6.4.3.2 Installment Loan

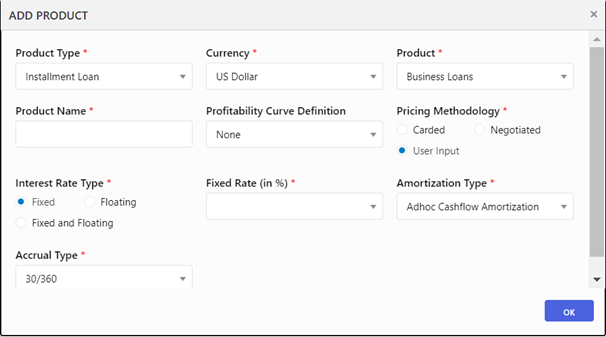

The ADD PRODUCT screen for the Installment Loan is common for all other Loan Products and Line of Credit Product.

Figure 6-15 Installment Loan Screen

- Enter the following details for Installment Loan Product Type:

- Currency

- Product

- Product Name

- Profitability Curve Definition

- Pricing Methodology

- Interest Rate Type

- Fixed Rate Duration

- Fixed Rate (%)

- Floating Rate Benchmark (if Fixed and Floating is selected for Interest Rate Type)

- Spread (in BPS) (if Fixed and Floating is selected for Interest Rate Type)

- Repricing Frequency (if Fixed and Floating is selected for Interest Rate Type)

- Transfer Pricing Parameters

The Real-Time Transfer Pricing service is optional as an additional service and can be invoked as mentioned in the Mortgage product type.

The Relationship Manager has also the flexibility to input the values directly without the service.

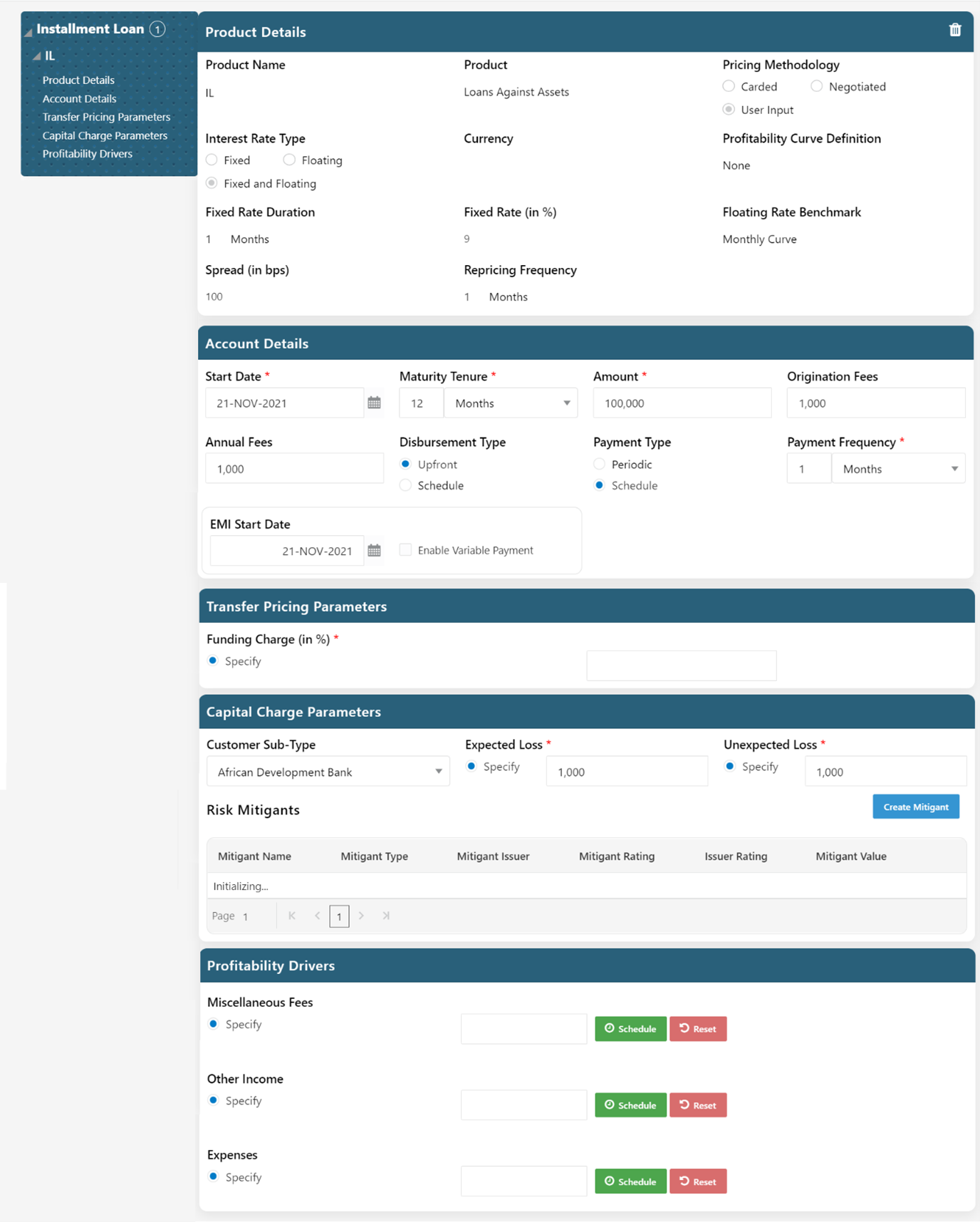

Figure 6-16 Installment Loan Product Type

- Enter the following Account Details.

Table 6-13 Account Details Fields and Descriptions

Field Description Start Date Select the Start Date of the deal from the calendar. Maturity Tenure Select the Date of Maturity for the deal either in Days or Months, or Years. Amount Enter the deal amount. Origination Fees Enter the amount of fees or activation fees that have been charged for the deal. Annual Fees Enter the annual amount of fees applicable for the account. - Capital Charge Parameters: Enter the following

details under Capital Charge Parameters:

Table 6-14 Capital Charge Parameters Fields and Descriptions

Field Description Customer Sub-Type Enter a value in terms of percentage for the Funding charge. Expected Loss This is the expected loss to be generated on the account. Enter an amount. Unexpected Loss This is the unexpected loss to be generated on the account. Enter an amount. - Risk Mitigants Parameters: Click

Create Mitigant and enter the following details under

Risk Mitigants Parameters.

Table 6-15 Risk Mitigants Parameters Fields and Descriptions

Field Description Mitigant Name Name of the Mitigant. Mitigant Type Type of Mitigant. Collateral Type Type of the Collateral. Start Date Collateral start date. Maturity Date Collateral maturity date. Mitigant Issuer The Authority that issues the Mitigant. Issuer Type The type of Authority that issues the Mitigant. Rating Source The Source that gives the Rating to the Mitigant. Issuer Rating The Rating of the Issuer. Mitigant Value The value of the Mitigant. Currency The currency of the Mitigant. - The entered Mitigant Details will be added in a row. You can perform the following

actions against the Mitigant Details row:

- Edit: To edit the Mitigant Detail, click the Edit icon. This opens the Mitigant Details in Edit Mode.

- View: To view the Mitigant Detail, click the View icon. This opens the Mitigant Detail in View Mode.

- Delete: To delete the Mitigant Detail, click the Delete icon. This dateless Mitigant Detail.

- Enter the Profitability Drivers.