock of HQLA (that is the numerator), the associated cash inflows cannot also be counted as cash inflows (that is the part of the denominator). Where there is potential that an item could be counted in multiple outflow categories, (for example, committed liquidity facilities granted to cover debt maturing within the 30 calendar day period), a bank only has to assume up to the maximum contractual outflow for that product.