Create New Subledger Definition

Note:

If you want to import definitions created by you, then see the Object Migration Section in the OFS Analytical Applications Infrastructure User Guide.- In the Subledger Definition Pane, click Add

to open the Subledger Process Window.

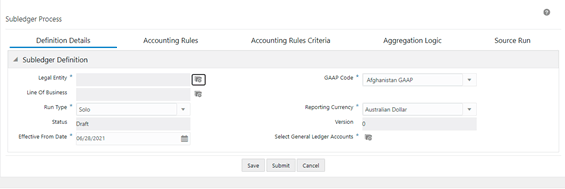

Figure 26-3 The Subledger Process Window

- Populate the Subledger Definition Pane in the

Definition Details tab.

Table 26-1 The subledger definition pane

Field Description Fields marked with asterisks (*) in the window are mandatory. Legal Entity* Click Hierarchy Selection adjacent to this field. Select the required Legal Entity from the Hierarchy Selection Window.

For more information, see Hierarchy Selection.

GAAP Code* Select a GAAPCode from the drop-down list. Line of Business Click Hierarchy Selection adjacent to this field. Select the required Legal Entity from the Hierarchy Selection window.

Status This field is not editable and is in the Draft status. Run Type Select either Solo or Consolidated from the drop-down list. Reporting Currency Select a currency from the drop-down list. Version When creating a definition, the version is set to 0. You cannot change this value. Effective From Date Select an Effective Date from the calendar icon. Select General Ledger Accounts Click Hierarchy Selection to select a value from the following fields:

Note: You must create the members and hierarchies in the Member and Hierarchy Maintenance Window to populate data in this field. For more information about creating members and hierarchies, see the OFS Analytical Applications Infrastructure User Guide.

- Hierarchy Folder: Select a Hierarchy folder from the drop-down.

- Hierarchy: Select a Hierarchy from the drop-down.

- Members: Add or remove members from the Selected Members Pane. By default, all accounts will appear in this list.

- Click Save.

- Select the Accounting Rules Tab.

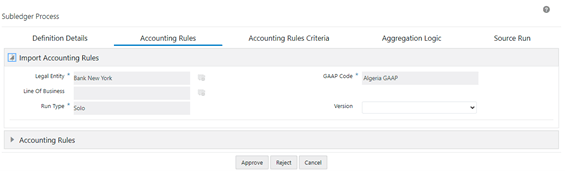

Figure 26-4 The Accounting Rules Tab

- Populate the Import Accounting Rules pane in the

Accounting Rules Tab.

Table 26-2 The import accounting rules pane

Field Description Fields marked with asterisks (*) in the window are mandatory. Legal Entity Click the Hierarchy Selection adjacent to this field. Select the required Legal Entity from the Hierarchy Selection Window.

For more information, see Hierarchy Selection.

GAAP Code Select a GAAPCode from the drop-down list. Line of Business Click Hierarchy Selection adjacent to this field. Select the required Legal Entity from the Hierarchy Selection Window.

For more information, see Hierarchy Selection.

Run Type Select either Solo or Consolidated from the drop-down list. Version When creating a definition, the version is set to 0. You cannot change this value. - On the Accounting Rules Page, select the drop-down arrow

to expand the table.

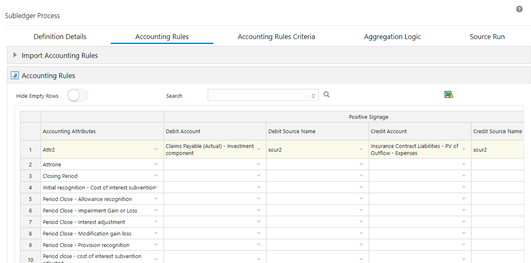

Figure 26-5 The Accounting Rules Tab with the Expanded Accounting Rules Pane

- Populate the Accounting Rules Pane.

Table 26-3 The accounting rules pane

Field Description Hide Empty Rows Click Enable if you want to hide empty rows.

When enabled, the empty rows in the Accounting Rules table are hidden.

Accounting Attributes

Select an attribute from the drop-down list. Debit Account Select a debit account from the drop-down list. Debit Source Account Select a debit source account from the drop-down list. Credit Account Select a credit account from the drop-down list. Credit Source Account Select a credit source account from the drop-down list. Modify Accounts for Opposite Signage Select this checkbox if you want to modify accounts for opposite signage. Journal Comments Enter the required journal comments for the Subledger. Workflow Comments Enter the required workflow comments for the Subledger. The pane allows you to perform the following actions:- Insert a new row before

- Insert a new row after

- Delete selected rows

- Copy

- Additionally, click Export Accounting Rules to download

the Excel file on your system.

- Fill the Excel file with the required data.

- Copy the data from Excel and paste it into the respective columns in the Copy Accounting Rules Pane.

Note:

You must ensure the following:- The data in the columns in the application must exactly match the data as per the columns in the Accounting Rules Excel. If the rules data was not added correctly, then the system will give you a validation error and you must add the rules data correctly in the corresponding columns in the application.

- Your system must contain the same GL entries as per the entries in the Debit Account column in the Accounting Rules Excel. If you copy and paste a GL entry that your system does not contain from Excel into the Debit Account column in the application, then the system will not validate it.

- Click Save.

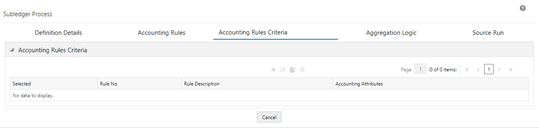

- Click the Accounting Rules Criteria Tab.

Figure 26-6 The Accounting Rules Criteria Tab

- Click Add to open the Accounting Rules

Criteria Window.

- In the Input Variables Pane, select the required input variables from the list to populate the Expression Pane.

- In the Accounting Attributes Pane, select the required accounting attribute from the list to populate the Expression Pane.

- In the Other Parameters Pane, select the

required functions and operators. The following are the available

functions and operators:

- Functions

- AND

- ABS

- Case

- Floor

- Greatest

- Least

- MOD

- OR

- Operators

- Greater than

- Plus

- Minus

- Less Than

- Equal

- Functions

- After you have built your Expression, click Validate and Apply.

- Click OK.The condition is added to the Accounting Attribute.

Note:

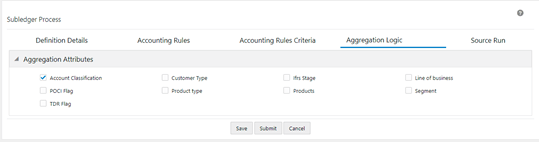

A condition can be mapped to multiple attributes but an accounting attribute can be mapped only to a single condition. For example, you have created Condition A and Condition B. You have mapped Condition A to Accounting Attributes A1, A2, and A3. But the same Accounting Attributes cannot be mapped to Condition B. - Click the Aggregation Logic tab.The Aggregation Attributes tab is displayed and contains the Account Classification, Customer Type, IFRS Stage, Line of Business, POCI Flag, Products, Product Type, Segment, and TDR Flag.This tab allows you to aggregate the results and pass journal entries at a chosen consolidated level. Consolidated entries might give added insights into the impact of changes on the chosen grouping.

Note:

Only those Credit and Debit General Ledgers total balances that are associated with an Accounting Attribute are checked and added to the journal entry. This ensures that only balanced journal entries are passed. If there is an imbalance between the Accounting Attributes, then the Accounting Attributes General Ledger Balances will not be passed to the journal entries.Figure 26-7 The Aggregation Logic Tab

- Select the checkbox(s) adjacent to the required attributes.

- Click Save.

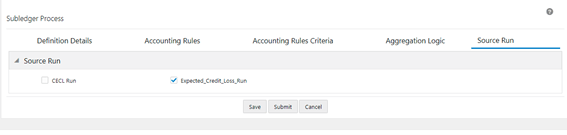

- Click the Source Run Tab.

Figure 26-8 The Source Run Tab

- Select the required Source Runs. This is the list of ECL and CECL Runs that have been executed. The Source Runs that appear in this tab, depending on the values that you selected in the Legal Entity, Line of Business, Calculation Method, Run Type, fields in the Definition Details tab

- Click Save.

- If you want to send it to the approver then click

Submit.

The approval request can be done from the Inbox screen. Log in as a Checker, access the required definition, and then either Approve or Reject the definition after reviewing it. For more information refer to the OFS AAI Administration Guide.

After a Subledger definition has been submitted for approval, you cannot modify any fields. You can modify the fields only if the Approver has rejected the Subledger definition.