4.4.3.11 Interdependent Cash Flows (LCR)

As per the Delegated Act Regulation, Article 26, credit institutions can calculate the liquidity outflow and net of an interdependent inflow. The European Banking Authority in an FAQ has clarified that such cash flows are only applicable for derivatives. The criteria for netting interdependent cash flows are:

- The interdependent inflow is directly linked to the outflow and is not considered in the calculation of liquidity inflows elsewhere.

- The interdependent inflow is required according to a legal, regulatory, or contractual commitment.

- The interdependent inflow meets one of the following conditions:

- It arises compulsorily before the outflow.

- It is received within 10 days and is guaranteed by the central government of a Member State.

These criteria are mapped internally in the application as follows:

Table 3-10 Cash Flow Criteria

| Cash Flow Criteria | |||||||||||

| Standard Product Type | Cash Flow Reason | Linked indicator | Occurrence | Comparison | Interval | Underlying Standard Product Type | Underlying Issuer Type or Guarantor Type | Interdependent CF Flag (Processing) | Outflows Net of ICF (Processing) | Calculation Granularity | |

| All Derivatives and Netted Derivatives. (Derivatives include Futures, Forwards, Options, Swaps, and others.) |

Legal OR Regulatory |

Yes | <=LCR Horizon | Inflow date < Outflow date | Yes | Total Linked Outflows - Total Linked Inflows | Account/Netting agreement level | ||||

| All Derivatives. |

Legal OR Regulatory |

Yes | <=LCR Horizon | Inflow date >= Outflow date | Inflow date - Outflow date <= 10 days | Bonds, Treasury Bills, Debt Securities | Sovereign, Central Government | Yes | Total Linked Outflows - Total Linked Inflows | ||

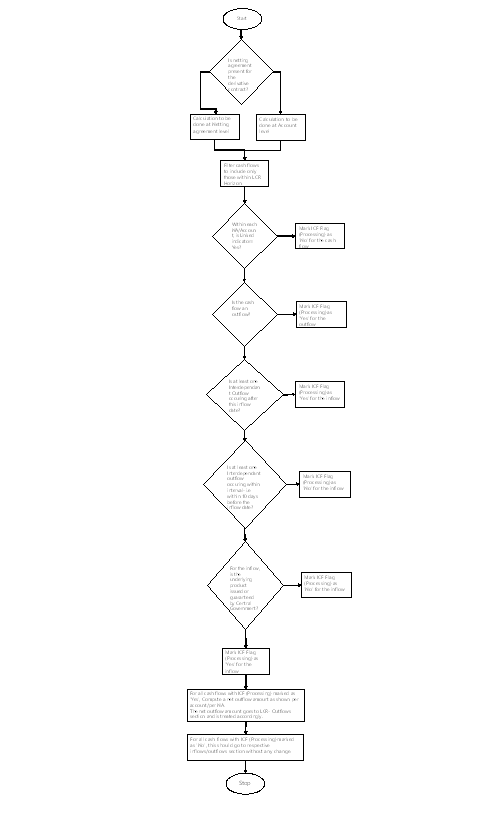

The Netted Cash Flows are directly included in the Outflows section of the LCR. You can turn-on or turn-off this feature. It is turned off by default, as it does not apply to all banks. The process flow is as follows.

Figure 3-35 Process Flow-Interdependent Cash Flows