17 Accounting Enablement

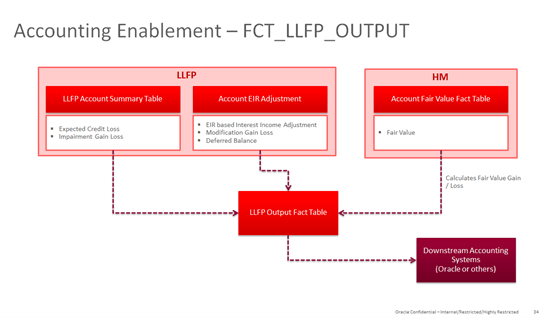

The Accounting Enablement feature of the OFS Loan Loss Forecasting and Provisioning application consolidates all the parameters or values that are required to be accounted for, from the perspective of IFRS 9, across the three phases. It enables you or the institution to push the data from OFS Loan Loss Forecasting and Provisioning and OFS HM to any Downstream Accounting Systems, Oracle's FAH, or other, at an account level or any aggregated level. The level of aggregation can be defined by the bank in the integration process based on a varied set of dimensions.

As mentioned, the process consolidates data from the LLFP application for the given MIS Date, into an Output Table.

- Expected Credit Loss

- Allowance and Provision Amount (separately)

- Impairment Gain or Loss

- Fair Value Gain or Loss

Depending upon the Hedge Effectiveness ratio and the type of Hedge (Cash Flow or Fair Value), the Fair Value Gain or Loss is split into the effective and in-effective portions. if any options are being used in the hedge, wherever necessary, the changes in time value and the intrinsic value are also posted separately.

A flag identifying if the specified account is part of an effective hedge is also populated to enable more detailed downstream accounting.

- Deferred Balance Amortization amount (EIR based Income Adjustment)

Deferred Balance is comprised of components such as fees, costs, and premiums or discounts. While the EIR adjustment process computes the Amortization amount for the deferred balances and the split amongst these three components, in the current process, the data is then migrated to the output tables to enable accounting entries, even on a separate basis, that is, individually for these three components.

- Ending Deferred Balances

Ending Deferred Balances, individually for fees, costs, and premiums or discounts is also migrated to the output table.

- Modification Gain or Loss

- Reclassification Gain or Loss

Note:

ECL, EIR Adjustment, and HM Valuations are prerequisites for the Accounting Enablement process.

To enable banks to aggregate the information into their ledger systems or accounting systems, LLFP provides the preceding information at an account level granularity but accompanied by various corresponding dimensions, this is intended to help the bank configure the aggregation process to suit its requirements.

- Customer Type

- Product

- Product Type

- Legal Entity

- IFRS 9 Classification

- Currency and

- Segment or Portfolio

Figure 17-1 The Accounting Enablement - FCT_LLFP_OUTPUT Process Flow